As a researcher who’s been navigating the cryptocurrency landscape since the early days of Satoshi, I can’t help but feel a mix of admiration and trepidation as I watch this Ethereum whale from the past cashing out their massive profits. It’s fascinating to see how far we’ve come, yet also concerning to observe the current struggles Ethereum is facing.

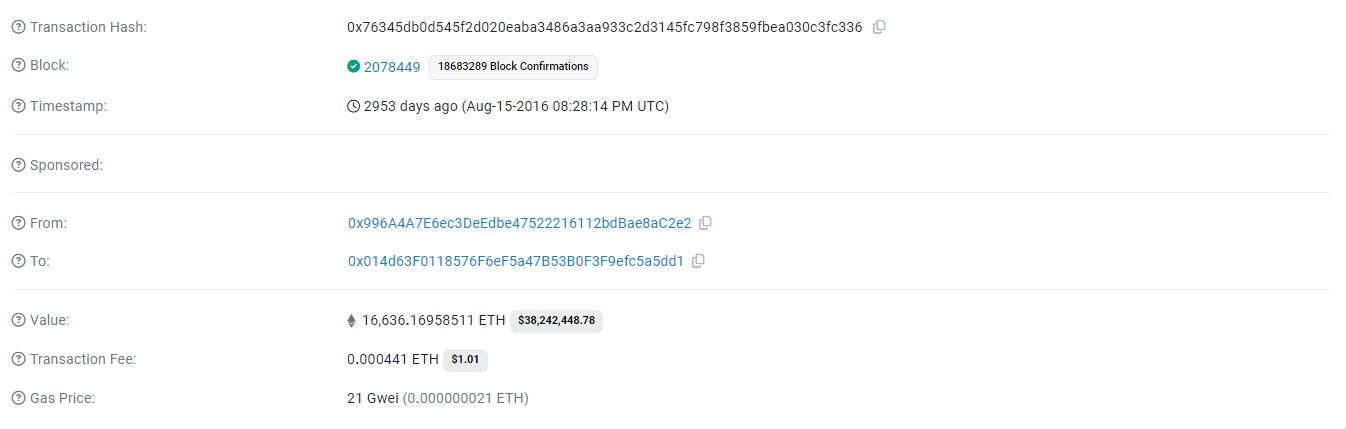

After owning the asset for over eight years and earning an astounding 446-fold return on investment, a ‘Ethereum whale’ active during the Satoshi era has started offloading their holdings. In February 2016, they purchased 16,636 ETH from ShapeShift at just $5.23 per ETH, as recorded by Ember’s data.

After enduring the significant surges in Ethereum’s price, the whale decided to offload some of its investments. They successfully sold 350 ETH for an astonishing $2,340 each, resulting in a staggering 446-fold return. However, Ethereum is currently struggling to maintain its previous pace, and this selling spree seems to align with that trend.

Ethereum has a weak ecosystem as a result of its poor performance and sharp decline in usage. The ETH/BTC ratio has fallen below 0.4 for the first time in three and a half years, suggesting that Ethereum is trailing behind Bitcoin.

Due to a growing preference for Bitcoin and other investments over Ethereum among many investors, this downward trend may reflect a broader negative sentiment in the investment community. Additionally, the current slow burn rate of Ethereum, which only sees around 135K ETH burned each year, paints a challenging picture regarding the network’s supply dynamics.

It appears that the creators of Ethereum did not foresee an economy like this, characterized by decreasing money supply (deflation). However, it’s not deflation that concerns investors but rather the annual growth rate of Ethereum’s supply, which is approximately 0.68%. Despite these issues, Ethereum remains a significant figure in the blockchain sector.

The project’s standing in the market may persistently struggle due to low usage on its network and a scarcity of innovative updates or advancements that generate excitement. Regrettably, there wasn’t any groundbreaking technology introduced by developers that could revolutionize the market as NFTs and DeFi did in 2021. There were discussions about the possible expansion of RWAs before Bitcoin halving, but it appears that the market has yet to follow suit.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- EUR ILS PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- CKB PREDICTION. CKB cryptocurrency

- OOKI PREDICTION. OOKI cryptocurrency

- LOVELY PREDICTION. LOVELY cryptocurrency

- ANKR PREDICTION. ANKR cryptocurrency

2024-09-16 11:44