Our esteemed champion of financial enlightenment, the very man who taught us to distinguish between the wisdom of “Rich Dad” and the folly of “Poor Dad,” has graced us with his pronouncements on the current state of the markets. It seems the relentless accumulation and adoption of digital currencies has not escaped his discerning eye.

“Bubbles are about to start bursting,” he declared with the dramatic flair of a seasoned showman on the digital stage known as X. One can almost hear the gasps of the assembled multitude. “When bubbles bust,” he continued, with a touch of morbid fascination, “odds are gold, silver, and Bitcoin will bust too.” But fear not, dear reader, for our financial guru sees a silver lining in this impending doom. Should these assets take a tumble, he will be there, ready to pounce like a hawk on a field mouse, snapping up bargains with the gusto of a man who knows a good deal when he sees one.

This latest pronouncement follows hot on the heels of a previous missive in which he celebrated the leading cryptocurrency’s ascent to the dizzying heights of $120,000. “Great news for those who already have some Bitcoin,” he proclaimed, with a hint of smug satisfaction, while offering a sympathetic pat on the back to those who had missed the boat.

But let us not get carried away, he cautioned, for even the most astute investor must tread carefully. “To not get slaughtered like a hog,” he warned, his words dripping with the wisdom of a man who has seen his fair share of market carnage. He awaits the economy’s reaction before committing further capital to the digital gold rush.

“If you have not begun acquiring BITCOIN….I suggest starting very small… starting with a Satoshi.”

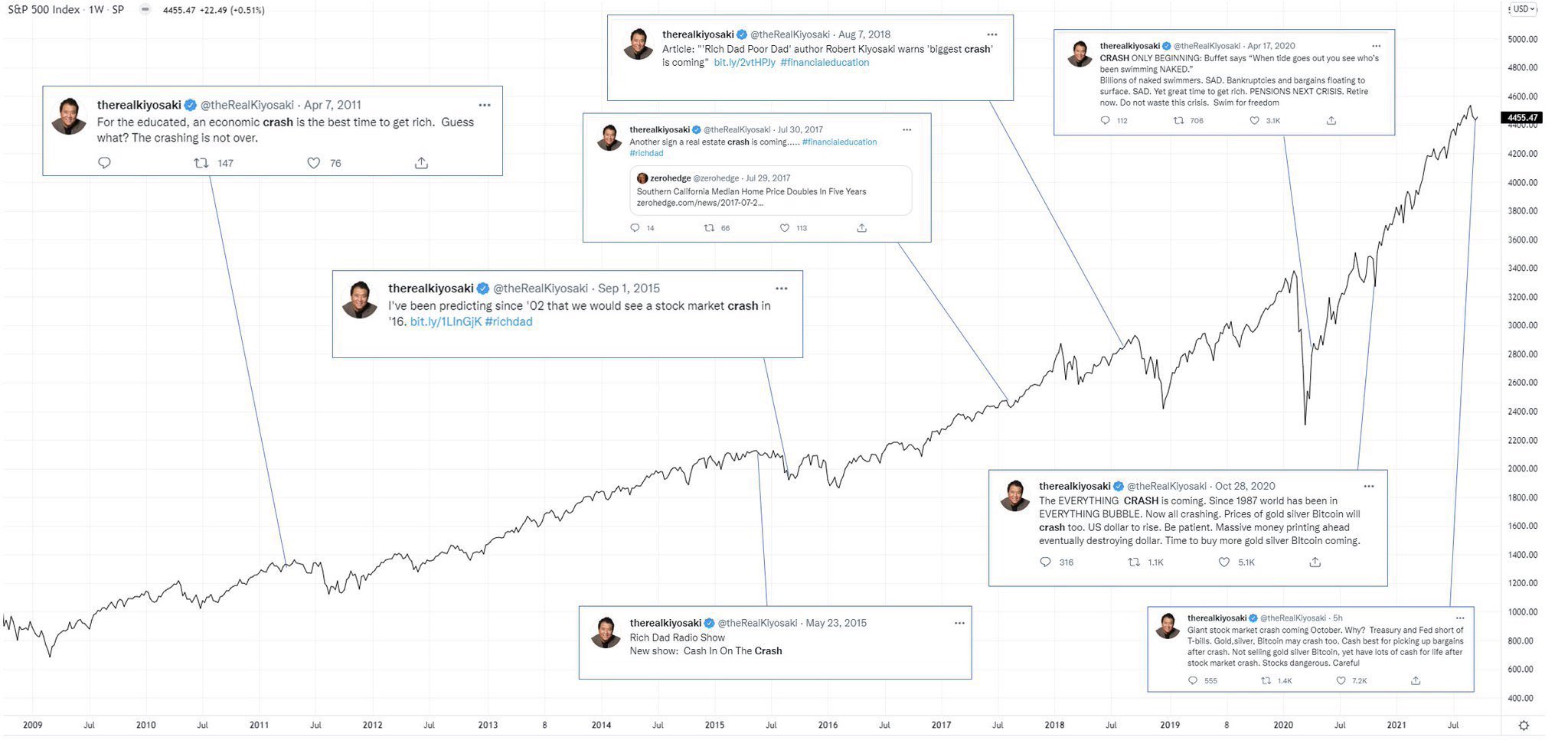

Ah, the fickle nature of market predictions! Our financial sage’s stance on Bitcoin has been as changeable as the Russian weather, swinging from bullish exuberance to cautious pessimism with the regularity of a pendulum. Just last month, he scoffed at the “CLICK BAIT Losers” who dared to predict a Bitcoin crash. One might even say he has a history of, shall we say, “miscalculations” when it comes to predicting market downturns. Indeed, a certain market newsletter, Brew Markets, has compiled a rather amusing chart detailing his past pronouncements, many of which have proven to be, well, let’s just say “less than accurate.”

Bitcoin Marches On

But let us not dwell on the pronouncements of a single man, however influential he may be. Bitcoin, like a stubborn ox, continues its relentless march forward, seemingly impervious to the pronouncements of even the most vocal prophets. According to the esteemed oracles of CoinMarketCap, Bitcoin’s dominance stands at a healthy 60%, a testament to its enduring appeal. True, there has been a slight dip in this metric over the past week, as the so-called “altcoins” have enjoyed a brief moment in the sun. But whether this is a mere blip on the radar or the beginning of a sustained shift in market sentiment remains to be seen.

And what of the market cycle indicators, those mystical runes that traders consult in their quest to predict the market’s every move? None have yet triggered, suggesting that the party may not be over just yet. With institutions, retailers, governments, and even your Aunt Mildred pouring millions into this digital gold rush, Bitcoin continues to set records, leaving naysayers and skeptics in its dust.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Prime Gaming Free Games for August 2025 Revealed

2025-07-21 13:29