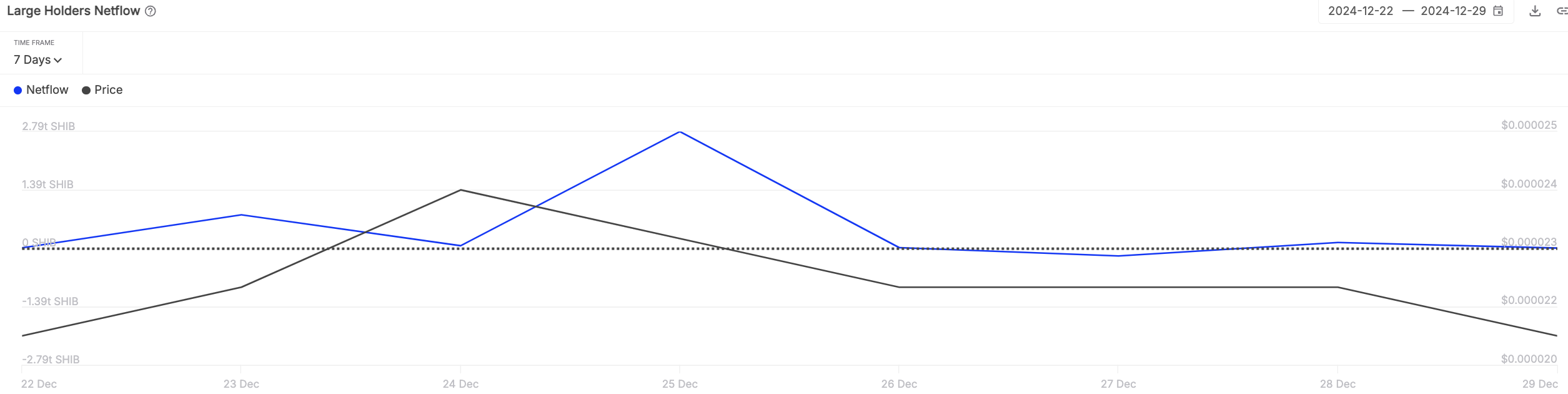

As a seasoned crypto investor with a knack for navigating the rollercoaster ride that is the digital currency market, I must confess, the current state of Shiba Inu (SHIB) leaves me with a mixed bag of emotions. On one hand, the lackluster price action and on-chain activity make it seem like a mere “nothing burger.” However, the staggering 99.28% drop in Large Holders Netflow over the past week is hard to ignore.

This isn’t my first dance with the crypto market, so I know all too well that whale activity can significantly impact a coin’s trajectory. In this case, the exodus of trillions of SHIB from the wallets of the wealthiest investors just seven days ago to a mere six billion today is cause for concern.

While the exact reasons behind this mass departure remain elusive, I suspect it may be due to the growing correlation between crypto and traditional finance (TradFi). With the launch of several Bitcoin and Ethereum ETFs this year, the digital currency market has become more intertwined with TradFi than ever before. Consequently, when traders take their holiday breaks, the volumes on the crypto market plummet—and SHIB seems to have succumbed to this trend as well.

That being said, I’m an optimist at heart and believe that we may see some volatility return once everyone gets back to work in the New Year. And who knows? If history repeats itself, those very same whales might just re-enter the market and shake things up a bit.

Now, to lighten the mood, let me share a little joke: They say Shiba Inu is the dog that doesn’t bark in the night—unless it’s about your portfolio!

The situation regarding the well-known meme-based cryptocurrency, Shiba Inu (SHIB), remains uncertain. Some might view it as a non-event, given that there are no significant price changes or hidden developments in its blockchain activity.

On a different note, an interesting yet disheartening statistic arises when we consider the Shiba Inu token’s performance over the last week. Specifically, its main metric has plummeted by a staggering 99.28%. This significant drop is highlighted by the Large Holders Netflow data from IntoTheBlock, which monitors the movement of the meme cryptocurrency into wallets that hold at least 0.1% of the total SHIB supply in circulation.

A week prior, the richest investors were buying up Shiba Inu tokens at a staggering rate of trillions. However, by December 30th, this figure had dropped significantly to only around 6 billion SHIB, which is equivalent to approximately $132,000 in U.S. dollars.

What happened?

It’s unclear why the whales chose to leave the Shiba Inu ship, but a potential explanation could be the increased correlation between the cryptocurrency market and traditional finance. This year, the introduction of numerous Bitcoin and Ethereum ETFs has made crypto more intertwined with TradFi than ever.

It seems that when traders finish work and go on holiday break, trading volume in the cryptocurrency market tends to decrease. If this was the case for SHIB, then we might not see any major price changes or significant whale activity right now.

Once normal operations resume, there might be renewed fluctuations, primarily due to those large investors (whales) re-entering the market.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- REPO: All Guns & How To Get Them

- Top 5 Swords in Kingdom Come Deliverance 2

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- LUNC PREDICTION. LUNC cryptocurrency

- All Balatro Cheats (Developer Debug Menu)

- BTC PREDICTION. BTC cryptocurrency

2024-12-30 19:23