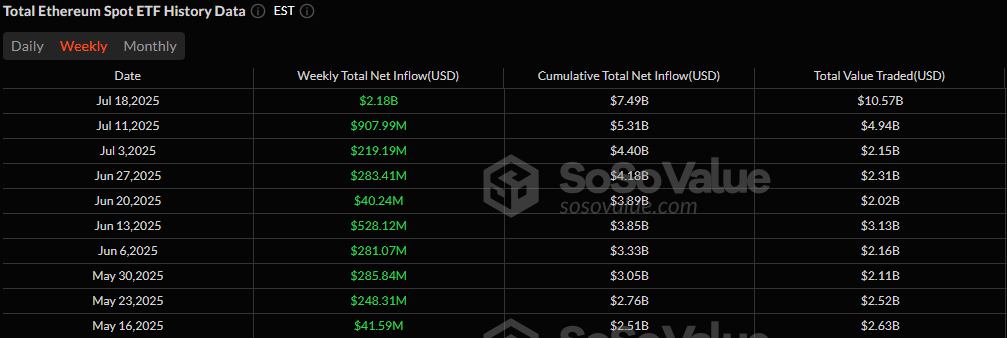

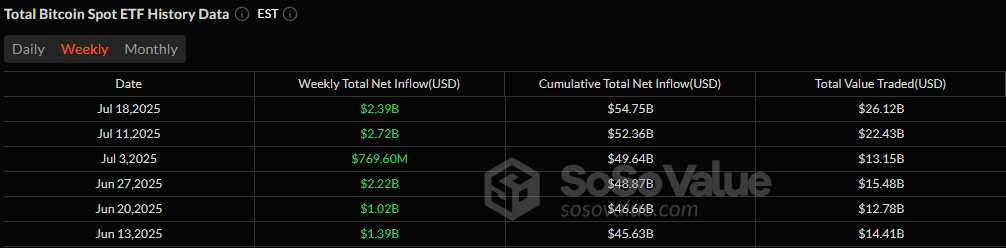

In the shadowy corridors of financial intrigue, where fortunes rise and fall like the tide, this past week illuminated our confidant ether with an unprecedented $2.18 billion inflow into ether exchange-traded funds (ETFs). Meanwhile, Bitcoin ETFs, ever the steadfast soldiers, marched along with a commendable $2.39 billion, marking their sixth consecutive week of gain—an achievement that many would envy yet few would comprehend.

The Tapestry of Wealth: $4.57 Billion Danced into the Crypto Realm

As the annals of history bore witness, the ether ETF surged forth, unfurling the banners of victory with a staggering $2.18 billion in net inflows—a feat unmatched in the grand saga of ether. Such a performance not only boasts a ten-week triumphant streak but also underscores the burgeoning and perhaps intoxicating thirst of institutions for ETH exposure. Oh, the irony of wealth and wisdom, tangled yet sublime!

The zenith of this spectacle arrived on Wednesday, July 16, a date now seared into our memories, as $726.74 million cascaded into ether’s embrace and $799.40 million tiptoed into the Bitcoin treasury. Quite the raucous affair for both parties, don’t you think?

Behold the thrilling influx into various ETFs, an extravaganza remarkably green:

ETHA (Blackrock): +$1.76 billion

Ether Mini Trust (Grayscale): +$201.71 million

FETH (Fidelity): +$128.77 million

ETHW (Bitwise): +$43.09 million

ETHV (Vaneck): +$12.88 million

EZET (Franklin): +$10.79 million

ETHE (Grayscale): +$14.05 million

CETH (21Shares): +$3.78 million

QETH (Invesco): +$3.72 million

In a display of less flamboyant finesse, Bitcoin ETFs secured $2.39 billion in net inflows, continuing their six-week verdant streak. Blackrock’s IBIT, that shrewd fox among the hares, claimed the spotlight with a commendable $2.57 billion in inflows, dazzling those lesser in stature. Let us observe how these Bitcoin contenders performed under the glaring sun:

IBIT (Blackrock): +$2.57 billion

Bitcoin Mini Trust (Grayscale): +$41.86 million

HODL (Vaneck): +$30.87 million

BITB (Bitwise): +$17.95 million

BTCO (Invesco): +$7.12 million

EZBC (Franklin): +$6.76 million

BTCW (Wisdomtree): +$3.11 million

Yet, not every ETF basked in this verdant glow of success. The GBTC (Grayscale) witnessed a somber departure of -$122.50 million, while ARKB (Ark 21Shares) stumbled with a -$119.57 million outflow, and FBTC (Fidelity) suffered a loss of a modest -$48.76 million. Such is the capricious nature of fortune!

As the currents of over $4.57 billion washed over the shores of crypto ETFs this week, one cannot ignore the resoundingly clear echoes of institutional conviction: the land of bitcoin and ethereum is awakening, and the rise of ether—once eclipsed—now stands on its own, basking in the sunniest of prospects. Watch out, world! 🍀💰

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-07-21 18:28