Ah, the North Korean hacking groups, those persistent phantoms haunting the crypto corridors for years! The infamous 2022 $625 million Ronin bridge exploit was merely a gentle nudge, a wake-up call that echoed through the digital halls—but alas, the threat has only grown more sophisticated, like a fine wine aging in a cellar of chaos. 🍷

In the grand theater of 2025, our North Korean friends have been busy, orchestrating a symphony of cyber mischief aimed at siphoning value and compromising the unsuspecting players of Web3. They’ve set their sights on a staggering $1.5 billion worth of assets at Bybit, employing credential-harvesting campaigns that would make even the most seasoned con artist blush. Millions have already been laundered, like dirty laundry in a washing machine of deceit. 🧺

While the headlines scream about grand thefts, the truth is far simpler—and more damning. The weakest link in this digital chain is not the smart contracts, dear reader, but the humans behind them. Yes, the very beings who, in their infinite wisdom, have decided to trust their fortunes to the whims of the internet. 🤦♂️

Nation-state attackers have evolved; they no longer need to hunt for zero-days in Solidity. Instead, they target the operational vulnerabilities of decentralized teams: poor key management, nonexistent onboarding processes, and unvetted contributors pushing code from their personal laptops, all while governance is conducted via Discord polls. For all our industry’s lofty talk of resilience and censorship resistance, many protocols remain as soft as a marshmallow in a hot cup of cocoa. ☕️

At Oak Security, where we’ve conducted over 600 audits across major ecosystems, we see this gap with alarming regularity: teams pour resources into smart contract audits while neglecting the basics of operational security (OPSEC). The outcome? Predictable chaos. Inadequate security processes lead to compromised contributor accounts, governance capture, and losses that could have been avoided with a sprinkle of common sense. 💡

The Smart Contract Illusion: Secure Code, Insecure Teams

Despite the mountains of money and talent funneled into smart contract security, most DeFi projects still flunk the basics of operational security. The prevailing assumption seems to be that if the code has passed an audit, the protocol is safe. This belief is not just naive—it’s downright dangerous! ⚠️

In reality, smart contract exploits are no longer the preferred method of attack. It’s far easier—and often more effective—to target the very people running the system. Many DeFi teams lack dedicated security leads, managing vast treasuries without anyone formally accountable for OPSEC. That alone should send shivers down your spine! 😱

And let’s not forget, OPSEC failures aren’t solely the domain of state-sponsored groups. In May 2025, Coinbase revealed that an overseas support agent—bribed by cybercriminals—illegally accessed customer data, triggering a $180–$400 million remediation and ransom limbo. Similar attempts were made on Binance and Kraken. These incidents weren’t the result of coding errors; they stemmed from insider bribery and human folly. 🤷♂️

it is difficult to implement in decentralized, globally distributed organizations. Budgets are tight, contributors are transient, and cultural resistance to cybersecurity principles, often misperceived as “centralization,” remains strong. 💰

But decentralization is no excuse for negligence. Nation-state adversaries understand this ecosystem. They’re already inside the gates, sipping tea and plotting their next move. The global economy is increasingly reliant on on-chain infrastructure. Web3 platforms urgently need to employ and adhere to disciplined cybersecurity practices, or risk becoming a permanent funding stream for hackers and scammers seeking to undermine them. ☕️

Code alone will not defend us. Culture will. 🛡️

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.

Semler Scientific Investors Cheered by New Hire, Lofty Bitcoin Acquisition Goals

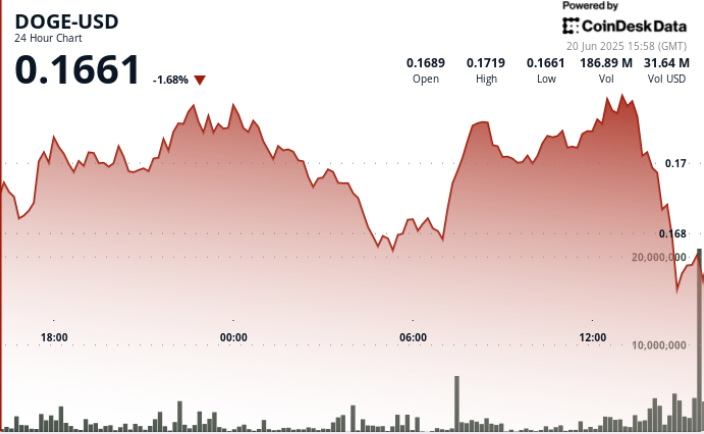

Dogecoin Rebounds From 16 Cents as Triangle Pattern Signals 60% Price Swing

Circle Started at Buy at Seaport Securities, Which Eyes $2T Opportunity in Stablecoins

KindlyMD Raises Another $51.5M for Bitcoin Treasury Strategy

A South Korean Biotech Firms Gets $183.3M Funding to Build Bitcoin Treasury

Semler Scientific Investors Cheered by New Hire, Lofty Bitcoin Acquisition Goals

XRP Early Buyers Accelerate Profit-Taking as Regulatory Wins Bolster XRP Ecosystem

North Korean Hackers Are Targeting Top Crypto Firms With Malware Hidden in Job Applications

Bitcoin Steady Above $104K as Traders Eye Historically Bullish Second Half

KindlyMD Raises Another $51.5M for Bitcoin Treasury Strategy

Arizona Moves Closer to Creating Bitcoin Reserve as Bill Passes Final Senate Vote

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- 8 One Piece Characters Who Deserved Better Endings

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- Who Is the Information Broker in The Sims 4?

- Sega Declares $200 Million Write-Off

- Full Mewgenics Soundtrack (Complete Songs List)

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

2025-06-20 20:22