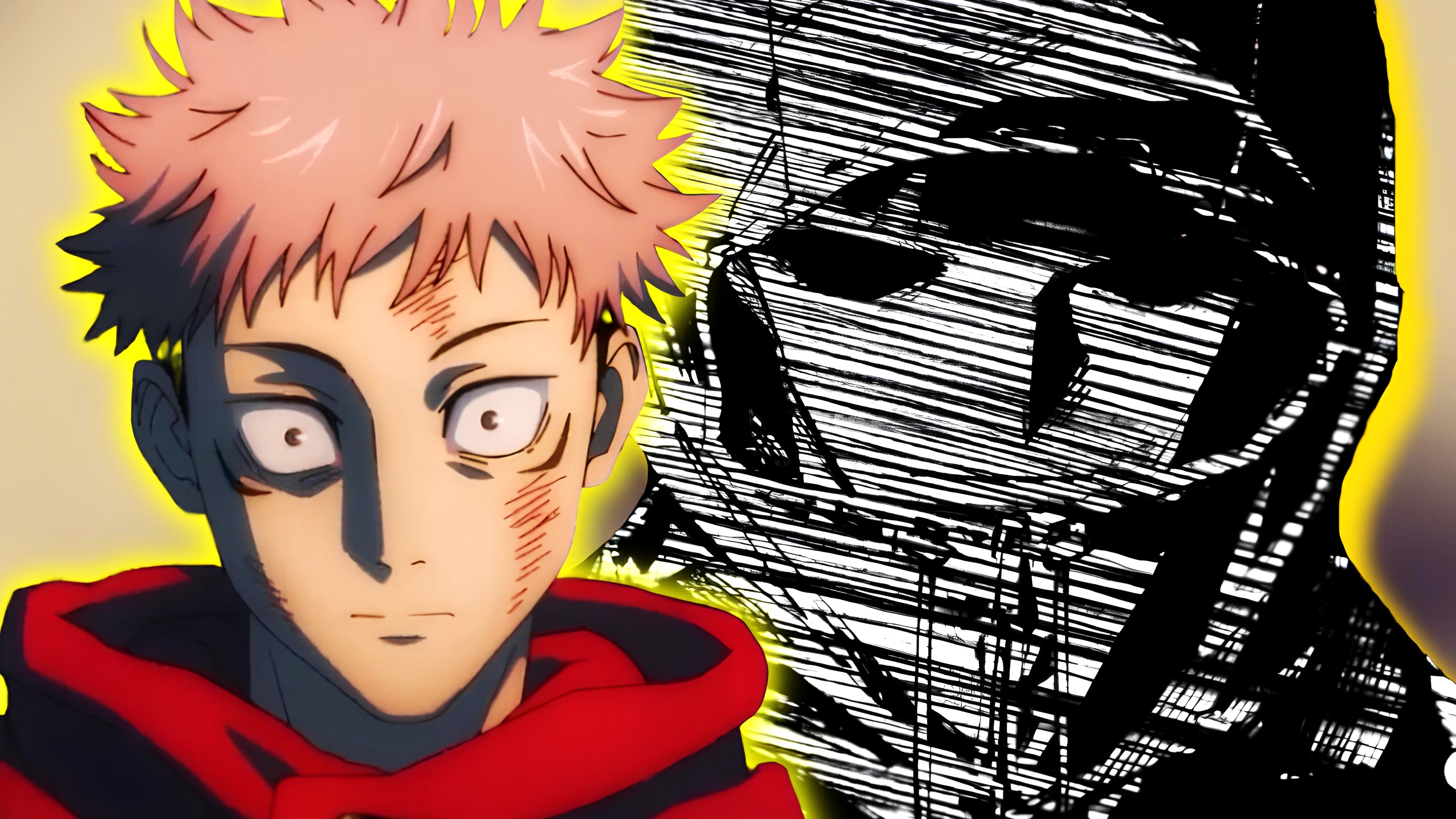

Things Confirmed About Yuji Itadori in Jujutsu Kaisen Modulo

The latest chapter of Jujutsu Kaisen Modulo is building tension as the sorcerers get closer to a showdown with the Simurian Warriors. Despite still getting to know each other, both sides are experiencing increasing misunderstandings regarding cursed spirits and the Kalyans, which is quickly leading them towards a full-scale conflict.