As an experienced crypto investor with a knack for spotting trends and understanding market dynamics, I find the recent surge in Solana ETP inflows quite intriguing. Having witnessed the rollercoaster ride that is the cryptocurrency market, I’ve learned to keep a keen eye on such significant movements.

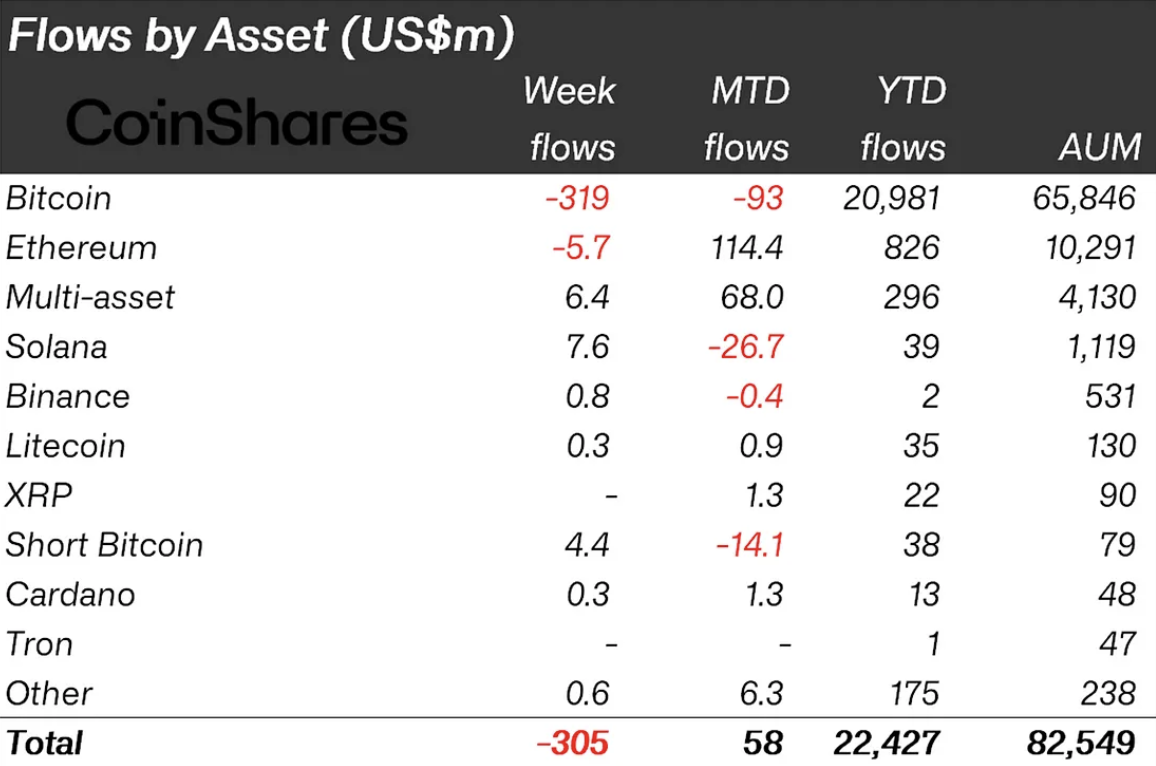

Last week, there was a significant withdrawal of approximately $305 million from the market involving investment products tied to cryptocurrencies. This represents a decrease of about $838 million compared to the previous week.

The poor and disappointing performance can be attributed to the realms of two significant cryptocurrencies: Bitcoin and Ethereum. However, in contrast, the ETP market for alternate cryptocurrencies demonstrated exceptional weekly outcomes.

As per the latest report from CoinShares, Solana (SOL) has been the top performer among crypto investment products. In just a week, investments into Solana Exchange Traded Products (ETPs) experienced an astonishing increase of over 7,600%, climbing from $100,000 to $7,600,000. This recent surge brings the total inflows for this year up to $39 million. It’s worth noting that Solana-related investment products experienced outflows amounting to $26.7 million in August.

Currently, when it comes to the year-to-date rankings for digital assets, excluding Bitcoin and Ethereum, Solana takes the top spot.

Solana ETF by 2025?

It’s intriguing to observe the factors that have prompted investors to consider Solana-oriented investment options.

One possibility could be that the upcoming launch of comprehensive Solana Exchange Traded Funds (ETFs) might not occur immediately, as the initial submissions by VanEck and 21Shares for Solana ETFs were declined by the Securities and Exchange Commission (SEC), leading to the withdrawal of their 19b-4 filings.

Consequently, numerous specialists believe that the odds of Sol ETFs getting approval this year are almost zero.

But, the forthcoming November elections might bring swift changes, making it a possible scenario where progress is followed by setbacks, then more advancements. In simpler terms, it could be like moving forward, taking a step back, and then moving forward again.

It appears logical for ETP traders dealing with Ethereum Tradable Products (ETP) to get involved when there’s a significant withdrawal of funds, especially given the current pessimistic outlook. To clarify, this is only a hypothesis; those who have invested in SOL ETPs might behave similarly to stock investors.

Still, a 7,600% jump is something to keep an eye on, as there is rarely smoke without fire in these cases.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- EUL PREDICTION. EUL cryptocurrency

- EUR NZD PREDICTION

2024-09-02 19:06