As a seasoned crypto investor with a few battle scars from past market volatility, I’ve grown accustomed to the rollercoaster ride that comes with investing in Bitcoin and other digital assets. The recent developments surrounding Mt. Gox have once again tested my nerves, but this time around, I’m trying to stay calm and analyze the situation objectively.

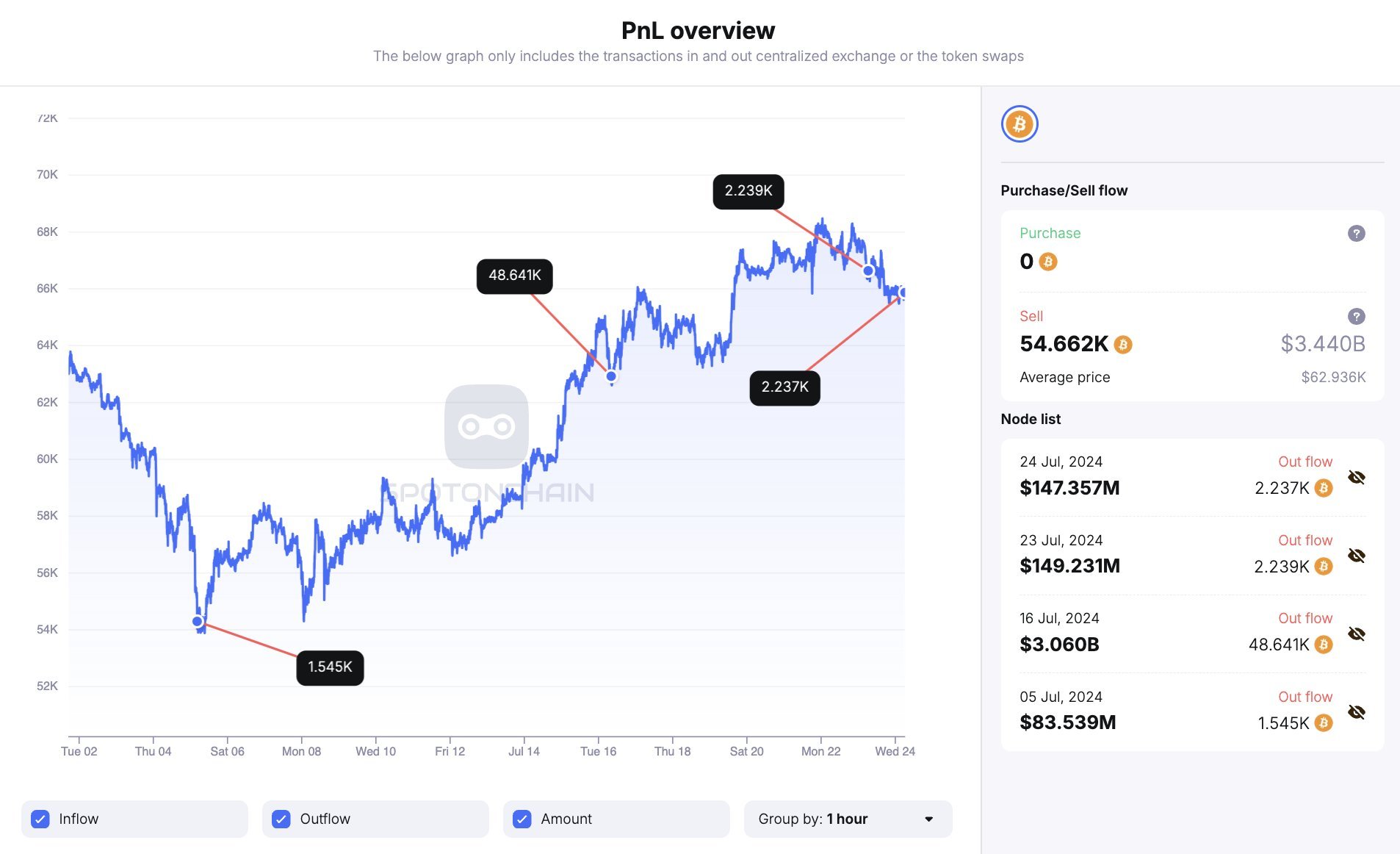

Mt. Gox, the notorious cryptocurrency exchange, recently shifted an additional 2,237 Bitcoins, valued around $147 million, to Bitstamp. This action is a continuation of the efforts to reimburse creditors, following a sequence of surprising Bitcoin transactions over the past few weeks.

