As an experienced analyst, I’ve seen my fair share of market volatility in the cryptocurrency space. The recent crash caused by the start of Mt. Gox compensation payouts is no exception. However, amidst the chaos, some assets have managed to shine – meme coins, specifically Dogwifhat (WIF) and Bonk (BONK), are currently outperforming the rest.

In the midst of the tumultuous collapse of cryptocurrency markets due to Mt. Gox compensation payouts, meme coins have shown remarkable resilience. Of the three top-performing cryptos in the entire top 100 list, two are classified as meme currencies.

Dogwifhat (WIF), Bonk (BONK) amid best performers as crypto collapses

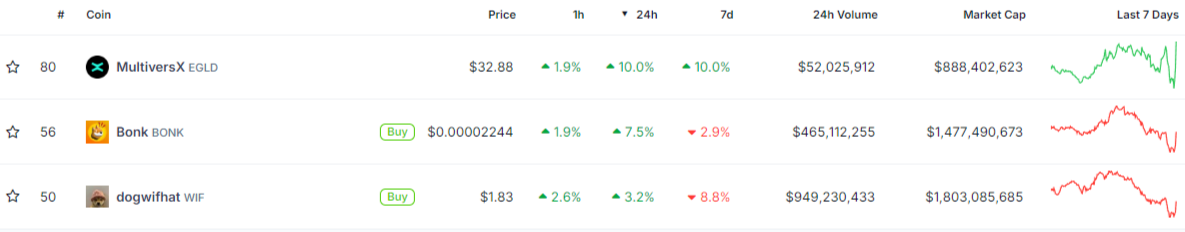

Over the past 24 hours, despite the agonizing downturn in cryptocurrency markets, Bonk (BONK), a notable meme coin with multi-chain capabilities, has surged by over 7.5%. According to CoinGecko, Bonk’s market capitalization is on the verge of surpassing the significant $1.5 billion threshold.

The leading meme coin on the Solana blockchain, Dogwifhat (WIF), is experiencing a gain of 3.2%. Its market capitalization continues to exceed $1.8 billion.

Based on current market performance, Dogwifhat (WIF) has emerged as the top crypto asset among the first fifty, delivering impressive returns. Meanwhile, MultiversX (formerly Elrond, EGLD) continues to reign supreme in the second hundred, boasting a 10% growth rate.

In simple terms, the total value of all cryptocurrencies decreased by 3.8%, while meme coins specifically saw a drop of 11.4% within the past day.

$578,000,000 erased: Worst day for bulls since mid-April

Two major cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), experienced significant losses within the past 24 hours. Bitcoin saw a decrease of approximately 2.8%, whereas Ethereum’s price dropped nearly 5%.

Previously reported by U.Today, the global cryptocurrency market has been inundated with news concerning compensation payouts to victims of Mt. Gox exchange’s failure in 2014. The distribution of Bitcoin (BTC) and Bitcoin Cash (BCH) will likely result in increased selling activity within the crypto sector.

Over the past day, approximately $578 million in losses have been incurred by Bitcoin (BTC) traders due to liquidations, according to data from CoinGlass. Among these losses, around $446 million were tied to long positions.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- USD ZAR PREDICTION

- SUI PREDICTION. SUI cryptocurrency

2024-07-05 19:15