- Our whimsical friend Popcat has deigned to bless us with a 9.08% increase in value over the past 24 hours, a veritable miracle on the daily charts 📈.

- The great beast of bullish momentum stirs, its mighty paws swiping at the air with a bullish crossover on RSI and Stoch, a wondrous portent of things to come 🤯.

Like a phoenix from the ashes, Popcat has risen from the depths of despair, defending the sacred $0.30 support level and bouncing back with a ferocity that has left onlookers aghast 🤯. After plummeting from the dizzying heights of $0.41 to the crushing lows of $0.29, our intrepid feline friend has staged a daring comeback, leaving all who doubted it in the dust 😾.

As we speak, Popcat is valiantly attempting to shatter the shackles of the descending channel, having recorded gains for two consecutive days and reaching a dizzying high of $0.339 🚀. The question on everyone’s lips: can this fearless feline sustain its momentum and break free from the chains of despair? 🤔

At the time of writing, Popcat was trading at $0.339, a 9.08% rise over the past 24 hours, accompanied by a 55% surge in trading volume to a staggering $45.39 million 💸. A veritable tidal wave of demand has swept the market, with buyers returning in droves to reclaim their rightful place at the throne 👑. According to Coinalyze data, Popcat buyers have accumulated a staggering 8 million tokens over the past 24 hours, a testament to the unyielding power of the memecoin 🚀.

As the buying spree continues unabated, sellers have been relegated to the sidelines, forced to watch in awe as the memecoin posts a positive Delta of 700,000 tokens 📊. This rising demand has not gone unnoticed in the derivatives market, where investors are positioning themselves strategically ahead of the next move, like chess players anticipating their opponent’s next gambit 🕵️♂️.

In the Futures market, Popcat’s Open Interest has jumped 6.69%, reaching a staggering $135.69 million, a clear indication that traders are actively entering both long and short positions 📈.

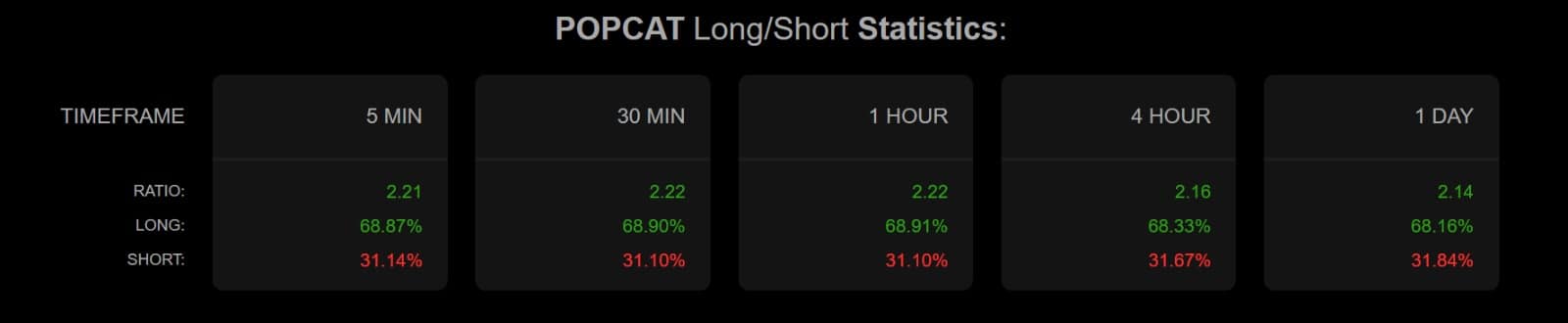

To gauge investor sentiment, we turn to Popcat’s Funding Rate (FR) and Long/Short Ratio, those trusty barometers of market sentiment 🌟. At press time, Popcat’s FR remained resolutely positive across all major exchanges, a testament to the unwavering bullish sentiment that has gripped the Futures market 🚀.

A consistently positive FR is a clarion call to bulls, signaling further price gains on the horizon 📈. This outlook is reinforced by Long/Short ratio data, which reveals that long positions continue to dominate, a clear indication that most participants are bullish and expect prices to rise in the near term 🤔.

According to Coinalyze data, Longs account for a staggering 68.1% of the Futures contracts, with Shorts accounting for a mere 31% of the total 📊. When longs dominate, it is a clear sign that the majority of participants are bullish, expecting prices to rise in the near term 🚀.

As we ponder the question of whether Popcat can sustain its recent gains and break free from the shackles of despair, AMBCrypto’s analysis reveals that bullish momentum is gradually gaining strength 📈. Directional momentum indicators suggest that the memecoin’s upward trend is building, a testament to the unyielding power of the bulls 🚀.

Notably, Popcat’s Stoch RSI made a bullish crossover in the past 24 hours, a clear signal of strengthening momentum 🤯. This crossover is a harbinger of higher closing highs, a veritable golden ticket to the promised land of profits 🎉.

The recent bullish crossover on the coin’s RSI reinforces the token’s upward momentum, signaling strong buyer demand 📈. Current market conditions reflect not only bullish sentiment but also the potential for continued gains 🚀. If this momentum holds, Popcat could test resistance at $0.3712, a dizzying height that would leave even the most seasoned traders breathless 😲.

However, renewed selling pressure, especially following two days of gains, could reverse this trend, sending the price plummeting below the $0.30 support level once again 😨. Ah, the eternal dance of the markets, where bulls and bears engage in a delicate ballet of supply and demand 🕺.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-06-16 15:08