As a seasoned researcher with a decade-long immersion in the labyrinthine world of cryptocurrencies, I find myself intrigued by this recent turn of events surrounding Ethereum. The sudden downturn, coinciding with geopolitical turbulence and the exodus of whale holders, paints an interesting picture of market dynamics.

Over the past week, the value of cryptocurrencies has taken a substantial hit, largely due to increasing geopolitical conflicts in the Middle East. This downturn caused many high-value assets to lose their recent gains. For instance, the price of Ethereum plummeted from around $2,600 to as low as $2,300 at certain points during the week.

The leading altcoin is facing another setback, as its recent performance hasn’t been impressive in the last few months. Remarkably, a well-known crypto analyst from platform X has shared an insightful on-chain analysis about Ethereum investors’ behavior during the past quarter.

How Ethereum Whales Shaving Off Their Holdings Will Impact Price

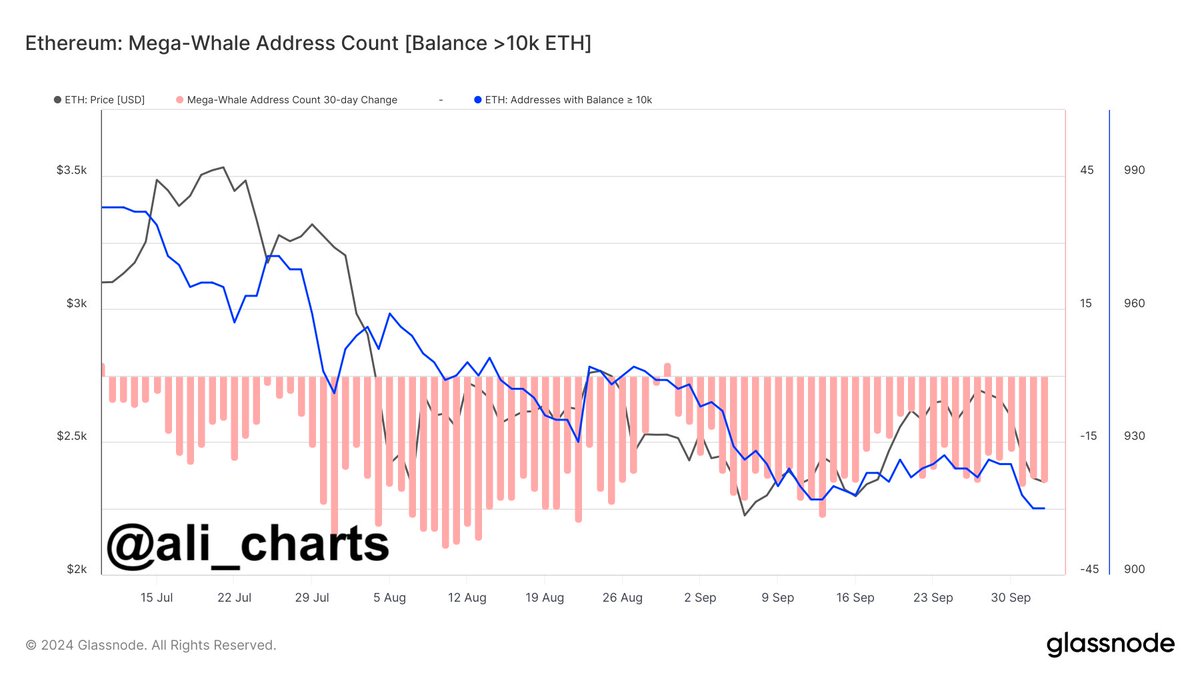

On the social media platform X, crypto analyst Ali Martinez has disclosed that a certain group of large Ethereum investors (referred to as whales) have been gradually reducing their holdings for several months now. This observation comes from the Mega-Whale Address Count, a system that monitors the number of wallets containing over 10,000 units of a specific cryptocurrency, in this case, Ethereum.

In simpler terms, “whales” are individuals or organizations that possess a large quantity of a particular cryptocurrency such as Ether. These substantial holders often attract attention from investors because their actions can significantly impact the market’s fluidity and price trends, given their sizeable assets.

As reported by Martinez, there’s been a drop of over 7% in the number of Ethereum addresses owned by whales (large-scale investors or institutions) holding more than 10,000 ETH since July 2024. This decrease among significant Ethereum holders might indicate some redistribution or profit-taking, and it could signal a substantial change in market sentiment, particularly among big-time investors and institutional players.

As a crypto investor, I’ve noticed an intriguing correlation: the decrease in whale activities seems to have happened around the time when Ethereum was facing price struggles. Even with the green light for spot ETH exchange-traded funds (ETFs), Ethereum’s value took a dive, plunging from approximately $3,500 in July down to as low as $2,200 by August.

Observing the recent trends in Ethereum’s token prices over several months, it appears that the reduction in significant Ethereum holders might significantly lessen overall buying demand, resulting in slower price fluctuations. Furthermore, persistent selling by these ‘whales’ could exert additional downward pressure on Ethereum’s price.

ETH Price At A Glance

Currently, Ethereum’s value stands slightly above $2,400, showing a minimal 0.1% drop over the last day. However, its weekly performance tells a different story, with a notable decrease of almost 10%.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD CLP PREDICTION

- SBR PREDICTION. SBR cryptocurrency

- SSE PREDICTION. SSE cryptocurrency

- USD COP PREDICTION

- EUR RUB PREDICTION

2024-10-06 17:11