As a seasoned crypto investor with a knack for spotting promising assets, I find myself intrigued by Ripple’s latest offering – RLUSD stablecoin. With its meteoric rise in just a week, it’s evident that this dollar-pegged coin is making waves in the market. While it’s still far from heavyweights like USDC and USDT, its rapid ascent towards the top 20 stablecoins is nothing short of impressive.

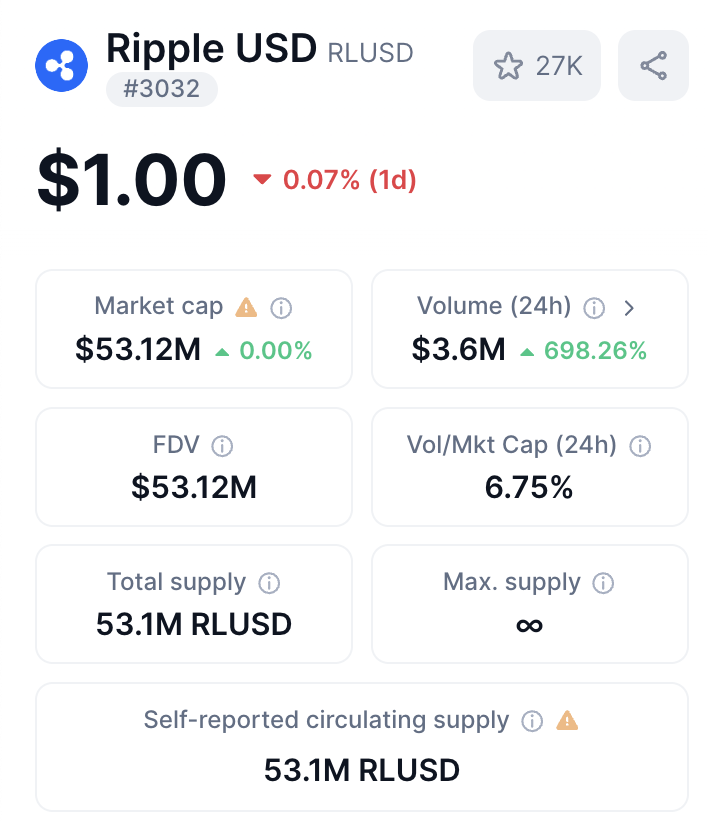

As a researcher, I’ve been closely monitoring the development of Ripple’s RLUSD stablecoin for nearly a week now. Since its launch on December 18th, across both the Ethereum and XRP Ledger (XRPL) blockchains, this dollar-backed digital asset has been consistently gaining traction. As per the latest rankings by CoinMarketCap, RLUSD’s market capitalization currently stands at approximately $53.06 million, placing it among the top 3,032 cryptocurrencies in terms of market value.

Four days ago, the number was 3,321, while this morning it stood at 3,187. Despite being distant from USDC and USDT, its main competitors, it is now approaching LUSD and has entered the top 20 stablecoins in the crypto market.

As a researcher examining the digital currency landscape, I’ve observed that Ripple USD (RLUSD) remains absent from prominent exchanges like Binance, ByBit, and Coinbase. The logical implication is that once it secures listings on these key platforms, we can expect a substantial rise in its market capitalization, user adoption, and trading volume.

Currently, its market capitalization stands at approximately $53.12 million, with a trading volume of around $3.6 million, and it ranks at number 3,032 among the top market cap listings according to CoinMarketCap.

Nevertheless, what’s presented here falls short of Ripple‘s aspirations, given their apparent aim to seize a larger share in the expanding stablecoin market, projected to reach $2.8 trillion by 2028. Notably, this ambition comes when you consider that the combined worth of all cryptocurrencies currently surpasses $3.3 trillion.

The stablecoin market is full of challenges, and it is really important to maintain user trust. If people stop trusting you, it can have really bad consequences. We saw this with the collapse of Terraform Labs’ UST, where they lost tens of billions of dollars, and related assets like LUNA also collapsed. While there are risks, the growth potential of the stablecoin segment is clear.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- How to Reach 80,000M in Dead Rails

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- Eiichiro Oda: One Piece Creator Ranks 7th Among Best-Selling Authors Ever

- 8 Best Souls-Like Games With Co-op

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- T PREDICTION. T cryptocurrency

2024-12-24 18:19