On the tenth day of the somewhat unremarkable month of April, an intriguing scroll was unfurled before the Second Circuit Court of Appeals. With all the gravity of a cat strutting through a dog park, the whispered intent of the Ripple and the SEC to take a little breather was revealed. An “agreement-in-principle” they beamed, as if announcing a secret password to an elite sorority of financial insiders.

A Major Shift in the XRP Lawsuit

Ah, the XRP saga—what a raucous melodrama! It all began in the dusky December of 2020, amid snowflakes and SEC accusations that Ripple was hawking XRP as if it were candy at a roadside stand, unregistered and scandalously sweet. This legal farce morphed into a classic Greek tragedy addressing the profound and oh-so-Homeric query: Is XRP a digital asset or just another haughty security in the grand Kryptonian pantheon?

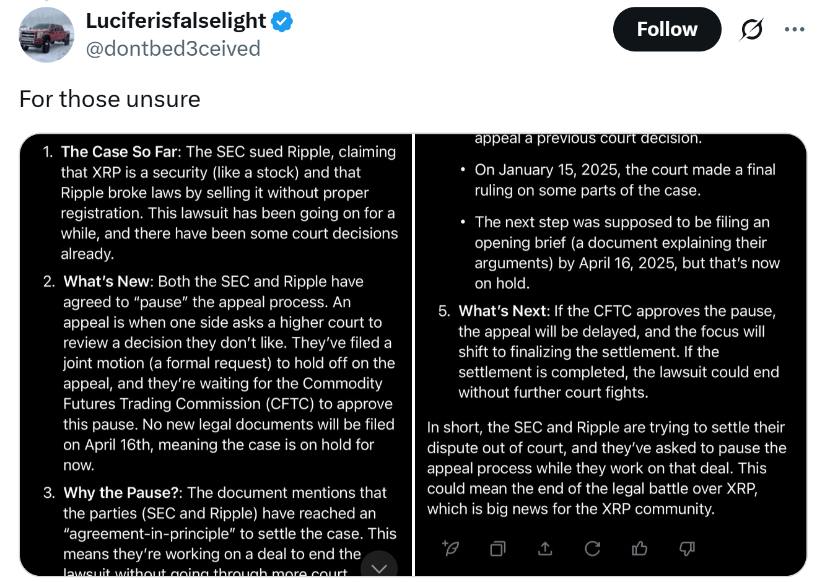

After four interminable revolutions around the sun—think of it as the slowest race in history—the SEC and Ripple decided to drop their metaphorical swords and share a pot of chamomile tea instead. A motion they filed to freeze all legal tussles for a luminous stretch of 60 days, suggesting they were saving precious judicial resources, while they searched for their magic negotiating hats.

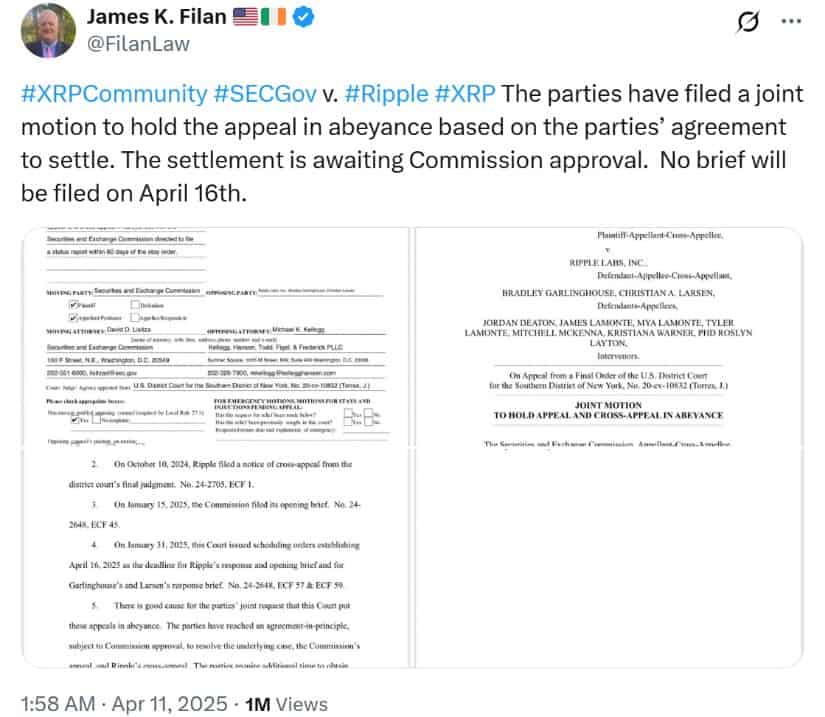

Consequently, the deadline meant to unveil Ripple’s counterattack to the SEC’s appeal faded away like the last slice of pizza at a party—gone and very much missed. Their astute lawyer, James Filan, shared the news on X (formerly Twitter, because, who wouldn’t want a rebranding?), confirming that hopes of a settlement were hanging on Commission approval. How thrilling! 🎉

Ripple’s Partial Legal Win and Path to Resolution

Flashback to July 2023—when Judge Analisa Torres, playing her own version of Solomon, ruled that while Ripple’s institutional sales were as illegal as an unlicensed magician, its programmatic sales danced merrily in the marketplace. A mixed verdict that left Ripple doing a little jig, opening the door for whispered talks of peace.

