- Ethereum received a rather extravagant boost after SharpLink decided to splurge $463M on ETH

- Whale activity and a sudden influx of new depositors appear to be backing Ethereum’s price resilience, or so they say

Ethereum’s price has been rather stubbornly consolidating around the $2500 mark for the past month. This is quite the feat, considering the broader market’s mixed signals, which are about as clear as mud.

While we’re not quite in bull mode yet, ETH has shown remarkable fortitude as it wrestles with extreme drawdowns. This steadfastness has piqued the interest of both retail and institutional investors, who are probably just as confused as the rest of us.

SharpLink’s audacious Ethereum investment: A masterstroke or mere folly?

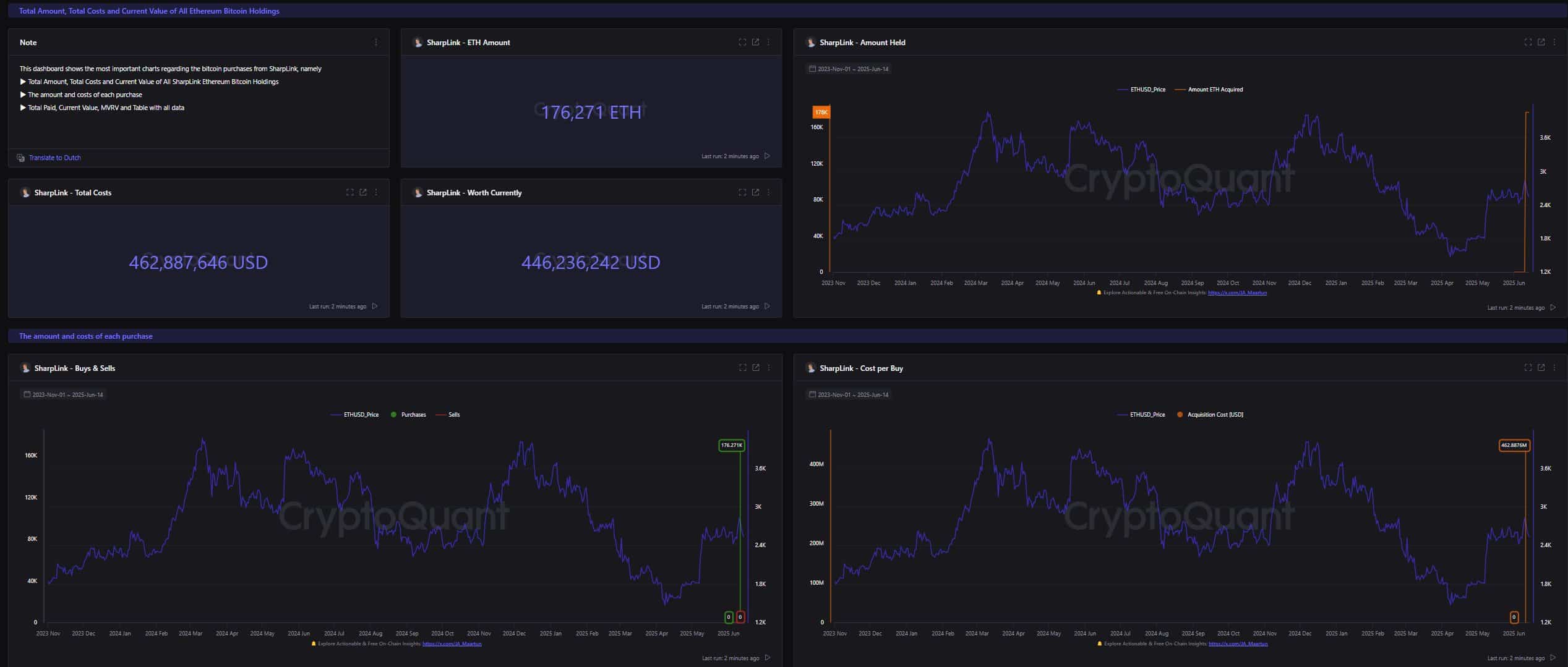

In a move as audacious as MicroStrategy’s, SharpLink has recently acquired a staggering 176,271 ETH—worth about $463 million. The company now holds the title of the largest publicly traded holder of Ethereum. One can only wonder how this will reshape the way public companies perceive and incorporate ETH into their long-term investment strategies.

SharpLink’s bold buy-in signals a robust confidence in the future utility of Ethereum in cross-border finance. Much like MicroStrategy’s bet on Bitcoin during the first institutional wave, this ETH acquisition could very well pave the way for others to follow suit, or at least try to.

Is Ethereum the new darling of institutions?

The timing of SharpLink’s purchase aligns with a broader trend of traditional firms warming up to crypto assets. Ethereum, with its delightful ecosystem of smart contracts, DeFi protocols, and staking opportunities, is increasingly being viewed as more than just a speculative play—more like a speculative play with a fancy hat.

This narrative shift—from high-risk asset to a long-term institutional portfolio component—is gaining traction across all fronts. As regulation becomes clearer, more firms may consider Ethereum not just as a hedge, but as a core asset. Who knew crypto could be so… respectable?

Whale activity and depositor surge: A recipe for success?

On-chain data has revealed that smaller whales—those charming entities holding between 1,000 and 10,000 ETH—have been accumulating at current price levels. Their actions suggest a confidence in a price floor and a potential upside, or perhaps just a good old-fashioned gamble.

Moreover, the number of unique depositors interacting with Ethereum has surged significantly. Such an uptick in network activity adds more fuel to the altcoin’s bullish momentum, reflecting a growing retail engagement and a long-term belief in ETH’s utility. Or maybe they just enjoy the thrill of the chase.

From rising institutional interests to increasing whale confidence, Ethereum’s fundamentals have been strengthening lately. In fact, SharpLink’s $463M investment could be the first of many headline moves in ETH’s next adoption cycle. If ETH follows the trajectory Bitcoin did after MicroStrategy’s buy-ins, we may just be at the dawn of a new Ethereum narrative. Or perhaps just another chapter in the ongoing saga of crypto chaos.

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Uncover Every Pokemon GO Stunning Styles Task and Reward Before Time Runs Out!

2025-06-17 08:45