Solana’s price action has been doing that awkward thing where it pretends to have a plan but keeps checking its mirrors. Bulls and bears are in a tug-of-war that feels like a flashback to every awkward WhatsApp argument you’ve ever had. It pokes at $224 again and again, like a stubborn ex, and you start to wonder if the momentum has ghosted you for good. 😂

At the heart of this little telenovela is the $200 support zone. If support holds and resistance flips, the Solana Price Prediction for 2025 could still wear a hopeful little grin, but a breakdown would mean a longer, bumpier walk before any recovery could pretend to arrive. 🙃

SOL’s Potential Breakdown Towards $200 Zone

Solana’s price is stubbornly wrestling to keep momentum, with the chart giving us a front-row seat to rejections near the $224 level. This area has become a proper resistance fortress, and unless buyers can flip it, the structure leans toward weakness. The price action has been sliding with a string of lower highs, while volume spikes shout “sellers aren’t leaving the party anytime soon.”

If $224 keeps doing its ceiling impression, the focus shifts to the downside, where the $200 level stands out as the next big support. A clean breakdown below that mark could drag Solana into deeper liquidity zones, potentially flirting with the $190 to $185 region. On the flip side, reclaiming and consolidating above $224 could signal a momentum shift, opening room for a bouncy trek back toward the mid-$240s. For now, Solana’s chart reads like a tightrope walk between keeping support and courting more downside pressure. 💥

Reversal Signals Emerging at Support

Owing to the emerging bearish outlook, Solana’s latest chart shared by Crypto Seth is giving off exhaustion vibes in its recent downtrend, with the price testing support around the $215 zone. The confluence of the 200 EMA and prior reaction levels is interesting, historically a solid base for rebounds. The candles look a tad tired but the reversal signals are flashing like nightclub lights, suggesting buyers may be gearing up to defend this zone. 🙌

While the broader structure remains fragile, the moving averages here provide a technical cushion. If buyers manage to defend this level, a short-term bounce could develop, potentially retesting the $224 resistance. But fail to hold and you’re staring at a continuation lower, bringing the $200 to $190 zone back into the cheerful conversation. 😬

Solana Price Prediction: Rising Wedge Still Intact

Despite a 15% slide in the past four days, Solana remains tucked inside its rising wedge like a determined cat. The chart shows price respecting both the upper and lower trendlines, with the current move leaning toward a retest of the lower boundary. Milk Road suggests near-term downside until the wedge’s bottom line is reached, which tracks the pattern’s rhythm of higher highs and higher lows. 🐱🏍

If buyers step in at the wedge’s lower edge, Solana could attempt another climb back toward the top of the structure, keeping the broader bullish vibe intact. That path could set the stage for a push toward $280 to $300 over the medium term, provided support holds and the stars align with a good coffee and a better mood. 🚀

Solana’s Strong Fundamentals

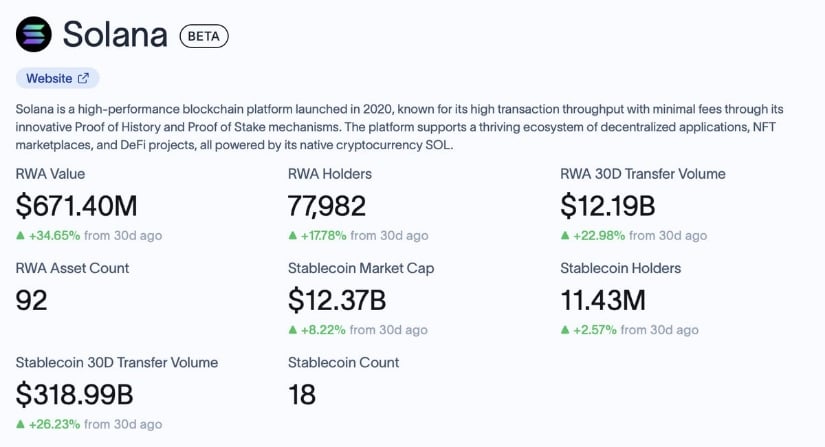

In a volatile market where both bulls and bears are playing equal parts, Solana’s fundamentals are doing the quiet, stubborn work. The ecosystem just hit a milestone with tokenized real-world assets (RWAs) crossing $671M in value, driven largely by more than $150M of inflows into BlackRock’s BUIDL fund. Okay, not exactly a love letter to volatility, but it’s something.

These steady inflows create a cushion for Solana even when price action is a bit of a mood-swing. Historically, strong institutional demand has helped form more durable bases in assets, and Solana seems to be following that script. If the trend continues, the broader fundamentals may start tipping toward a solid Solana price prediction. 💪

Will SOL Be Able To Establish a New ATH in 2025?

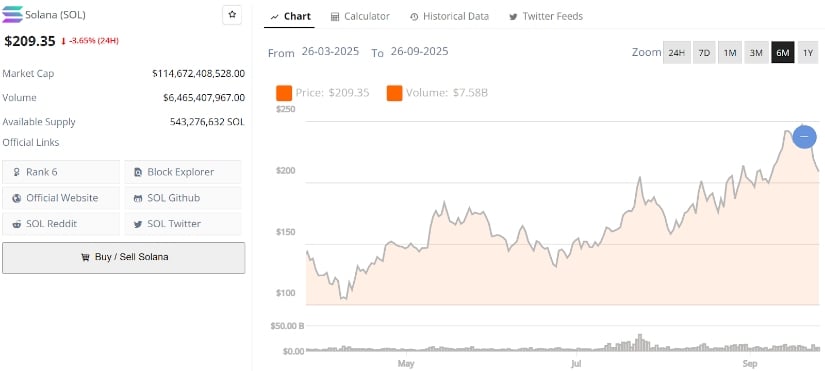

Solana is trading around $209 after slipping 3.65% in the past 24 hours, with a market cap of about $114.6B. The pullback has raised questions about momentum, but looking at the bigger chart, SOL has been climbing through 2025, hitting higher lows and edging closer to its previous all-time high. Trading volumes remain active, with over $6.4B exchanged in the last 24 hours, showing participation is still real despite the dip. 🔋

The key technical level to watch remains the $200 support. If Solana can defend this zone and reclaim resistance around $224, it opens the door for another leg higher. A sustained move above $240 to $250 would put SOL back in the running for an ATH challenge later this year. Fingers crossed, champagne on standby, and maybe a reminder not to rush the finale. 🥂

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-09-24 23:55