Starting from early July, Mt. Gox has moved a sum of 54,662 Bitcoin, equivalent to around $3.44 billion, in various transactions. A notable portion of these transfers were directed towards platforms such as Bitbank and Bitstamp. Additionally, there was a large deposit made to a wallet believed to be connected with Kraken.

At first, there were worries in the market as the sale of formerly withheld Bitcoins from Mt. Gox had the potential to ignite a mass selling spree, given that affected parties had been anticipating the return of their assets for more than a decade.

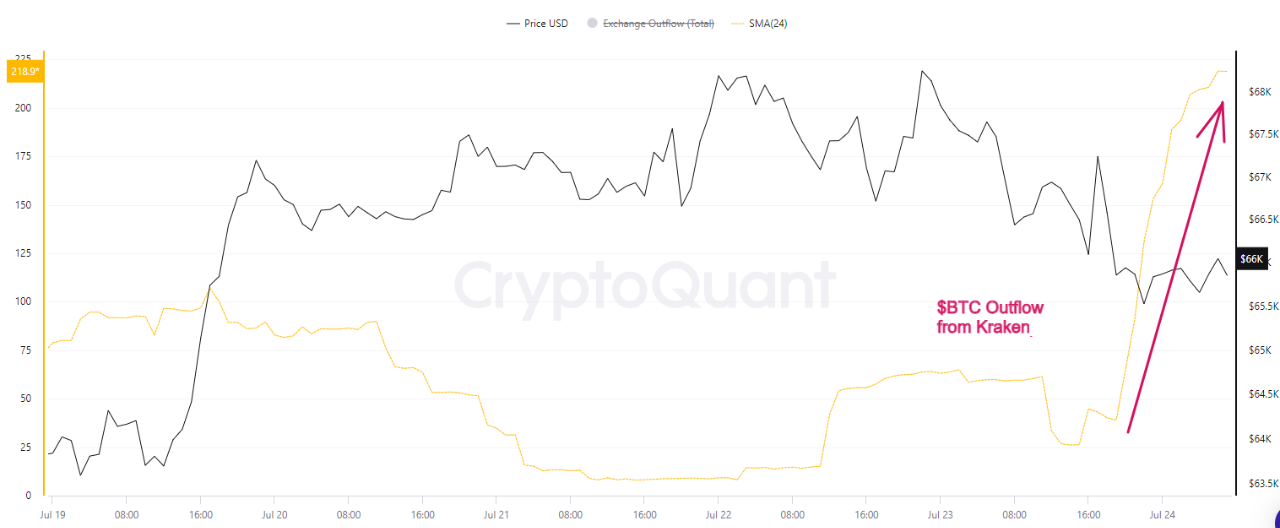

As a crypto investor, I’ve been keeping a close eye on the latest analysis from CryptoQuant. Contrary to the bearish sentiment, their data presents an optimistic perspective. Notably, there has been a significant surge in Bitcoin withdrawals from Kraken, following the distribution to Mt. Gox users. This trend suggests that instead of selling off their Bitcoin, many recipients are transferring it to cold storage. Such actions indicate a long-term holding strategy and could potentially signal a bullish market outlook.

In spite of the significant fund shifts, the rise in Kraken withdrawals indicates a possible decrease in instant selling pressure.

As a researcher studying the cryptocurrency market, I’ve come across an intriguing finding: Approximately 90,344 Bitcoins, equivalent to around $6 billion in value, are being held by the exchange. The ongoing debate revolves around the potential impact of this holding behavior on Bitcoin’s price. Will it contribute to price stability or even lead to a price increase, allaying initial concerns and uncertainties surrounding the Mt. Gox repayments? Only time will tell.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- TROY PREDICTION. TROY cryptocurrency

- NOTE PREDICTION. NOTE cryptocurrency

- UFO PREDICTION. UFO cryptocurrency

- PRIME PREDICTION. PRIME cryptocurrency

2024-07-24 17:09