Good heavens, what a lamentable state the crypto markets find themselves in this fine week! Bitcoin, Ethereum, and their lesser companions are quite in the doldrums, despite the U.S. Federal Reserve’s most generous 25 basis-point rate cut. One would think such a gesture might inspire a modicum of enthusiasm, but alas, the spirits remain unmoved. 🥱

Bitcoin’s Grand Descent to $114K: A Tale of Unmet Expectations

Imagine, if you will, the scene: Bitcoin, once the darling of the financial ball, has tumbled most ungracefully to $114,000. The Fed’s announcement of a quarter-point rate cut, which one might have expected to set hearts aflutter, has instead left the room in a most peculiar silence. Volatility, that ever-present companion, remains contained, and the flow of capital into Bitcoin ETFs has slowed to a mere trickle. How very disappointing! 😒

Market data, that most reliable of narrators, informs us that weekly Bitcoin trading volume has fallen to $43.7 billion, a full 23% below its usual vigor. It seems both the genteel retail investors and the formidable institutions are lacking in conviction. Whatever shall we make of it? 🤔

Ethereum’s Woes: Institutions Withdraw Their Favors

Ethereum, too, finds itself in a most precarious position. Accumulation has stalled, and the institutions and whales, once its most devoted suitors, are withdrawing from staking. Instead, ETH is being ushered onto centralized exchanges, increasing the supply and adding to the already considerable selling pressure. Network fees, at a mere 0.17 Gwei, are but a shadow of their former selves, pointing to a most subdued on-chain activity. How very unbecoming! 😩

Crypto ETF Inflows: A Fading Romance

One of the greatest drivers of crypto prices in 2024 and early 2025 has been the influx of ETFs. However, the latest data reveals a most distressing truth: Bitcoin ETF inflows are waning, and traditional investors are reducing their exposure. If this trend persists, it could threaten crypto’s deeper integration with Wall Street. Whatever shall become of this once-promising union? 💔

Stablecoin issuance and derivatives positioning also paint a picture of caution, suggesting investors are bracing for turbulence rather than embracing the dance. How very prudent, yet how very dull! 😑

Altcoins in Distress as Bitcoin Asserts Its Dominance

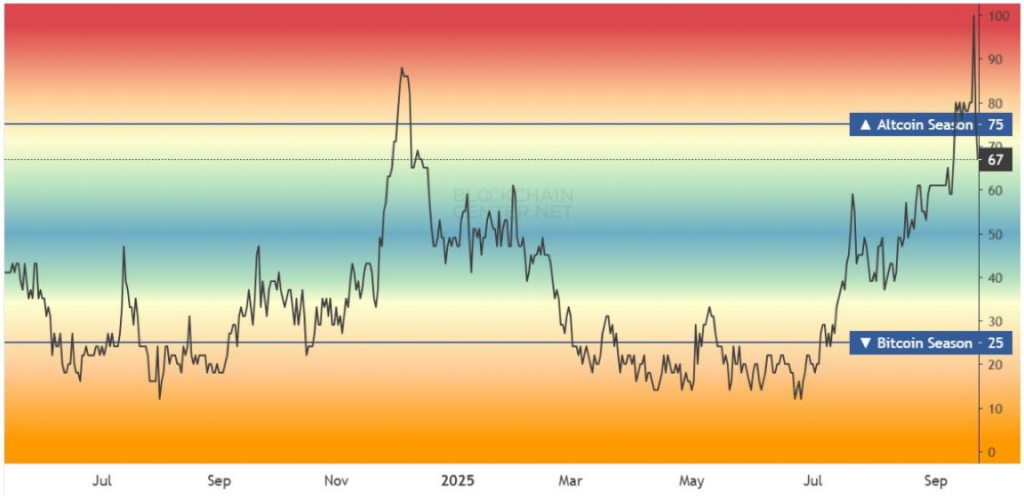

While Bitcoin struggles to maintain its composure, altcoins like Ethereum and Ripple are facing even steeper declines. Capital is rotating back into Bitcoin’s embrace, leaving the Altseason Index to crash from 100 to a mere 67. The momentum for smaller-cap tokens appears to be waning, much like the enthusiasm at a ball after the punch has run out. 🍾🙄

The Macro Backdrop: A Perfect Storm of Woes

The macro backdrop, ever the meddlesome chaperone, is amplifying the selloff:

- Federal Reserve policy: The 25 bps cut has sparked quite the debate on whether more cuts will follow this year. If inflation remains stubborn, the Fed might slow its easing-a most bearish outcome for risk assets. 🦉

- Inflation data: Uneven U.S. inflation reports are raising fears of “higher for longer” rates, dampening speculative appetite. How very inconvenient! 😣

- Profit-taking: After a strong rally earlier this year, many investors are locking in gains, leading to a most unwelcome selling pressure. Greed, it seems, knows no bounds. 💸

- Weak global sentiment: Equities, bonds, and global assets remain shaky, feeding into crypto’s downturn. It appears the entire financial world is in a state of disarray. 🌍😵

- Whale activity: Large players reducing their exposure have accelerated the selloff across exchanges. Those whales, always making a splash! 🐳💨

Crypto Market Outlook: The Calm Before the Storm?

Despite the prevailing gloom, some analysts see this as the calm before a decisive move. Bitcoin’s volatility structure shows short-term tranquility but steepening longer maturities-a sign traders expect turbulence ahead. How very intriguing! 🌪️

Curiously, Ethereum’s options market suggests downside hedging demand has collapsed, and call options are regaining premiums. Could it be that traders are positioning for a rebound if macro conditions stabilize? One can only hope! 🤞

Binance founder Changpeng Zhao (CZ) added fuel to the speculation, remarking, “Maybe we haven’t hit the real bull market yet.”

His comments come as many traders question whether Bitcoin’s explosive 2025 rally is losing steam. Whatever will become of us all? 😱

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more. After all, one must keep abreast of the gossip! 📰👀

FAQs

Why is the crypto market down today?

The market is down due to profit-taking after a strong rally, fears of persistent inflation limiting future Fed rate cuts, and a significant slowdown in institutional investments into Bitcoin ETFs. How very tiresome! 😤

Did the Federal Reserve interest rate cut affect Bitcoin?

Yes, despite a 25 basis-point cut, Bitcoin’s price fell as the move was already expected. The focus has shifted to future Fed policy and concerns that fewer cuts may come, which dampens risk-asset appetite. How very predictable! 😏

Will the crypto market crash continue?

Some analysts see this as a consolidation before a bigger move. While short-term sentiment is bearish, options markets suggest some traders are positioning for a potential rebound if macroeconomic conditions stabilize. One can but hope for a happy ending! 🌈

What cryptos are showing bullish momentum?

While most majors are down, Ethereum’s options market shows a shift. Demand for downside protection has collapsed while call options are gaining value, suggesting some traders are positioning for a potential rebound. Perhaps there’s light at the end of the tunnel? 💡

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

- Best Ship Quest Order in Dragon Quest 2 Remake

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

2025-09-22 10:10