As a seasoned Bitcoin investor with over a decade of experience under my belt, I find myself both intrigued and cautious upon hearing the news of a dormant address coming back to life after 11.2 years, holding a substantial stash worth around $50 million.

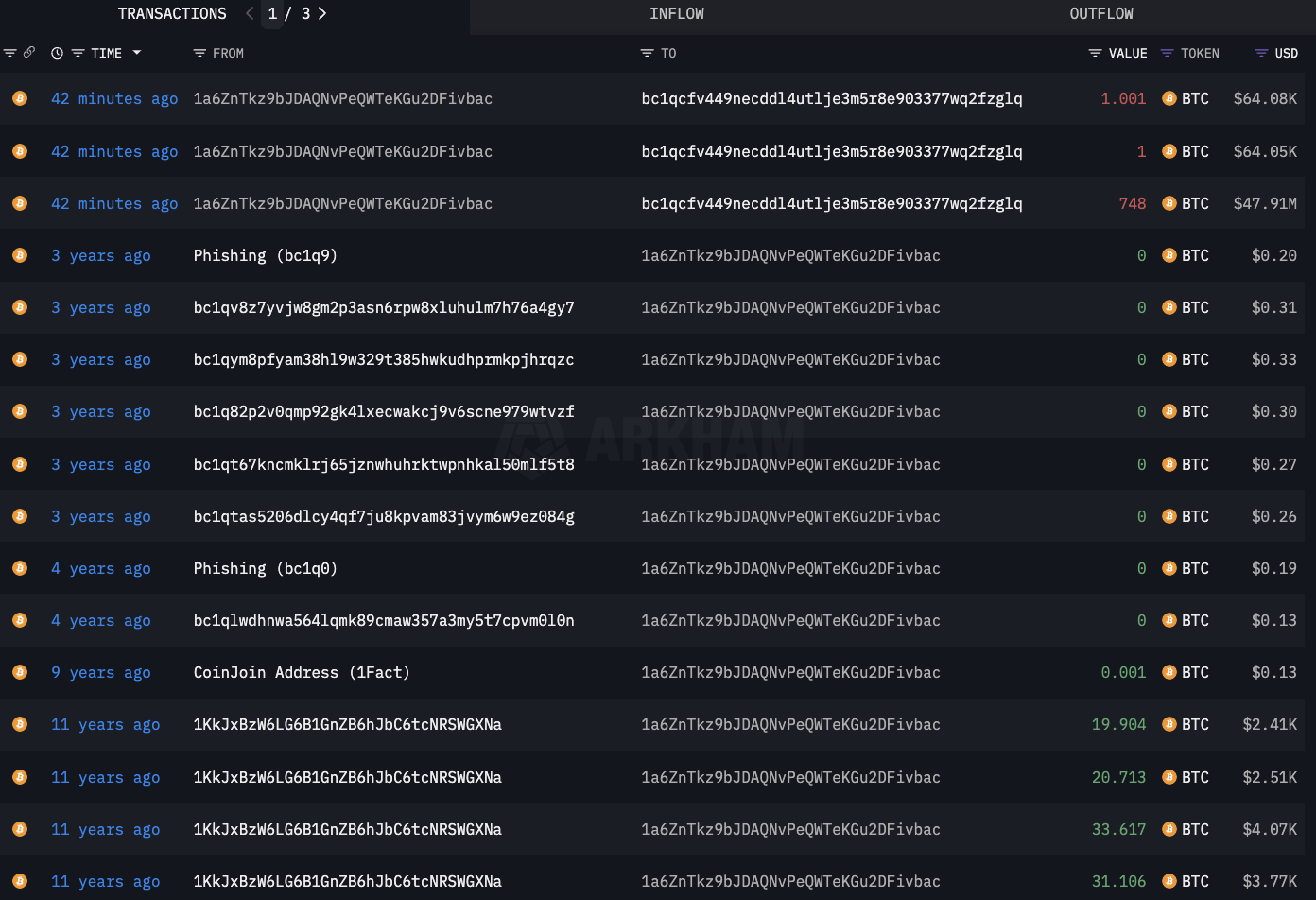

An unidentified Bitcoin (BTC) investor has become active again after a long absence of over 11 years, based on information from Whale Alert. Upon closer examination of the blockchain data, it seems that this mysterious figure now holds approximately 750 BTC or around $50 million worth of coins.

An inactive Bitcoin wallet holding approximately 750 coins, equivalent to around 48 million USD, has recently become active again after a long period of 11.2 years.

— Whale Alert (@whale_alert) July 25, 2024

As a researcher, I’ve uncovered some intriguing information regarding the Bitcoin address “1a6Zn”. I discovered that this address last saw transaction activity on June 4, 2013, coinciding with a Bitcoin price of approximately $120 per BTC. Fast forwarding to the year 2024, holding this amount of Bitcoins will result in an impressive fortune worth around $50 million. In terms of returns, that initial investment would have grown by an astounding 53,583%. To put it into perspective, this equates to a remarkable annual growth rate of 4,784% over the span of 11.2 years.

Following the revival of this ancient, previously dormant whale, they moved all the tokens to the “bc1qc” wallet address instead.

Why?

The enigma persists: one plausible explanation might be related to security enhancements. As time goes by, the norm for storing Bitcoins has evolved, and this transaction could signify a transition from the outdated “1” address format to the more robust “bc1” format.

In recent history, July has seen a notable resurgence of dormant Bitcoin, making it the most recent significant awakening. Some market observers view this development as bearish, considering that cashing out even a portion of a staggering 53,583% profit is an enticing proposition for many.

Taking into account that they have owned their Bitcoins for an extended period, it seems unlikely that they are currently looking to sell.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- MDT PREDICTION. MDT cryptocurrency

- UFO PREDICTION. UFO cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

2024-07-25 18:39