As a seasoned crypto investor with several years of experience in the market, I’ve seen my fair share of market volatility and price swings. The recent developments regarding Bitcoin’s “paper” surge while the spot price has plunged have piqued my interest.

The data reveals a significant increase in the usage of “paper” Bitcoin, or Bitcoin traded on exchanges without actual coins being transferred, whereas the market value of the cryptocurrency itself has decreased.

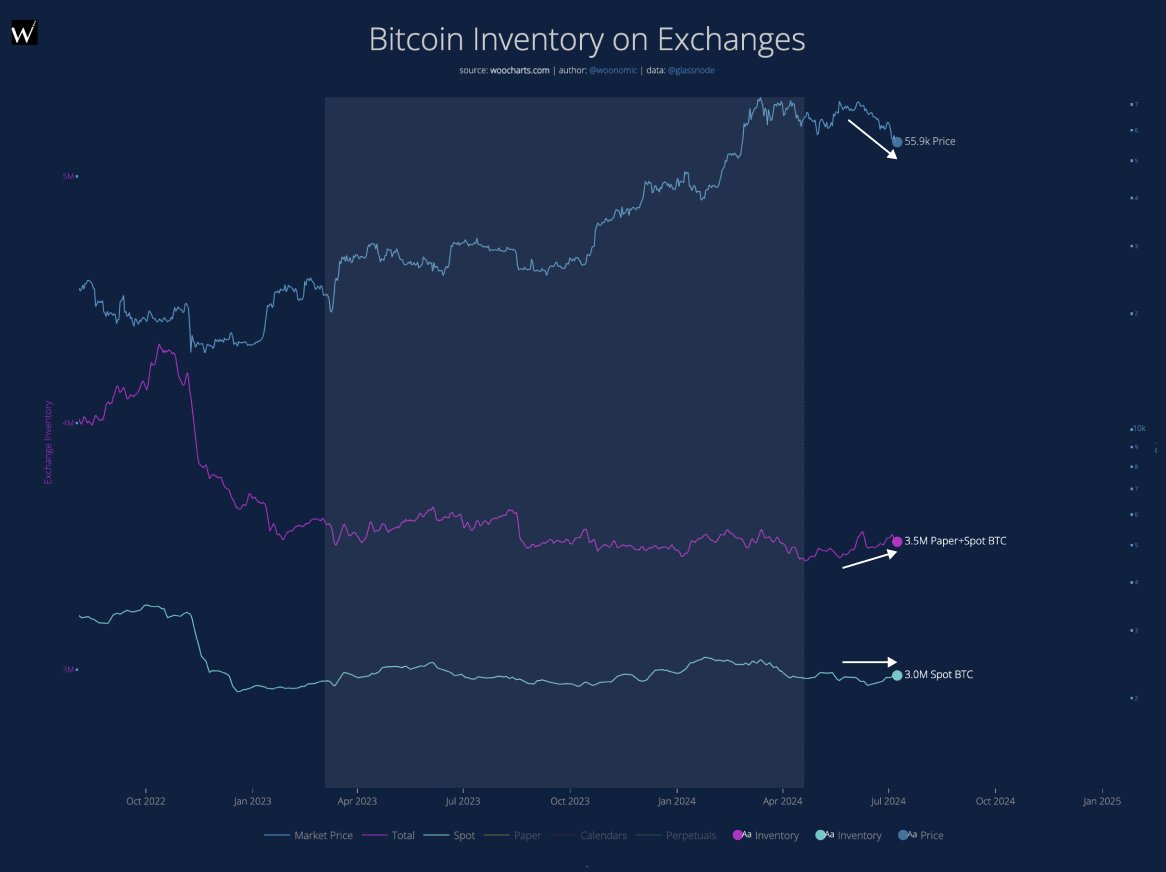

Paper Bitcoin Has Been Rising While Spot BTC Has Stayed Stale

As an analyst, I’ve been closely following the Bitcoin market in a new thread on X. Lately, I’ve observed a bearish trend in BTC‘s price movement. Two significant factors have contributed to this downturn: the German Government’s sale of Bitcoin, and the ongoing Mt. Gox distributions. These events have generated a considerable amount of fear, uncertainty, and doubt (FUD) among investors.

Woo noted that approximately 10,000 Bitcoins were offloaded by Germany, while they continue to hold about 39,800 Bitcoins in their possession.

As a crypto investor following the developments at Mt. Gox, I’ve noticed that they have only distributed 2,700 Bitcoin out of the estimated 141,700 BTC owed to their clients. The exchange is still holding onto a significant amount of 139,000 BTC. However, the potential bearish effect of these coins on the market depends on the intentions of those who receive them. If they decide to sell, it could lead to a downward trend in Bitcoin’s price. Conversely, if they choose to hold onto their coins, there might be minimal impact on the market.

As an analyst, I’ve observed that these two entities haven’t significantly increased selling pressure on the Bitcoin market thus far. But, based on my analysis, it appears that the primary cause of Bitcoin’s recent downturn might be paper Bitcoins.

As a crypto investor, I’d like to point out that there’s a distinction between investing in Bitcoin itself through owning the actual cryptocurrency tokens, and investing in derivative products related to Bitcoin, such as futures or options contracts. These paper BTC investments don’t require holding any physical Bitcoins. Here’s a visual representation of Bitcoin’s recent price movement during this market downturn, based on the data from the derivatives market.

