In today’s episode of “Wait, Didn’t You Die in 2011?”—a mysterious whale apparently dusted off their time-traveling wallet and casually yeeted over $1 billion in Bitcoin. Yes, really. This wallet, untouched since the days of Angry Birds, actually moved 10,000 BTC (worth an eye-watering $1.09 billion) to a new address after a 14.3-year-long snooze—no biggie, just letting your billion-dollar piggy bank get a bit of fresh air.

According to Spot On Chain, the BTC stash was acquired in April 2011 for the princely sum of $109,246. If you’re playing along at home, that means the average acquisition price was a jaw-slapping $0.78 per coin. Ah, the early 2010s, when coffee, beanie hats, and apparently Bitcoin were all under a dollar. The current ROI? Over 140,000x. Imagine explaining that to your bank manager: “No, I swear, I just… found it lying around.”

Who knows what prompted this hallowed whale to click “send” now? Maybe they’re just bored. Maybe they forgot their birthday and needed excitement. Or maybe the scent of Bitcoin inching toward its all-time high ($109,100 right now, in case you missed it) was just too irresistible. We’re less than 3% from another summit, so yes, cue the hype music and suspiciously timed whale migrations.

Big moves like these usually have crypto Twitter in a tizzy. “Is the whale about to dump?” “Did grandma finally find her old hard drive?” Likely, the whale’s just transferring its loot from cryogenic storage to somewhere slightly toastier—and possibly within reach of a “Sell” button. 🐳💸

Elsewhere in whale watch news: Sentora’s data shows these titans of crypto are quietly reducing their positions. But before you queue the doomsday playlist, Sentora’s analysts (surely sipping very expensive lattes) think this is all good news, signs of a sophisticated market getting wiser. ‘Old whale coins are dispersing!’—translation: the dinosaurs are selling, the mammals are taking over, and soon we’ll all be microchipped with Bitcoin wallets anyway.

