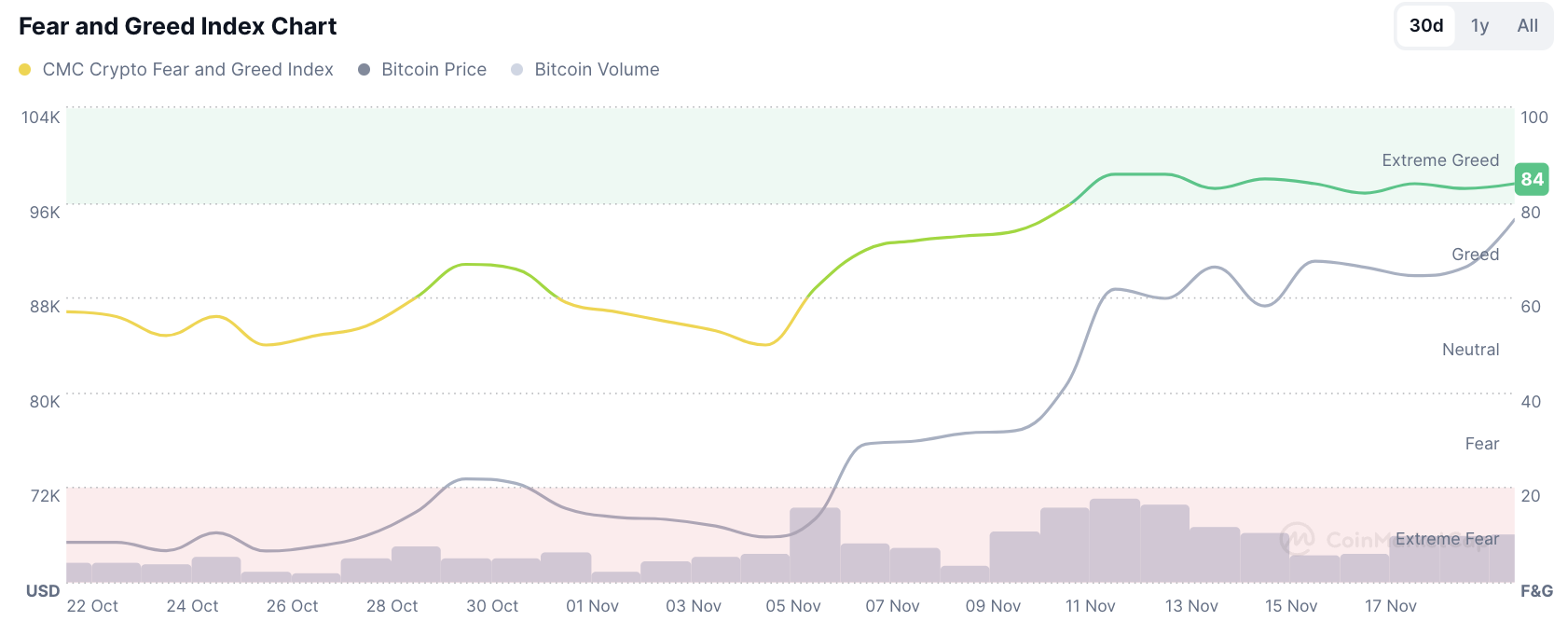

As a seasoned crypto investor with over a decade of experience in this wild west of digital assets, I’ve witnessed my fair share of bull and bear markets, moonshots, and rug pulls. The recent surge of Bitcoin to $94,585.23 on Binance is nothing short of breathtaking, especially when the CoinMarketCap fear and greed index is flashing “extreme greed” at 84. It’s a rollercoaster ride that I wouldn’t have it any other way.

Bitcoin (BTC) hit an unmatched high of $94,585.23 on Binance, maintaining its strong grip over the cryptocurrency market. This spike aligns with CoinMarketCap’s fear and greed index reading 84, indicating that the market mood is deeply entrenched in “extreme greed.” However, it’s worth noting that this isn’t Bitcoin’s all-time peak yet.

Back on November 16th, the indicator peaked at 86, and Bitcoin was being traded at around $87,930. At that time, the daily trading volume amounted to approximately $133.67 billion. Interestingly, a new record high for trading volume was set more recently when Bitcoin’s trading volume stood at only about $76.14 billion.

Despite Bitcoin’s significant price increases dominating the headlines, it appears that other areas within the cryptocurrency sector are experiencing less growth. For instance, the TOTAL2 indicator, which measures the market cap of alternative coins, has only seen a minimal increase of about 1%.

During this timeframe, Bitcoin experienced an even greater rise, increasing by approximately 2.2%, while other assets only saw a 1% gain. This underscores Bitcoin’s significant advantage when it comes to benefiting from optimistic market trends.

It’s noteworthy that the value of Ethereum compared to Bitcoin has decreased to levels similar to those observed in March 2021. This suggests a significant change in investor behavior, as even Ethereum, which is the second-largest cryptocurrency by market capitalization, is finding it challenging to match Bitcoin’s recent growth trend.

In summary, it appears that the majority of focus, investment, and particularly capital are being directed towards Bitcoin, while other market assets may be growing at a slower pace or even experiencing a drain of liquidity. Although such intense interest often indicates a positive trend, the disproportionate distribution of market gains provokes questions about the sustainability of these patterns and whether there will ever be an altcoin boom, or if this market will remain dominated by Bitcoin alone.

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- Luma Island: All Mountain Offering Crystal Locations

- EUR CAD PREDICTION

- DCU: Who is Jason Momoa’s Lobo?

- XRP PREDICTION. XRP cryptocurrency

- OSRS: Best Tasks to Block

- How to Claim Entitlements In Freedom Wars Remastered

- The Best Horror Manga That Debuted In 2024

2024-11-20 17:43