The decline was reinforced by technical signals suggesting seller dominance across multiple timeframes. At the time of writing, SEI is trading at $0.27, showing short-term stabilization within a key technical region. 📉💸

SEI Price Signal-Based Indicators Reinforce Bearish Pressure

The 1-hour SEI/USDT chart provided by analyst Gilanns illustrates a structurally weak setup dominated by repeated breakdowns and failed bullish attempts. A persistent series of lower highs (LH) and lower lows (LL) confirms that the prevailing trend remains bearish. 🦊📉

Multiple instances of the “Three Black Crows” pattern signal strong selling phases, while key candlestick formations such as “Spinning Tops” and “Hammers” highlight intraday hesitation. Despite these temporary pauses, no confirmed bullish reversal has materialized. The wave ratio and momentum indicators remain negative, underscoring the fragility of the current structure. 🎭💣

Gilann’s trading signals across the chart include numerous “BUY,” “SELL,” and “ADD” alerts. However, buy signals frequently gave way to sell triggers soon after, indicating a lack of sustainable momentum. The appearance of Bearish Divergence on the RSI further confirms underlying weakness, as price fails to keep up with improving momentum. 🤡📉

Bullish Divergence did occur late in July, but it failed to ignite any breakout. The dominance ratio slightly favors bulls at +2.6x, but structural breakdowns and absence of higher lows suggest the short-term direction may still favor sellers until a pattern shift is confirmed. 🧠🌀

Volume and Market Data Reflect Buyer Indecision

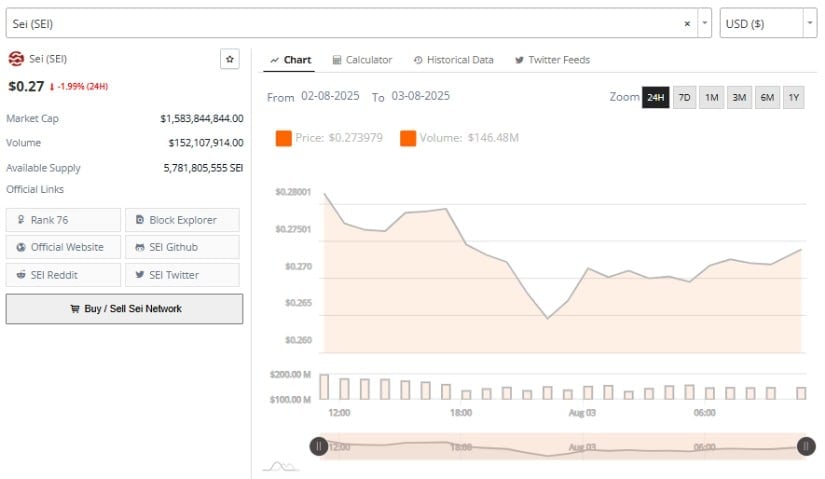

The 24-hour price chart from August 2 to August 3 illustrates a steady drift lower, with SEI slipping from an opening near $0.2801 to a low around $0.2630. While this movement was not aggressive, it indicated soft bearish sentiment throughout the session. 🐢📉

Volume activity remained moderate, peaking at $146.48 million, which was insufficient to support a full recovery. Price attempted a rebound to $0.2730 during evening hours, but the bounce lacked conviction, resulting in range-bound movement entering August 3. 🧍♀️📉

At the time of writing, SEI trades at $0.27, posting a 1.99% 24-hour decline. The market cap stands at $1.58 billion, with the token ranked 76th by overall market capitalization. The supply remains stable at approximately 5.78 billion SEI. 📈📉

Despite mild recovery attempts, the lack of volume expansion continues to limit any breakout potential. The flat price behavior in the current session shows that participants are awaiting further signals before making directional bets. Unless significant volume or external catalysts emerge, SEI is likely to continue trading within this constrained range. 🕵️♂️🔍

Technical Indicators Suggest Key Support Zone Near $0.26

The daily SEI/USDT chart displays a corrective structure following the token’s strong performance in July. The price has fallen from highs near $0.3903 and now tests the $0.26–$0.27 support range. 🛡️📉

This zone previously served as a breakout base, making it an important reference level for buyers. A hold above this area could offer the foundation for a future rebound. Current price action has formed a potential bottoming structure, but confirmation remains pending. 🕊️🔮

Momentum indicators support this cautious view. The Chaikin Money Flow (CMF 20) reads -0.12, showing that capital outflows exceed inflows. This trend follows a sustained accumulation phase throughout July, indicating a pullback in demand. 💸📉

The Bull and Bear Power (BBP 13) stands at -0.0736, suggesting modest bearish momentum. If BBP and CMF begin to flatten or reverse while the price stabilizes above $0.26, it could hint at a forthcoming trend shift. Until then, SEI remains at a technical crossroads. 🌪️🧭

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

2025-08-04 00:30