As a seasoned crypto investor who has weathered numerous market cycles since the Satoshi era, I’ve learned to keep a keen eye on such developments. The recent awakening of the Bitcoin whale from 2011, with its 20 BTC transfer to Bitstamp, is a stark reminder of the power of patience and the unpredictable nature of this market.

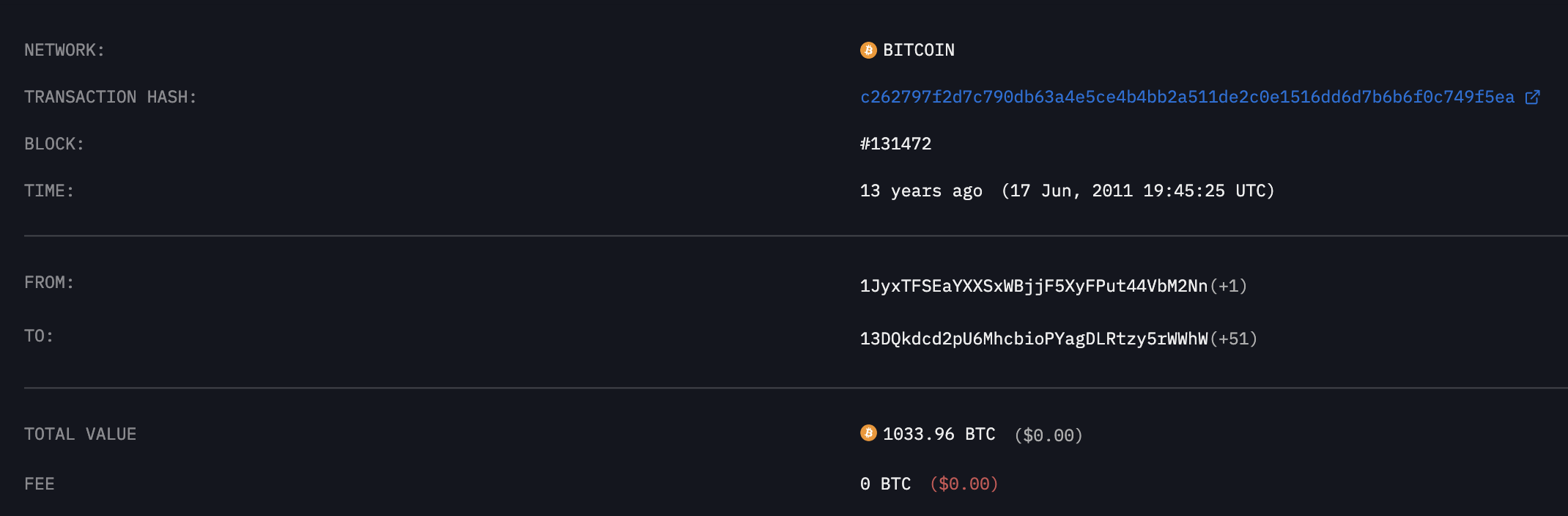

An anonymous Bitcoin (BTC) whale from the Satoshi era has awoken after 13.4 years of dormancy and made its first transaction, according to a report by Whale Alert. The wallet with the address “1FoicoWy” has been inactive since 17 June 2011, when it received a 20 BTC portion of a 1,033.96 BTC transfer between two anonymous wallets, which involved 51 empty wallets, of which “1FoicoWy” was one.

⏳ An inactive Bitcoin address holding approximately 20 coins (equivalent to about $1,370,949 today) has unexpectedly become active again after a long dormancy of around 13.4 years (which was equal to roughly $333 worth of BTC back in 2011)!

— Whale Alert (@whale_alert) October 20, 2024

This Bitcoin hoard had remained untouched for a span of approximately 13 years and 4 months, up until October 20, 2024. On that day, without warning, it became active, initiating a transaction to an anonymous wallet identified as “3Eddvk.

More details

At this fresh location, there was no prior record of transactions associated with it. However, this wasn’t the end point for the 20 BTC, as they were subsequently moved to Bitstamp – a well-established player in the world of major cryptocurrency exchanges.

As a researcher, I’ve observed a common belief within the cryptocurrency community that large Bitcoin transfers from long-time holders, often referred to as “Bitcoin whales,” and their sudden activity, often precede a market sell-off. The rationale behind this is that these old investors are returning to cash out their substantial profits. Indeed, in one recent instance, an investor who had been holding Bitcoin since 2011 saw a return of an astounding 411,696%.

In many instances lately, these bitcoin transfers haven’t been followed up, like in the Bitstamp case we just witnessed. However, this specific instance lends credence to worries about the actions of long-time Bitcoin holders. Moreover, this is merely one of 51 recipients. Imagine if another 50 wallets, each holding approximately 20 bitcoins, were activated and started transferring funds to exchanges? This could potentially have a significant impact.

Read More

- USD MXN PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- VANRY PREDICTION. VANRY cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- RSR PREDICTION. RSR cryptocurrency

- XRP PREDICTION. XRP cryptocurrency

- ZIG PREDICTION. ZIG cryptocurrency

- NTRN PREDICTION. NTRN cryptocurrency

- POL PREDICTION. POL cryptocurrency

- EUR CAD PREDICTION

2024-10-21 13:31