In the shadowed valleys of financial speculation, where the gleam of silver seduces the unwary, the whispers of a bubble grow louder. Yet, the sages of Societe Generale, with their logarithmic lenses, declare: “Not so fast, comrades!” For in the labyrinth of charts and models, truth is as elusive as a Soviet queue without despair.

The Silver Siren: Bubble or Mere Volatility’s Dance? 🌪️✨

The question hangs heavy in the air, like the breath of a bureaucrat in a winter queue: Is silver’s rally a bubble, or merely the market’s capricious waltz? On December 30, the French bank Societe Generale, with its Log-Periodic Power Law Singularity (LPPLS) framework-a tool as convoluted as a Politburo meeting-detected bubble-like behavior in silver prices. Yet, they caution: “Do not mistake the shadow for the gallows.”

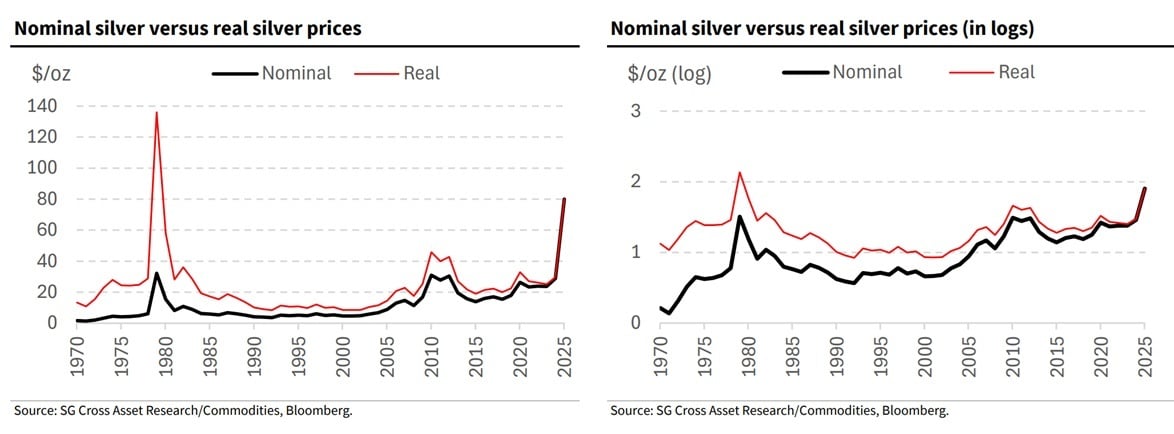

Led by the enigmatic Dr. Mike Haigh, the commodity research team applied their LPPLS model, a device designed to sniff out super-exponential price acceleration, the harbinger of late-stage market instability. “When silver soared above $80/oz,” they remarked, “it seemed as though the market had inhaled the fumes of frenzy. But, comrades, switch to a logarithmic scale, and the narrative shifts-the ascent appears as steady as a tractor in a collective farm.”

The logarithmic scale, they insist, is the true compass, revealing the exponential trend beneath the chaos. Yet, even as the LPPLS model flags a potential bubble, the analysts warn: “Do not let the model lead you astray. Quantitative diagnostics are but a hammer in a world of screws.”

Societe Generale’s research highlights silver’s fragile market structure-smaller and less liquid than gold, prone to herding behavior and amplified volatility. “The ‘bubble’ regime,” they note, “is but a warning sign, a flicker of instability in a market that craves correction like a gulag inmate craves freedom.”

Charting silver on a logarithmic scale, they observe, places the 2025 rally within a 25-year compounding trend. “The log scale,” they quip, “tells a better story, closer to the truth-though truth, in markets, is as rare as a full shelf in a Soviet supermarket.”

Beyond the technical models, Societe Generale points to fundamental drivers: de-dollarization, geopolitical uncertainty, and tightening physical supply. China, the global silver refinery, plans to restrict exports by up to 30%, exacerbating annual deficits. “Volatility may reign,” the analysts concede, “but the bubble framework does not foretell a collapse-only the market’s eternal dance between greed and fear.”

FAQ ⏰

- Why did Societe Generale flag silver as a potential bubble?

Their LPPLS model detected super-exponential price behavior, a red flag for market instability-though they caution against taking it as gospel. - Does Societe Generale expect silver prices to crash?

Nyet! They explicitly warn against viewing the bubble signal as a harbinger of doom. - How does silver’s market structure affect price volatility?

Silver’s smaller, less liquid market makes it as prone to herding as a collective farm to inefficiency. - What fundamentals are supporting silver demand in 2025?

De-dollarization, geopolitical risk, supply deficits, and China’s export restrictions-a perfect storm for silver bulls.

Read More

- Mewgenics Tink Guide (All Upgrades and Rewards)

- 8 One Piece Characters Who Deserved Better Endings

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- How to Discover the Identity of the Royal Robber in The Sims 4

- Sega Declares $200 Million Write-Off

- How to Unlock the Mines in Cookie Run: Kingdom

- Full Mewgenics Soundtrack (Complete Songs List)

- Starsand Island: Treasure Chest Map

2026-01-04 02:18