As a researcher with a background in crypto markets and experience in analyzing demand indicators, I find Julio Moreno’s recent analysis on the falling Bitcoin demand an insightful perspective on the current market correction. The use of the Bitcoin apparent demand metric, based on the 1-year inactive supply, provides valuable information about the state of demand in the Bitcoin market.

As a cryptocurrency analyst, I’ve noticed that the Bitcoin price has experienced considerable downward pressure over the last few weeks. A fellow researcher in the field has shed light on the crucial role of demand during this market correction.

BTC Apparent Demand Is Falling – Cause For Alarm?

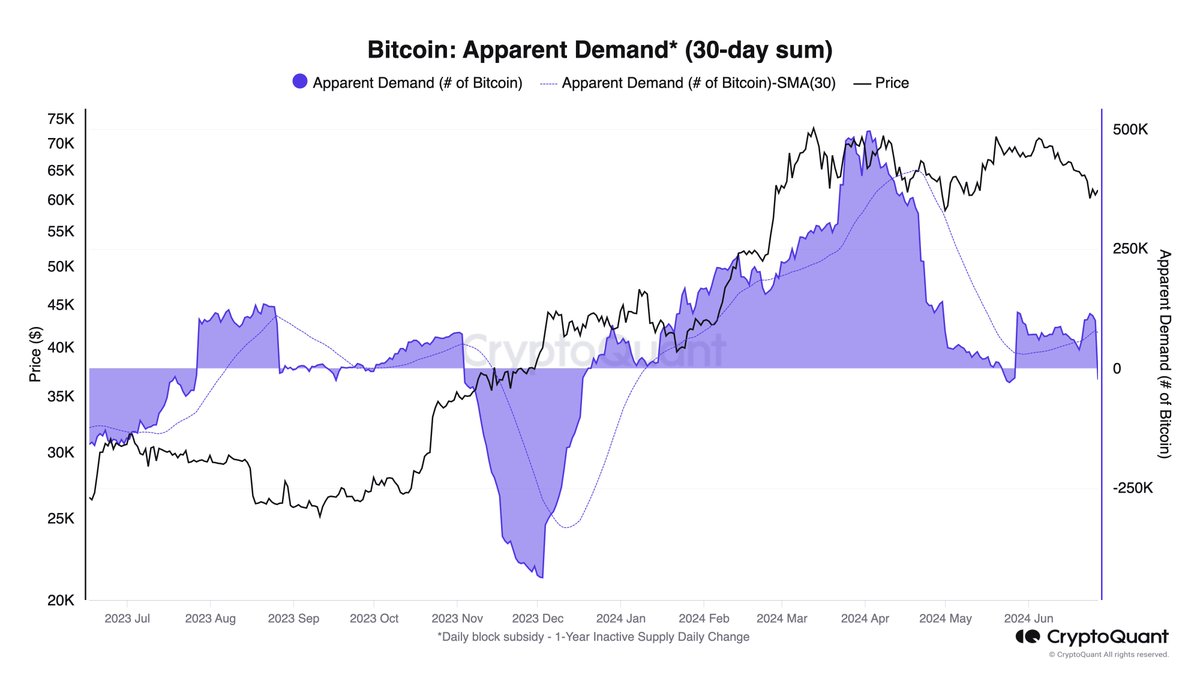

In a recent article on the X platform, Julio Moreno, the research chief at CryptoQuant, discussed the connection between the latest drop in Bitcoin’s price and decreasing demand for the cryptocurrency. This insight derives from the Bitcoin Apparent Demand indicator available on the CryptoQuant platform.

In the financial realm, the term “apparent demand calculation” is frequently employed to assess the demand trend by juxtaposing manufacturing output and inventory fluctuations. Essentially, this indicator sheds light on whether demand is experiencing growth or decline.

As a crypto investor, I often look at the apparent demand for cryptocurrencies like Bitcoin by examining the inactive supply. In simpler terms, this means keeping an eye on the quantity of Bitcoin that hasn’t been transacted or moved within a specific time frame.

According to Moreno’s explanation, the chart depicts the 1-year inactive supply as a representation of Bitcoin inventory. In simpler terms, it tracks down the quantity of BTC that has remained stationary or untouched in transactions for over a year.

Based on information from CryptoQuant, around 23,000 Bitcoins have exited the group of coins that have not been active for a year within the past month. This indicates a potential decrease in Bitcoin demand since it appears long-term investors are choosing to sell and transfer their Bitcoin holdings.

As a crypto investor, I’ve noticed that the current decrease in demand for cryptocurrencies carries significant implications, particularly for the value of the leading digital asset. The Head of Research at CryptoQuant explained that this reduced demand is one factor contributing to the recent price correction.

Long-term BTC holders selling large quantities pushes more Bitcoin into the market, which in turn increases the total amount available for purchase. This excess supply puts a downward trend on prices as demand may not be sufficient to absorb all the newly released coins. Additionally, price decreases can occur when the market’s demand fails to keep up with the increased supply offered for sale.

In their latest weekly report, CryptoQuant noted a notable decrease in Bitcoin’s demand relative to Q1, which coincided with the introduction of US spot Bitcoin exchange-traded funds. With prices now dipping, a surge in BTC demand could potentially rekindle the ongoing bull market.

Bitcoin Price At A Glance

From my recent investigation, the current Bitcoin price hovers around $60,790, representing a 1.6% decrease over the last seven days. Based on information obtained from CoinGecko, it appears that the cryptocurrency market leader has experienced a nearly 6% decline during this same timeframe.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

- IQ PREDICTION. IQ cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

2024-06-29 12:41