In a twist that would make even the most stoic of Russian novelists raise an eyebrow, Satsuma Technology PLC-a company that once claimed to build AI but now seems to specialize in Bitcoin alchemy-has managed to plunder investors of $217.6 million, 64% more than they dared to ask for. The pièce de résistance? They accepted 1,097.29 Bitcoin, a currency that, just a decade ago, was the preferred medium of exchange for black-market tacos and libertarian daydreams. BTC$114 03724h volatility:0.7%Market cap:$2.27 TVol. 24h:$34.90 B

This digital gold rush was fueled by the usual suspects: ParaFi, Pantera Capital, Kraken, and Digital Currency Group-names that sound like they belong to a Victorian-era investment syndicate, not a bunch of crypto bros with too much caffeine and not enough sleep. The fundraising, one might say, is the UK’s most significant Bitcoin heist since the 18th-century East India Company decided to monetize its tea leaves.

🚨JUST IN: 🇬🇧 Satsuma Technology, the latest British invention to rival the steam engine and the umbrella, has closed a £163.7M ($217.6 million) raise. The investors, bless their gullible hearts, sent 1,097 BTC as a “treasury strategy.” One wonders if they’ve considered investing in a time machine to avoid this.

– NLNico (@btcNLNico) August 6, 2025

Satsuma’s grand plan for this newfound wealth? To “grow operational capacity” and “pioneer decentralized AI.” A noble goal, if one ignores the fact that their AI infrastructure currently consists of a PowerPoint presentation and a LinkedIn post. The funds will also be split between fiat (to ensure “operating stability”-a euphemism for not burning through cash) and Bitcoin, because nothing says “stability” like tying your company’s fate to a currency that fluctuates more than a British weather forecast.

With this windfall, Satsuma now boasts a Bitcoin hoard of 1,125.85 BTC, worth roughly the same as a small island nation’s GDP. This treasure is, of course, held by their Singapore subsidiary, a decision that smells faintly of tax evasion and questionable accounting practices. One might ask, “Why not just buy a yacht?” But no, Satsuma prefers to let its money “decentralize” itself in a digital vault, where it can’t be touched by regulators-or common sense.

CEO Henry K. Elder, a man whose name sounds like it belongs in a 19th-century novel, declared that this oversubscribed round “validates the company’s new crypto-based corporate model.” A model that, by all accounts, involves taking investors’ money and hoping Bitcoin doesn’t crash. “The fact that many chose to subscribe in the first-ever Bitcoin subscription in London speaks to their trust in our ability to innovate and execute,” he wrote, as if innovation and execution are things one can simply declare into existence.

The UK’s Growing Obsession with Bitcoin

Thanks to Satsuma’s efforts, the UK now has a new #2 Bitcoin corporate holder. The Smarter Web Company, with its 2,050 BTC, sits comfortably in first place, while Phoenix Digital Assets clings to third with a mere 247 BTC. Meanwhile, Bluebird Mining Ventures, a gold mining company, has decided to replace its gold reserves with Bitcoin. One can only hope the ground doesn’t literally crumble beneath them.

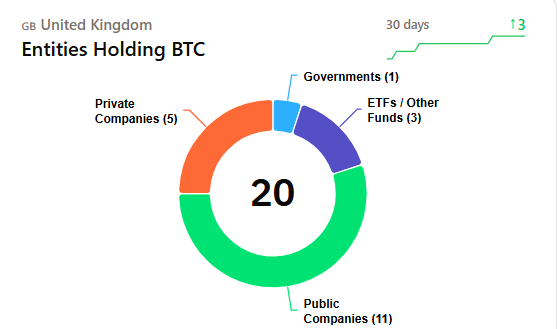

The UK government, ever the slow-moving bureaucratic beast, has taken steps to embrace digital assets. In May 2025, they introduced draft legislation to regulate crypto-a move that has the same urgency as a tea-soaked sock drying in the sun. According to BitcoinTreasuriesNet, 20 UK entities now hold Bitcoin, including 11 public companies, 5 private firms, 3 ETFs, and 1 government entity. A 30-day surge, no doubt fueled by the same optimism that led the UK to believe Brexit was a good idea.

Distribution of UK-based entities holding BTC | Source: BitcoinTreasuriesNet

At the time of writing, Bitcoin trades at $114,154, a price that’s 7.46% below its all-time high but still 108% higher than last year. One might call it a rollercoaster, but in this case, the only thing being thrown around is investors’ money. As for Satsuma? They’ve proven that if you dress up a PowerPoint in enough buzzwords and throw in a Bitcoin logo, you can convince people to hand over millions. A lesson for the ages-or at least until the next crash.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- How to Unlock & Upgrade Hobbies in Heartopia

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Who Is the Information Broker in The Sims 4?

2025-08-06 14:26