The purple line in the graph signifies the total amount of Bitcoin held in paper and spot form on centralized exchanges within the industry. This figure has been increasing noticeably as of late.

As a researcher studying the Bitcoin market, I’ve noticed an uptick in the total supply of Bitcoin. However, it’s important to consider that this growth might not solely be attributed to the creation of new Bitcoin through mining, but also to the addition of paper Bitcoin through spot deposits.

Approximately 140,000 additional paper Bitcoins have been generated recently. Keep in mind that this is contrasted with Germany’s sale of only 10,000 Bitcoins. Woo’s observation suggests that the market might experience a significant reduction in derivatives holdings for Bitcoin to stage a meaningful comeback.

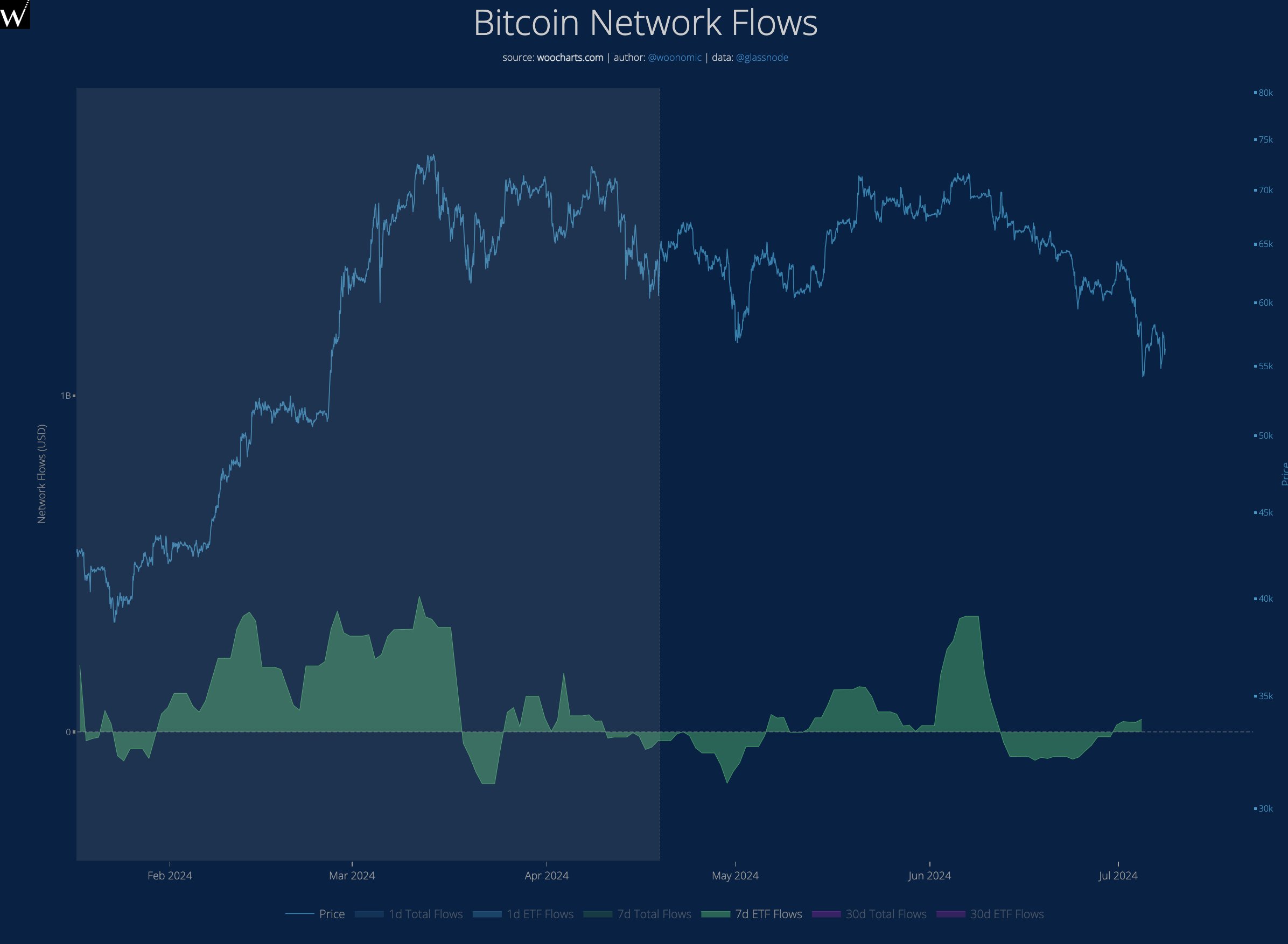

As a researcher, I’ve been keeping a close eye on the bearish signals surrounding Mt. Gox and the German government’s offloading of coins. However, it seems that a bullish development may be emerging for the coin as well. The analyst has pointed out that exchange-traded funds (ETFs) have begun to accumulate spots, indicating a potential uptrend.

BTC Price

I’ve had a rough ride as a Bitcoin investor over the past month. The value of my holdings has taken a hit with Bitcoin’s price plummeting by over 17%, reaching a low of $57,200.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

- USD COP PREDICTION

2024-07-10 07:11