The Staking Solana ETF (BSOL), launched by Bitwise, arrived in the market like a timid soul at a masquerade-unseen but suddenly the center of attention. Its first week? A deluge of $417 million in inflows, eclipsing rivals with the subtlety of a cannon in a teacup.

On November 1, Bloomberg’s Eric Balchunas noted the fund’s meteoric rise, placing it among the top 20 ETFs globally. One might think the stars themselves had conspired to bless this venture-or perhaps the investors were simply sleepwalking toward the next financial folly. 🤷♂️

BSOL’s Triumph, Solana’s Sigh

For perspective, the NEOS Bitcoin ETF (BTCI) eked out a paltry $56 million, while Grayscale’s Ethereum offering managed a similarly modest $56 million. BSOL, meanwhile, laughed at the arithmetic. Ten times the fun, minus the math. 🧮

What a week for $BSOL! It led crypto ETPs by a country mile in flows (+$417m), even outpacing $IBIT’s rare slump. Ranked 16th overall-a debut so grand, it could’ve been a tsar’s coronation.

– Eric Balchunas (@EricBalchunas) November 1, 2025

Meanwhile, BlackRock’s IBIT, usually the market’s stoic monarch, faced a rare defeat: $254 million in outflows. Perhaps the investors had grown weary of its regal hauteur. Or maybe they simply craved novelty. 🏛️➡️🎪

The fund’s triumph hints at a broader shift-institutional titans, once shackled to Bitcoin’s throne, now eye Solana’s realm with a mix of curiosity and desperation. Regulated access to high-speed blockchains, they say, is the new black. Or perhaps it’s just the new tax write-off. 💼

Analysts, ever the optimists, attribute this to “pent-up demand” after a year of anticipation. As if the market had been holding its breath, waiting for permission to gamble on altcoins. One wonders what else was pent up-perhaps the collective sanity of retail traders. 🤯

Yet, the Solana token (SOL) did not celebrate. It slipped by 3%, trading at $186.92. A cruel joke, perhaps? Inflows and outflows dancing in a waltz of indifference. The capital, it seems, was not fresh but borrowed from other ETFs-like a peasant swapping one master for another. 👞

Bitwise’s CIO, Matt Hougan, remains undeterred. He envisions Solana as the engine of stablecoin transfers and tokenized assets, powered by its “high-speed infrastructure” and “developer community.” One imagines developers typing furiously, their keyboards smudged with the sweat of ambition and caffeine. ☕

“If I’m right, the combination of a growing market and a growing share will be explosive for Solana,” he declared. A man who believes in explosions. 🎇

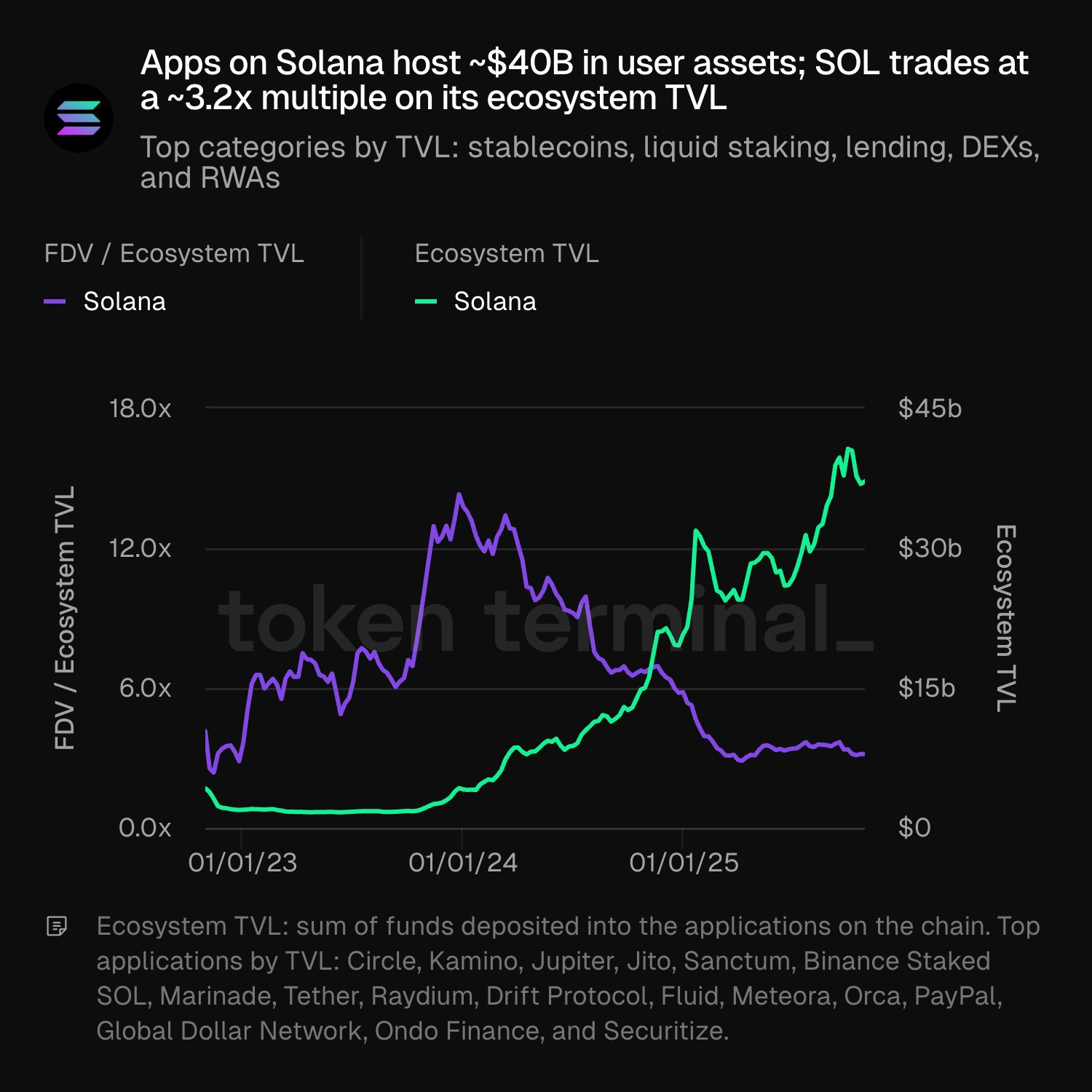

Indeed, Solana’s on-chain metrics gleam with promise. Token Terminal reports $40 billion in user assets hosted on its apps. A tidy sum, though one wonders if it’s enough to buy a decent lunch in 2025. 🍽️

The token’s price, currently 3.2 times its ecosystem’s total value locked, suggests a precarious balance between hope and hubris. A delicate dance, much like Chekhov’s characters teetering on the edge of despair and farce. 🕺

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-11-02 13:12