A Most Unfortunate State of Affairs:

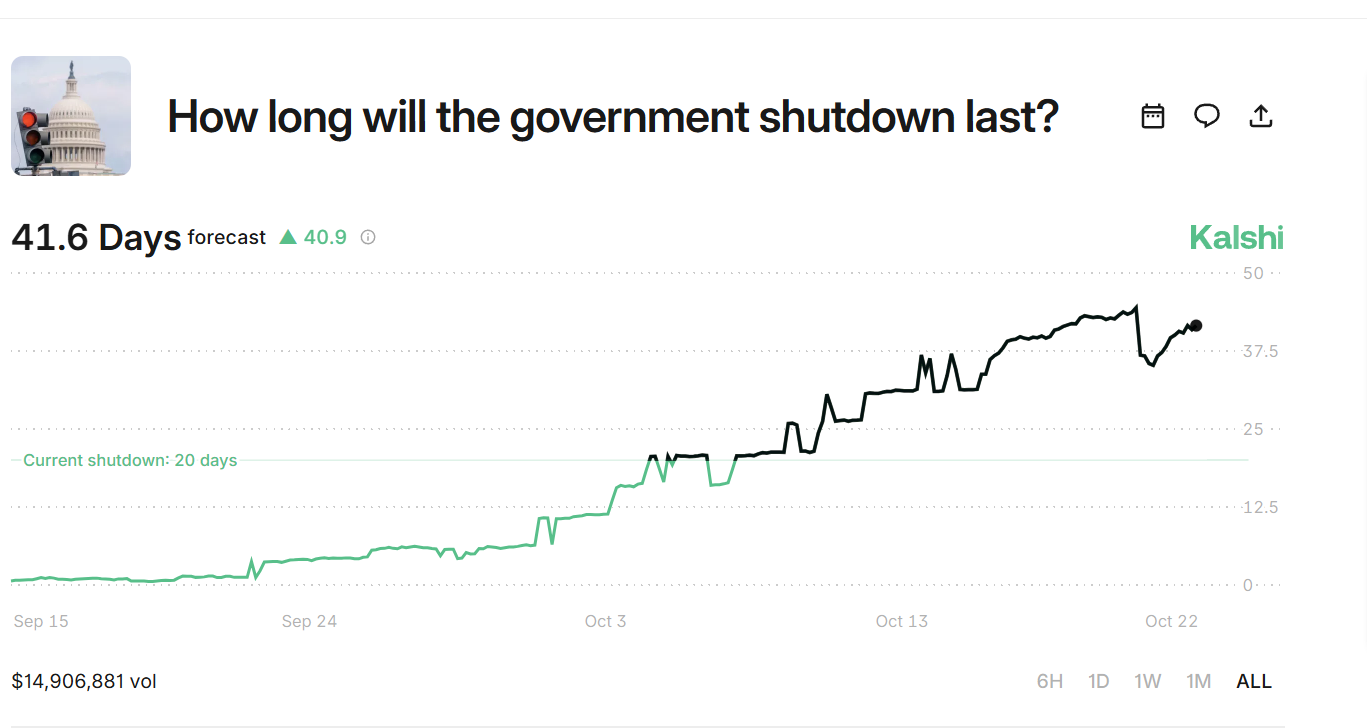

- It appears our American cousins are once again beset by a governmental inconvenience – a shutdown, predicted to last a most unbecoming length of time, exceeding even the trials of 2019. One wonders if they ever learn.

- The Federal Reserve, thankfully, remains aloof from such vulgar displays of political discord, yet even they may find their deliberations hampered by a scarcity of timely reports. How dreadfully inconvenient!

- And as if to capitalize on such instability, the markets for Bitcoin and gold are exhibiting a rather…spirited behaviour. One struggles to comprehend the whims of modern finance!

Good Morning, Asia. A Brief Dispatch Concerning the Markets:

The gentlemen wagering on Polymarket seem to believe a resolution – one dares hope a sensible one – will arrive by November the fifteenth. Kalshi, with its decidedly mathematical approach, forecasts a somewhat longer ordeal, extending into the eleventh of November. One pictures them charting these matters with great seriousness.

While nearly a million hardworking souls in Washington face either idleness or unpaid service – a truly lamentable situation – the Federal Reserve, fortunately, continues its operations, unburdened by the follies of Congress. They may, however, be forced to make weighty decisions with an imperfect understanding of the economic climate. A most precarious position, indeed.

These Polymarket speculators (a rather speculative bunch, one imagines) assign a remarkable 96% probability to a reduction in rates at their October meeting, followed by a further adjustment in December. One can only conjecture as to their sources of information!

The consequence, alas, is a shortage of essential data. Without reliable reports on employment, prices, and overall prosperity, the esteemed members of the Fed may be compelled to act upon…well, educated guesses. 🙄

It’s a curious observation, perhaps merely a coincidence, that the previous prolonged interruption in Washington coincided with a rather dreary period for Bitcoin. One shudders to think what further fluctuations the current crisis may bring.

This time, however, the tumult has coincided with a rather astonishing surge in the value of gold – exceeding four thousand two hundred per ounce! – and a rather decisive correction in the volatile world of cryptocurrency leverage. A flurry of activity, to be sure. 🧐

Market Observations

BTC: Bitcoin has risen above one hundred and eight thousand dollars, though a slight weakening has been observed as traders reconsider their recent gains. The digital asset, it seems, is sensitive to even a hint of uncertainty.

ETH: Ethereum is encountering some resistance at four thousand one hundred dollars, though certain firms are seemingly determined to accumulate further holdings. A display of confidence, or perhaps merely a gamble?

Gold: Gold experienced a rather precipitous decline, falling by 5.5% to four thousand one hundred and twenty-one dollars. One suspects some investors sought to profit from its recent successes. Silver, too, suffered a similar fate. A correction, one presumes, though one always feels a pang of sympathy for those who miss the peak.

Nikkei 225: Japan’s Nikkei 225 has enjoyed a modest rise, buoyed by a respectable increase in exports. It would seem Asia remains, for the moment, somewhat immune to the commotion across the ocean.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Who Is the Information Broker in The Sims 4?

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-10-22 05:07