What to know:

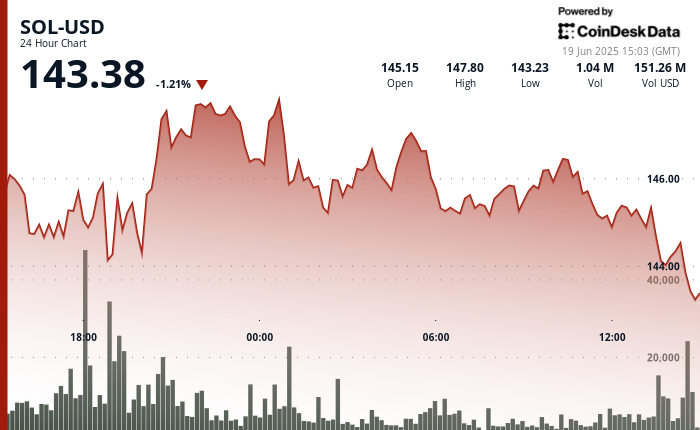

- Solana (SOL) fell 1.21% to $143.38 after losing momentum above $147.80, ending near session lows despite strong institutional support.

- Canadian firm Sol Strategies filed with the SEC on June 18 to list on Nasdaq under the ticker STKE, aiming to fund its Solana ecosystem strategy.

- The firm holds more than 420,000 SOL, valued at over $61 million, but price action shows bears remain in control near critical support levels.

Solana’s native token, SOL

, dropped to $143.38 Tuesday, down 1.21%, closing near the day’s low after failing to hold above $147, according to CoinDesk Research’s technical analysis model.

Despite receiving new institutional support, there were still vulnerabilities, as Canadian blockchain investor Sol Strategies submitted an application to the U.S. Securities and Exchange Commission on June 18, aiming for a Nasdaq listing with the symbol STKE.

Although the filing doesn’t trigger immediate market fluctuations, it underscores a burgeoning institutional interest in Solana’s future prospects. Sol Strategies recently revealed that they own over 420,000 SOL, valued at approximately $61 million, and have chosen to focus their treasury strategy around SOL. The firm is also pursuing regulatory clearance in Canada to potentially raise up to $1 billion, along with a previously issued $500 million convertible note offering in April, which was used to acquire and stake SOL.

Even though positive indications suggest otherwise, Solana (SOL) is exhibiting a more cautious trading pattern. The value has mostly stayed within a flat range over the last week, and an effort to break out above $147.80 didn’t sustain further growth. As the market closed, bears regained control, causing SOL to drop below the $144 psychological resistance. Despite growing long-term support, the price is moving under major moving averages and trading volume has decreased during the day, creating a fragile sentiment overall.

Technical Analysis Highlights

- SOL traded in a 24-hour range from $143.23 to $147.80, a 2.83% swing.

- Resistance held at $147.80 after a failed breakout during the 22:00 UTC candle on June 18.

- Price declined steadily to $143.38, closing near the low after weak recovery attempts.

- Sellers were active between 13:46–14:00 UTC, with a drop from $144.62 to $143.38 on strong downside momentum.

- The $144–$145 zone remains critical; failure to reclaim it may open a path toward deeper support near $140.

Read More

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- EUR USD PREDICTION

- How to Unlock & Upgrade Hobbies in Heartopia

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- ARC Raiders Player Loses 100k Worth of Items in the Worst Possible Way

- Unveiling the Eye Patch Pirate: Oda’s Big Reveal in One Piece’s Elbaf Arc!

- TRX PREDICTION. TRX cryptocurrency

- Xbox Game Pass September Wave 1 Revealed

2025-06-19 19:18