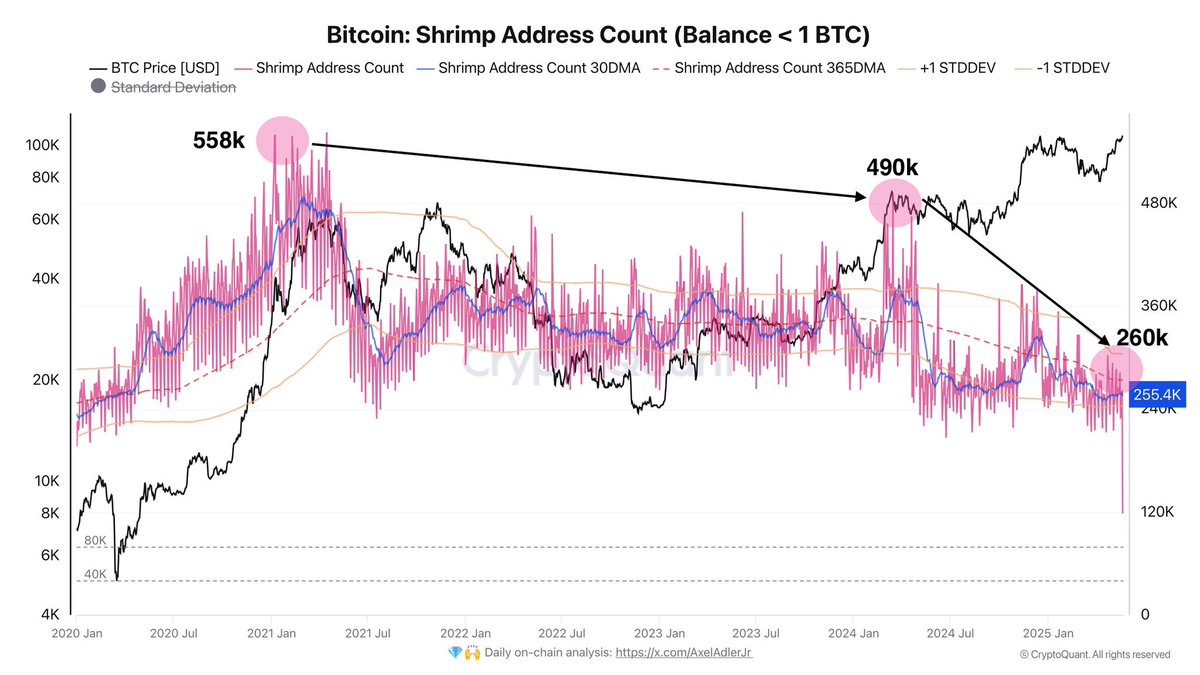

Today, the humble shrimp addresses have dwindled to a mere 260,000, a sharp nosedive from the glorious days of 590,000 during the 2021 All-Time High. Perhaps they’ve all gone fishing, or simply decided it’s more fun to watch than participate. 🎣

Even at the April 2024 peak, numbers had already slipped to 490,000, making it clear that small-time investors are becoming an endangered species—like walruses in a desert. The trend? Downward. It’s as if everyone decided, “Nope, not my circus, not my monkeys,” and left the ring. 🐒

This decline reveals a broader narrative: retail engagement in crypto is fading faster than your New Year’s resolutions. Supporting this, the 30-day average of address activity is way below the yearly average, confirming that the typical retail investor has joined the sidelines—possibly drinking coffee and watching from afar, unmotivated and indifferent. ☕

All this fits with the observation that Bitcoin network activity remains tepid—like a Sunday morning in a ghost town—despite the market’s booming prices. The enthusiasm is concentrated among the big fish and institutions, leaving the small fry at the shore, futilely tossing pebbles. 🐟

Now, it’s worth noting that some shrimp may have grown into bigger fish, moving up categories. But this is the exception, not the rule—like finding a decent parking spot downtown. The steep decline can’t be blamed solely on that. 🚗

In short, while Bitcoin struts and boasts in headlines, the quiet truth is that retail investors are still hiding under their beds, missing the party. And perhaps, that’s just as well—less chaos, more popcorn. 🍿

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail: How To Find Robbie’s Grave

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Slormancer Huntress: God-Tier Builds REVEALED!

- Hands-On Preview: Trainfort

- LUNC PREDICTION. LUNC cryptocurrency

- Unleash Devastation: Top Rupture Teams to Dominate in Limbus Company!

2025-05-22 01:01