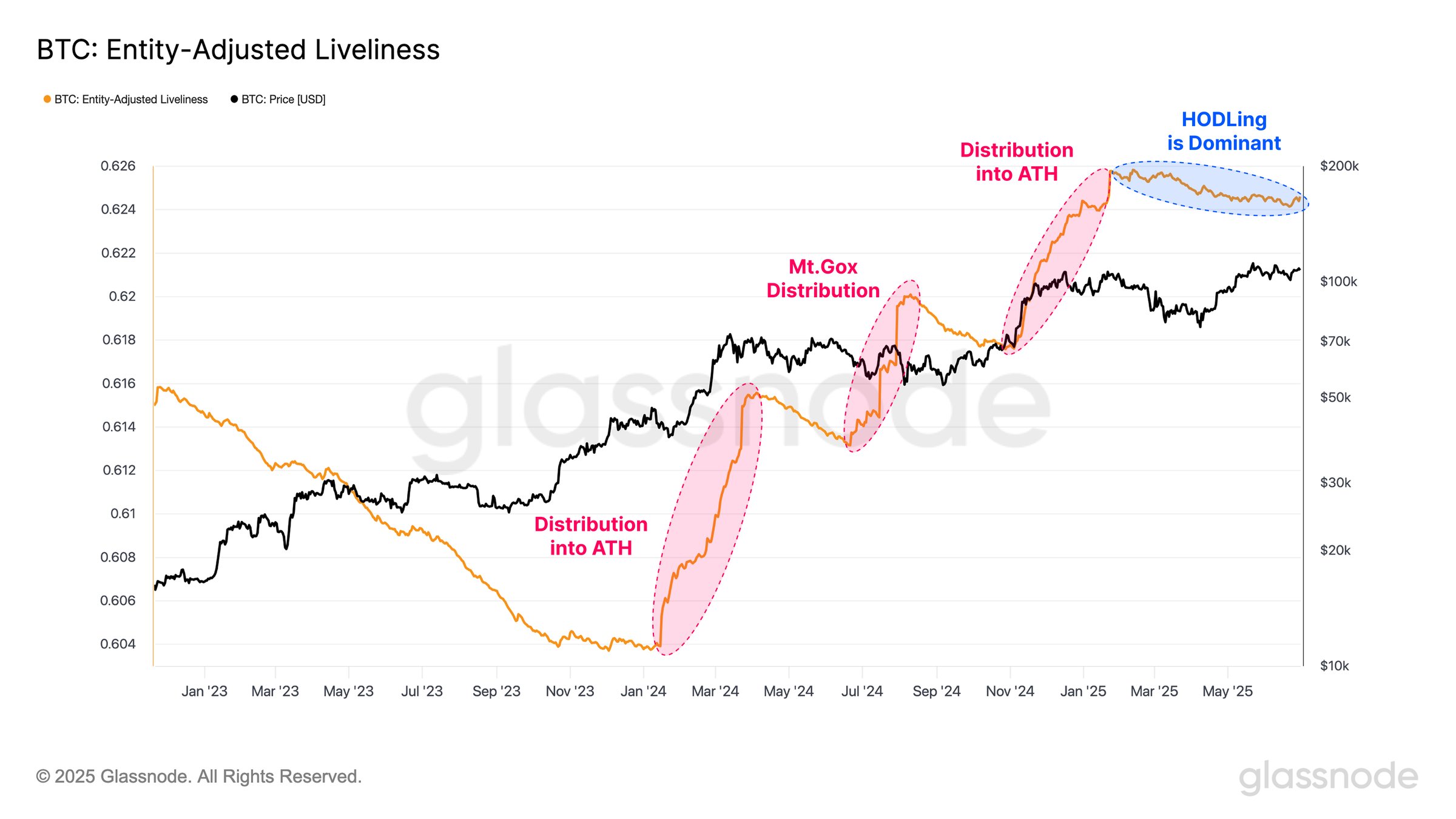

However, the folks at Glassnode aren’t quite ready to hand out party hats. Their “Liveliness” metric, which should really come with a better name, shows BTC holders are getting even… sleepier. Not selling, just sitting. Apparently, we’re all channeling our inner sloth investors. 🦥

Unlike those wild 2017 days of panic buys and “quick, sell everything” energy, this time, long-term holders are lounging through peak prices, feet up, cocktails in hand. Case in point: 14.7 million coins are now held by total chillers who’ve diamond-handed for over 155 days. Most BTC bought near $100,000 still hasn’t budged. Faith? Laziness? Lost ledger? Who’s to say. Either way, speculative fever seems to have gotten a prescription for Xanax.

Institutions gobbling up that sweet, sweet BTC

While OG whales contemplate selling or just opening Excel for the first time in 14 years, institutional investors are stampeding in. Fragbite Group saw its stock moon 64% after tweeting “lol, we’re buying Bitcoin,” and Vanadi Coffee’s share price turned into a caffeine-fueled rocket (+240% in a month) after pledging to dump up to $1.1 billion into BTC. Because apparently, coffee and crypto are the peanut butter and jelly of 2024.

Not to be left out, Belgravia Hartford waved around $1 million of new crypto cash, while Green Minerals in Norway wants to raise $1.2 billion for their digital piggy bank. Suddenly, Bitcoin is everybody’s favorite office party punchbowl—grab a ladle, institutional FOMO is contagious.

Traders and analysts are dusting off their wildest predictions once more. CryptoFayz says if BTC finally hops over that $111,960 line, the next stop is $116,000—based, presumably, on charts that look suspiciously like modern art. Meanwhile, Standard Chartered and Bernstein have both forecast Bitcoin hitting $200,000 (by end of 2025, no less; place your bets). And BitMEX’s Arthur Hayes, not one to be out-hyped, slapped a $250,000 target for good measure. Lambo memes on standby. 🚀

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-07-04 11:03