As a seasoned crypto investor with a keen eye for market trends, I find the recent activity surrounding the 100 billion Shiba Inu token deposit into Coinbase by an enigmatic whale highly intriguing. Having closely monitored the cryptocurrency landscape for years, I’ve come to recognize patterns and understand the implications of such on-chain data.

Recent analytics findings from Arkham Intelligence reveal an intriguing occurrence: A secretive entity, resembling a digital “whale,” has emerged, transferring an astonishing sum of 100 billion Shiba Inu tokens into the prominent US crypto exchange, Coinbase’s hot wallet.

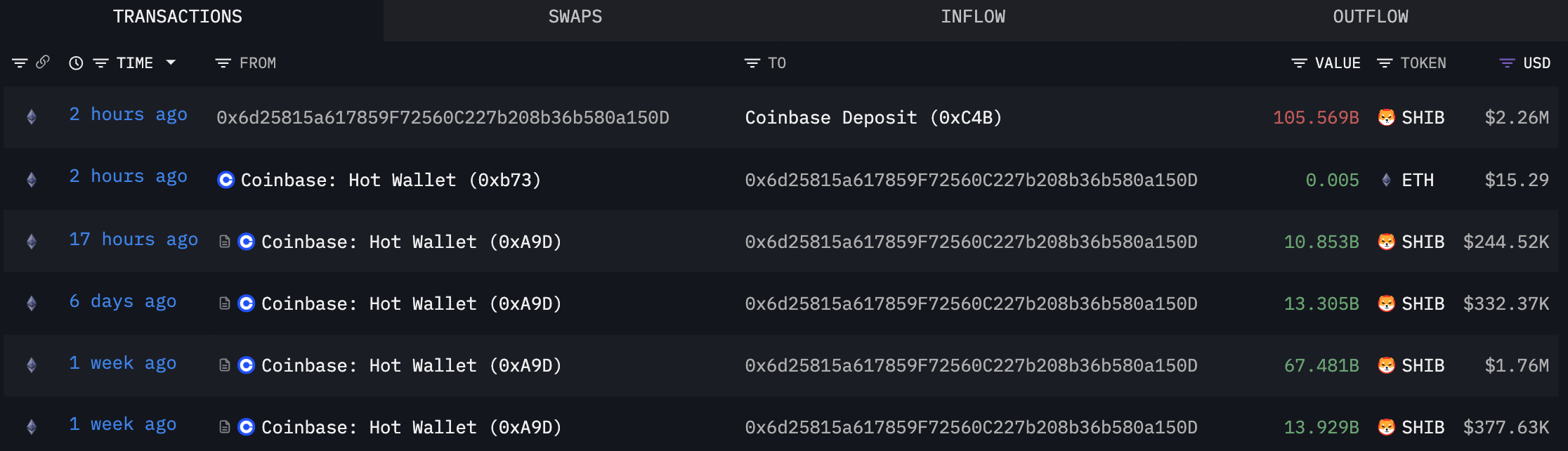

Based on blockchain records, the mysterious figure represented by the “0x6d2” address has recently transferred approximately $2.26 million worth of SHIB to an address linked to Coinbase.

Additionally, this address had been acquiring Shiba Inu tokens from the exchange at an accelerated rate for the past week, resulting in a massive haul of 105.57 billion SHIB. Later, it transferred the entire amount to Coinbase.

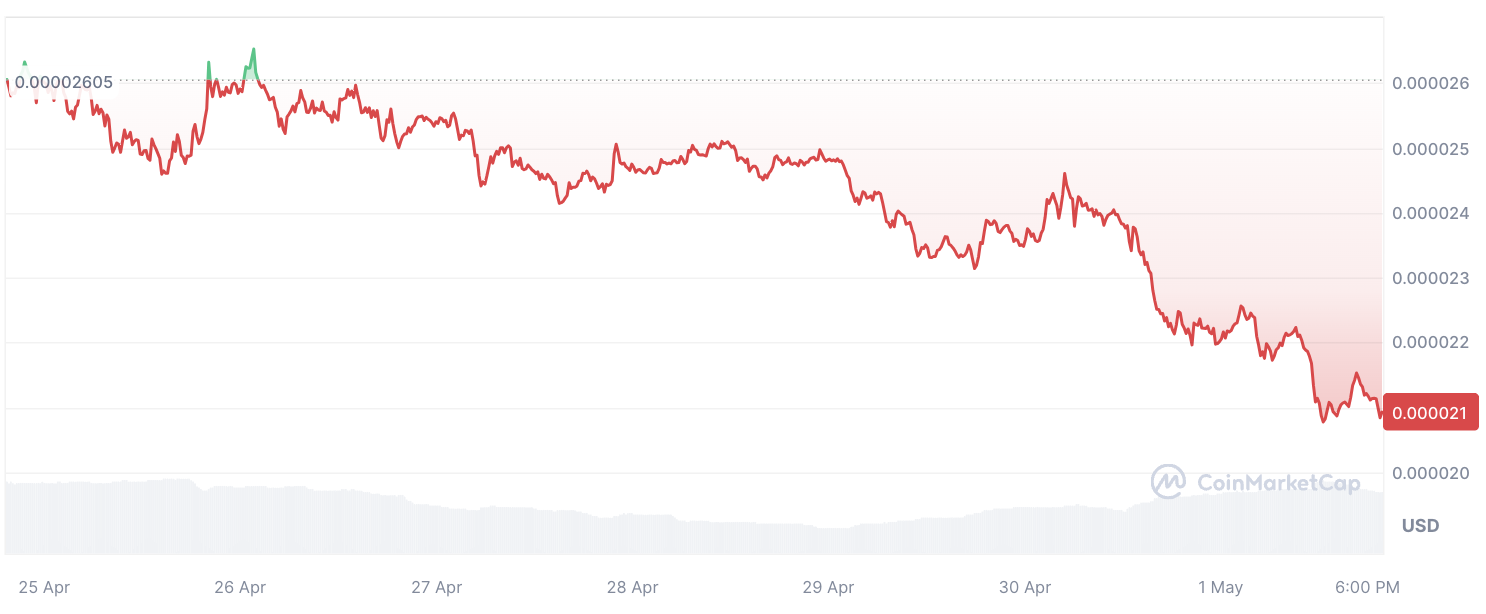

It’s worth noting that these actions occurred around the same time as a significant drop in SHIB‘s value, causing the price to fall from over $0.000026 to $0.00002057 per coin – a decline of more than 20%.

Risk off as FOMC nears?

From an analyst’s perspective, I find it noteworthy that this significant SHIB deposit has surfaced right before the upcoming Federal Open Market Committee (FOMC) meeting. With market players anxiously anticipating the committee’s decision on U.S. Federal Reserve interest rates, this whale’s action of depositing tokens onto the exchange is interpreted as a possible sell signal by many.

In the past, individuals have often sold their holdings in preparation for significant economic occurrences to minimize possible losses. Although there is widespread belief that the Federal Reserve will decrease interest rates, investors exhibit apprehension and are therefore moving their funds into cash. Consequently, a decline is observed in various asset markets, including cryptocurrencies.

As I prepare for the upcoming Federal Open Market Committee (FOMC) meeting, I can’t help but feel intrigued by the enigma surrounding the influential Shiba Inu whale in the crypto market. With great anticipation, I wait for any revelations regarding their intentions and motivations behind recent significant transactions.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- NAKA PREDICTION. NAKA cryptocurrency

2024-05-01 19:13