As a seasoned crypto analyst with over a decade of experience in the digital asset space, I have witnessed the evolution of blockchain platforms from obscurity to mainstream adoption. The current surge in Solana’s popularity is particularly intriguing, especially considering its rapid growth even amidst Bitcoin’s bull run.

As an analyst, I find myself observing that Solana continues to hold its position as the fourth largest blockchain platform, with USDT occupying the third spot in terms of market capitalization. Over the past year or so, I’ve noticed a significant surge in the value of SOL, the native token of this dynamic network, even outpacing Bitcoin‘s impressive growth towards new all-time highs. This remarkable expansion of Solana is truly noteworthy.

Despite an optimistic atmosphere, the cryptocurrency market appears to be easing and there’s speculation that the anticipated surge from Q1 2024 may be postponed. Yet, with crypto analysts monitoring political developments and other significant factors, Solana is gaining traction.

Solana Attracts More NFT Users Than Ethereum, Polygon

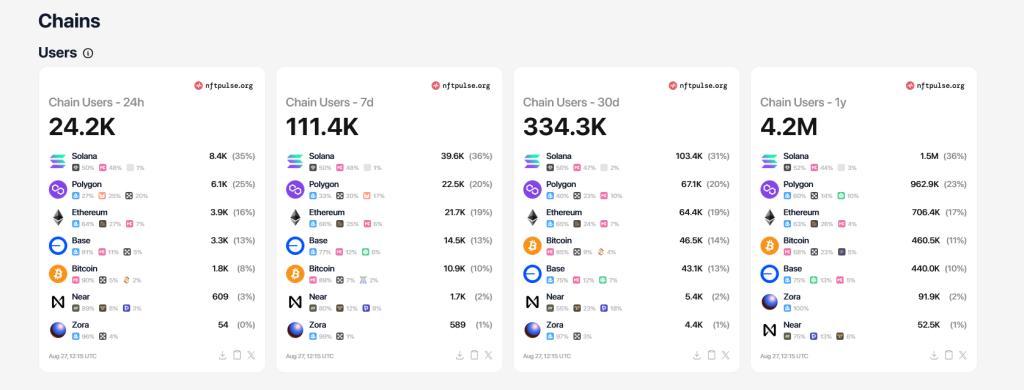

According to recent activity on blockchain networks, it appears that Solana reigns supreme in the world of NFTs, particularly when looking at the quantity of items minted. In fact, Solana holds a commanding 35% market share, which is nearly twice as much as Ethereum’s 16%.

As reported by NFT Pulse, Solana attracted approximately 8,400 users over the past day. On the other hand, a substantial number of users opted for Polygon, an Ethereum sidechain, with around 6,100 active users within the same timeframe.

In the last week alone, we’ve seen approximately 40,000 active users on Solana, bringing the total to over 1.5 million so far this year. On the other hand, Ethereum has had about 706,000 active users per year during the same period.

Ethereum Generates The Most Trading Volume In USD Terms

When it comes to trading volume, Ethereum clearly takes the lead. In fact, over the past day, Ethereum has generated approximately $4.7 million in trading volume – that’s more than twice as much as Solana, which saw around $2.1 million. Furthermore, when it comes to Non-Fungible Tokens (NFTs) traded in the last year, Ethereum far surpasses Solana, with a staggering $7.3 billion worth of NFTs being traded on Ethereum compared to just $2 billion on Solana.

The preference for Solana among users is largely because of its affordable transaction costs and exceptional scalability. While Ethereum’s fees are relatively higher, gas fees on Ethereum have noticeably decreased over the past few months.

Reducing fees might partially stem from the efforts of Ethereum developers aimed at improving user experience. At the start of the year, they activated the Dencun hard fork, which enabled less expensive layer-2 transactions on the smart contracts platform.

As the cost of deploying smart contracts and creating NFTs becomes less expensive, we see an increase in user numbers. For instance, Base, a prominent Ethereum layer-2 solution with high Total Value Locked (TVL), has attracted approximately 14,500 new users over the past week.

With the increased action on the Solana network, investors are keeping a close eye to see if buyers will surge beyond the current $190 mark, potentially propelling SOL up towards its 2024 peak at $210.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- EUR CLP PREDICTION

- USD COP PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

2024-08-28 04:41