As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed countless market cycles and trends, both bullish and bearish. The recent outflow from BlackRock’s iShares Bitcoin Trust (IBIT) is a stark reminder of the volatile nature of the cryptocurrency market. Having closely followed the evolution of digital assets since their inception, I am not surprised by the extreme swings in investor sentiment.

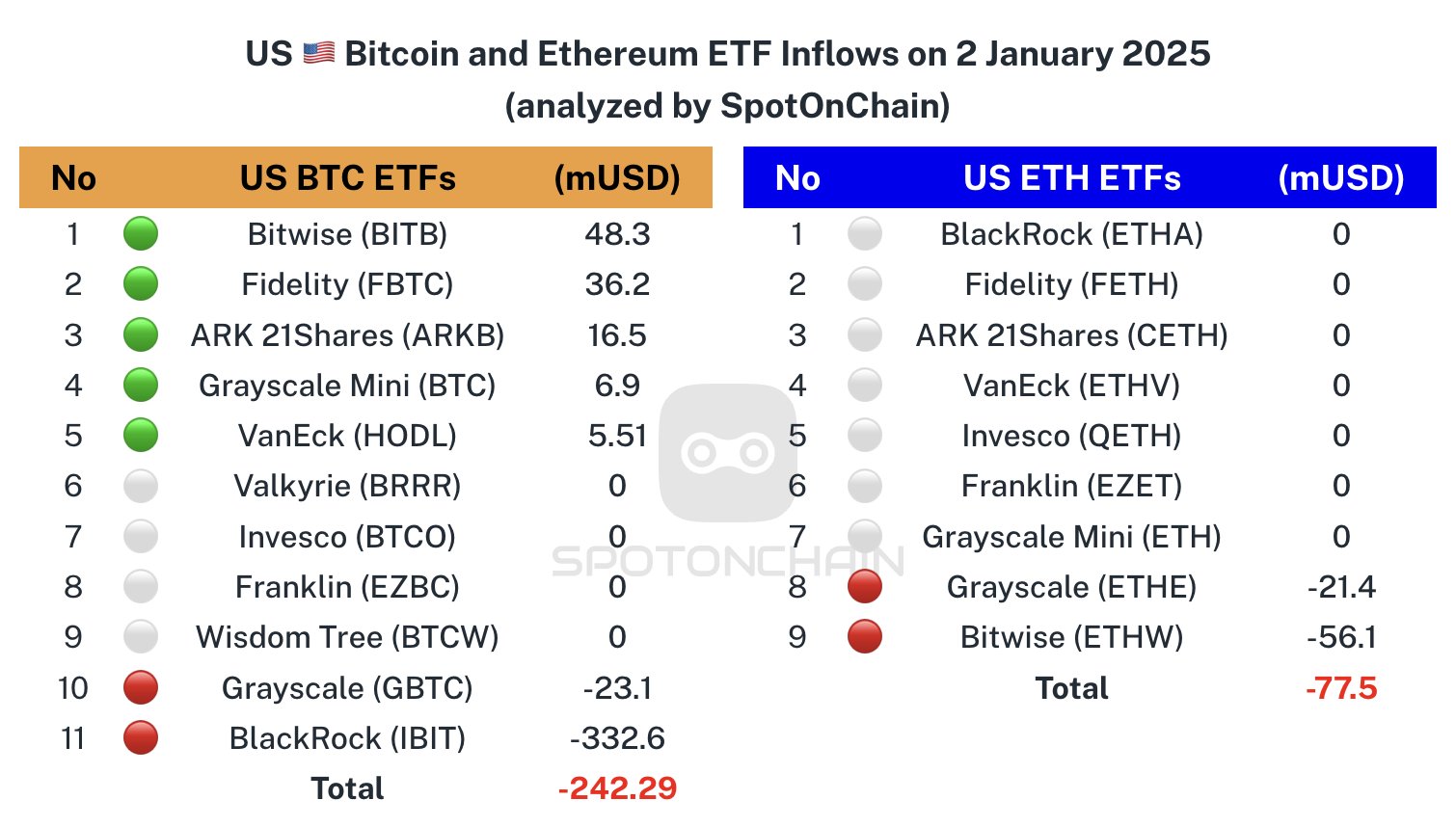

The $332.6 million outflow on the first trading day of 2025 is a significant event, but it’s important to put it into perspective. In 2024, the ETF had an impressive run with inflows worth $37.2 billion, and BlackRock’s Ethereum ETF (ETHA) also saw strong investor interest. It’s a rollercoaster ride that comes with the territory of dealing with cryptocurrencies.

The current dip in the broader market is concerning, but it’s not uncommon for digital assets to experience pressure during such periods. As I analyze the charts, I can see Bitcoin approaching the critical resistance level at $97,700. If history is any guide, a bear reaction from this zone could lead to a potential correction towards the $80,000-$70,000 range.

In the grand scheme of things, a 30% decline would be a healthy textbook correction for Bitcoin and might pave the way for further growth. As an old-timer in this field, I’ve learned that corrections are not always bad news – they often provide opportunities to buy low and sell high.

On a lighter note, I can’t help but think of the old saying, “Buy low, sell high.” If Bitcoin dips to $70,000, it might just be the perfect opportunity for some smart investors to stock up on the world’s most popular cryptocurrency. After all, as they say in our business: “Everyone is a genius in a bull market!”

On January 1st, 2025, the iShares Bitcoin Trust (IBIT) experienced its largest single-day outflow yet, with approximately $332.6 million worth of bitcoins being withdrawn. This is equivalent to around 3,413 Bitcoins, surpassing the previous record set on December 24, 2024, when $188.7 million or about 1,933 Bitcoins were withdrawn.

Despite some initial bumps in the beginning of 2024, IBIT managed to perform strongly throughout the year, amassing a total of $37.2 billion in incoming funds. Similarly, BlackRock’s Ethereum ETF (ETHA) garnered substantial attention from investors, accumulating $3.53 billion during the same period.

Currently, I hold approximately 548,505 Bitcoins valued at around $52.81 billion and roughly 1,071,415 Ethereum with a value of about $3.68 billion in my portfolio as an analyst.

Cryptocurrency market reacts with negative

The impact on the wider cryptocurrency market is yet uncertain, but it’s evident that digital asset prices are under stress today and experiencing a drop. This could be due to Bitcoin encountering a bearish response from around the $97,700 zone, which currently functions as significant resistance for Bitcoin’s price.

There is a possibility that Bitcoin could follow a well-known chart pattern known as “head and shoulders.” This pattern may trigger if the price falls below the support level (neckline) approximately at $92,000.

If that occurs, we might see a significant adjustment in the range of $80,000 to $70,000 for Bitcoin. This represents a 30% drop from its highest point ever, which is considered a normal, textbook correction that’s beneficial for the continued growth trend.

Read More

- XRP PREDICTION. XRP cryptocurrency

- EUR MYR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD MXN PREDICTION

- USD BRL PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- EUR CAD PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- GBP RUB PREDICTION

2025-01-03 12:19