Meanwhile, Ripple’s big kahuna, CEO Brad Garlinghouse, declared an emphatic “game over” while Chief Legal Officer Stuart Alderoty twirled his mustache, promising no cross-appeals would follow. The latest filing, encompassing all well-dressed litigations—those against Garlinghouse and the other co-founder, Chris Larsen—strongly suggests a happy ending is lurking just around the corner.

Observers with magnifying glasses have pointed fingers at the timing of this cozy intermission, attributing it to the coronation of Paul Atkins, the new SEC Chair, a staunch crypto enthusiast. Insiders conjecture that the SEC is simply biding its time, waiting for the new sheriff in town before thumbs up’ing the settlement.

“The SEC is primed to settle; they are just waiting for a new epoch to officially begin,” chirped a sarcastic user on X, and who could blame them? 😏

Market Reactions and XRP Price Forecast

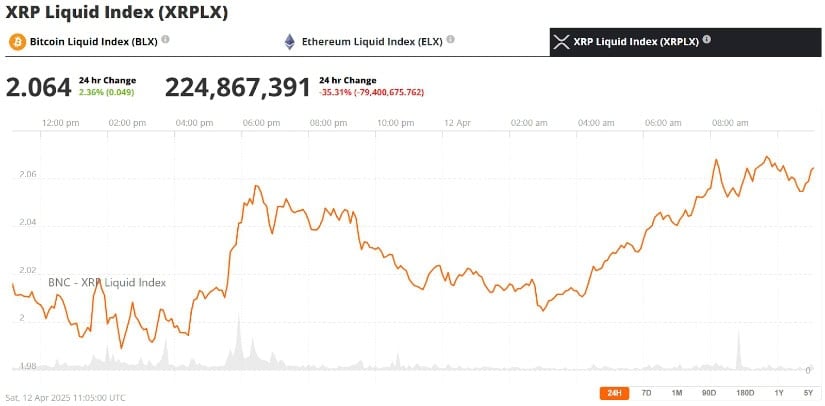

As the news trickled through virtual alleyways, the price of XRP dipped in an unsightly 4.24% plunge, landing like an unwelcome guest at $1.9649—snatching away some of its flashy 14.32% gain from the prior hours. Economists, those modern day shamans, believe the market has already baked in a positive outcome; some sacred fortune cookie has spoken!

The current price hovers at $2.01, with a bustling 24-hour volume parade of $4.14 billion, according to the oracle known as CoinMarketCap. Analyst Egrag Crypto has fueled mystical hopes for XRP’s future, positing that a whimsical spike could even reach $27 with regulatory clarity. Don’t we all love a touch of hyperbole?

The approval of the Teucrium 2X Long Daily XRP ETF, all primped and presented by NYSE Arca, boosts confidence and echoes institutional allure towards XRP—a digital asset composed of code and ambition.

Implications for Ripple and the Crypto Industry

The fabled settlement holds the potential to not only fade the Ripple saga into the annals of history but also to craft pivotal precedents for crypto oversight in America. Ripple is rumored to face a mere $50 million slap on the wrist—down from an audacious $125 million theatrical demur proposed by the SEC. A tale of two punishments!

This outcome may pave the way for Ripple to reconnect with its institutional buddies, expand its territory in the U.S., and help establish its ledger as the gold standard for compliant cross-border payments. A true fairy tale with a twist of financial genius!

“The SEC’s pause in litigation signals a shift akin to a well-timed plot twist; a narrative of regulatory grace awaits,” remarked a legal sage embroiled in this towering drama.

If all goes according to this freshly spun yarn, the Ripple settlement could overhaul the SEC’s tactics from high-handedness to a more poetic regulatory clarity. We can almost hear the Hallelujah chorus in the backdrop.

Looking Ahead

As both titans await the enthusiastic nod from SEC overseers, the coming two moons may usher in a destiny-shaping resolution. Should a settlement materialize, Ripple might just don the mantle of a pioneering exemplar for crypto compliance—a guiding light for blockchain and U.S. regulatory camaraderie! 🌟

For XRP aficionados and the crypto tribe at large, this Ripple revelation might just illuminate the path towards a closure to a protracted dispute that has shaped our conversations on digital assets. Whether XRP will leap into the sky like a well-launched firework or flounder back to earth, time alone will tell. Nonetheless, we await the unfolding of the next act with bated breath!

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- How to Unlock the Mines in Cookie Run: Kingdom

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- REPO: How To Fix Client Timeout

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-04-12 18:48