In the grand theater of the markets, where fortunes rise and fall with the capricious whims of the crowd, Opera Limited has staged a dramatic ascent. On the second day of February, its shares, like a prima ballerina, leapt nearly 17%, a pirouette fueled by the announcement of deeper support for Tether’s stablecoin and the gilded XAU₮0 token in its MiniPay wallet. Ah, the modern world-where digital gold and stablecoins dance hand in hand, and the unbanked masses are promised a seat at the table, or so the tale goes.

This expansion, a marriage of convenience between Opera and Tether, brings the USDT stablecoin and the gold-backed XAU₮0 token-a bridged creation not of Tether’s own making-into the embrace of MiniPay, Opera’s self-custodial wallet built on the Celo blockchain. A noble endeavor, no doubt, targeting the wretched of the earth in Africa, Latin America, and Southeast Asia, who, deprived of traditional banking, now have access to digital dollars. MiniPay, since its late 2023 debut, has processed 350 million transactions and activated over 12.6 million wallets. A triumph of technology, or merely a new guise for old exploitation? The jury is still out.

Tether and Opera Expand Financial Access in Emerging Markets Through MiniPay

Read more:

– Tether (@tether) February 2, 2026

December’s Frenzy: A Month of Peer-to-Peer Euphoria

In December 2025, MiniPay users, in a frenzy of activity, completed over 3.5 million peer-to-peer payments and shuffled more than 96 million USDT through the platform. The wallet, ever hungry for growth, added 300,000 unique USDT buyers in that month alone, a 33% surge from November. Paolo Ardoino, Tether’s CEO, with the solemnity of a priest, declared, “Tether’s mission has always been to provide simple, reliable access to stable value for people who need it most.” A noble mission, indeed, though one wonders if the stability of value is not a mirage in this volatile digital desert.

Opera’s Shares: A Rally Amidst Revenue Triumphs

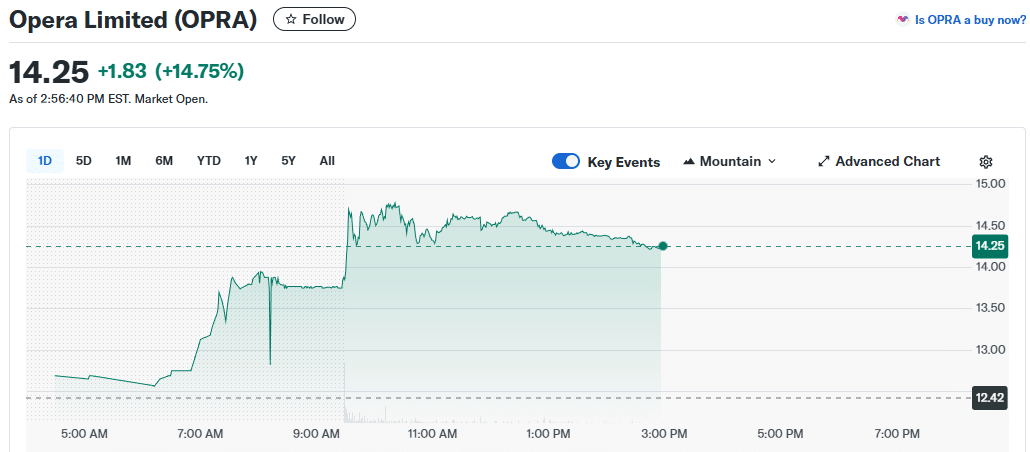

The markets, ever fickle, reacted with zeal. Opera’s stock, opening at $13.86 on Monday, soared from its previous close of $12.42, reaching a zenith of $14.87 during the session. This surge propelled the company’s market capitalization to a staggering $1.30 billion, according to the oracles at Yahoo! Finance. A triumph, no doubt, but one must ask: is this the dawn of a new era, or merely a fleeting moment of glory?

Opera surge 17% | Source: Yahoo! Finance

Adding to the spectacle, Opera revealed that its fourth-quarter 2025 revenue would surpass $170 million, exceeding its own modest guidance of $162 to $165 million. This pushes full-year 2025 revenue above $608 million, a 26% growth from 2024, or $130 million in absolute gains. The company, ever optimistic, expects full-year adjusted EBITDA to exceed $141 million. Analysts, with their charts and graphs, bestow upon Opera a “Moderate Buy” rating and an average price target of $23.50-a 62% premium over Monday’s trading levels. The complete Q4 results, a grand unveiling, are slated for February 26, 2026.

Thus, Opera stands at the crossroads, poised to capitalize on two growth vectors: crypto-based payments in underbanked regions and expanding commercial partnerships that drive core revenue. A bold strategy, but in this digital age, where the line between innovation and illusion is razor-thin, one must wonder: will Opera’s waltz with Tether lead to a standing ovation, or will it end in a cacophony of missed steps and fallen expectations? Only time, that implacable judge, will tell.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Mewgenics Tink Guide (All Upgrades and Rewards)

2026-02-03 01:18