As a seasoned analyst with over two decades of experience navigating the complexities of financial markets, I find myself deeply concerned about the current state of the crypto industry in the United States under the leadership of Gary Gensler at the SEC. The staggering figure of $426 million spent by crypto companies on defensive litigation against the SEC is simply unacceptable and unsustainable.

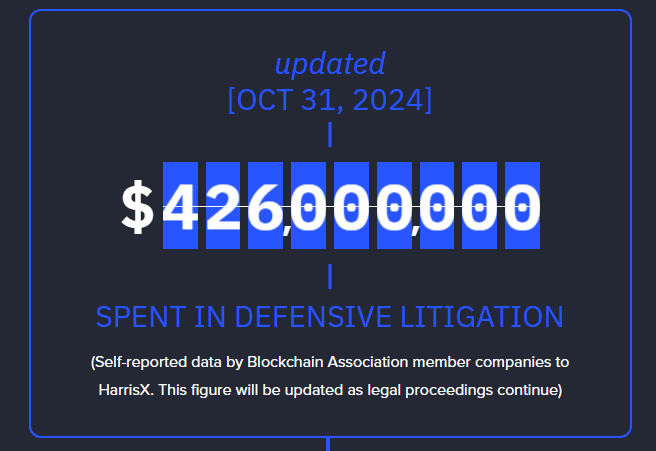

The Blockchain Association, an organization advocating for cryptocurrency, disclosed that crypto businesses collectively set aside approximately $426 million to defend against legal actions initiated by the U.S. Securities and Exchange Commission (SEC), led by Chair Gary Gensler.

According to a joint report released on October 31st, the Blockchain Association has criticized the regulatory agency for its “enforcement-based regulation” strategy, which negatively affects the entire cryptocurrency sector. This criticism includes not only the financial burdens associated with contesting complaints and lawsuits, but also the job losses that subsequently ripple through the economy.

SEC’s Costly Approach

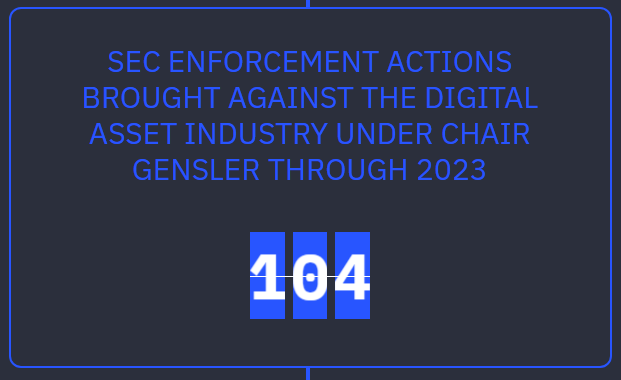

The Blockchain Association collaborates with HarrisX, a research and data firm, to shed light on persistent challenges within the industry. Notably, in the same press statement, they pointed out that from 2021 to 2023, the American regulatory body has opened 104 cases against cryptocurrency businesses, during which time Gensler served as the agency’s chairman.

According to the figures shared by its members, they stated that costs associated with defensive litigation totaled approximately $426 million.

As per the group’s perspective, it’s high time for a shift and an opportunity for cryptocurrency businesses to thrive. They label the approach taken by Gensler as “legal warfare,” which they believe should cease. The group suggests that replacing the agency’s leadership is the initial move towards change.

SEC’s Aggressive Regulation On Crypto Now An Election Issue

The press release also advocated for a change in leadership by motivating crypto voters to take action. Under Gensler’s watch, the agency has filed cases and inquiries against top blockchain companies such as Ripple, Binance, and Coinbase.

Beyond just financial setbacks, Gensler’s approach has been seen as stifling innovation, leading to job losses and reduced investments. In a recent tweet/post, the organization’s CEO, Kristin Smith, urged digital currency users and creators to advocate for a change in leadership. However, her post did not mention any specific individuals or political groups they would assist during this election.

US Elections To Shape Next SEC Policies?

Discussions about Gensler’s future have been heating up not only among cryptocurrency observers but also among potential US presidents. It is rumored that if Donald Trump wins the presidency, Gensler may be dismissed from his position. On the other hand, Kamala Harris, a Democrat, might be considering a new leader to replace Gensler should he face difficulties in his role.

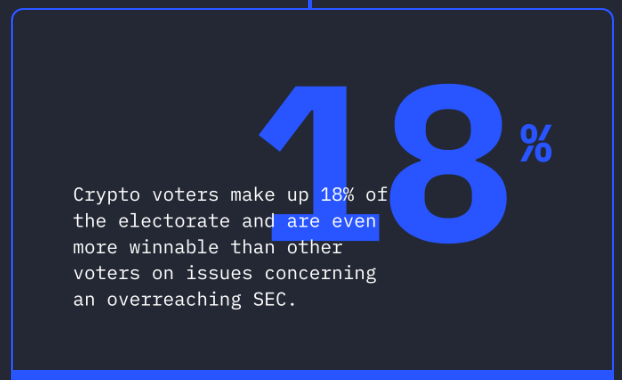

The Blockchain Association asserts that the matter of cryptocurrencies holds significant weight in elections, potentially influencing voter decisions. They pointed out that no political party currently holds a clear advantage on this topic, and candidates who advocate for advancements in digital currencies are likely to garner support from crypto-voting blocs.

Approximately one out of every five voters in the electorate is known to cast ballots using cryptocurrency, potentially swaying election outcomes significantly. In the upcoming U.S. elections on the following Tuesday, certain states will already be holding early voting sessions.

Featured image by Dall.E, chart from TradingView

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- APU PREDICTION. APU cryptocurrency

- USD GEL PREDICTION

- USD PHP PREDICTION

- BCH PREDICTION. BCH cryptocurrency

- USD COP PREDICTION

- CHEEMS PREDICTION. CHEEMS cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

2024-11-02 03:12