As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility and unexpected price drops. Solana (SOL) losing around 10% of its value in a short period is concerning, especially after the preliminary approval of the Ethereum ETF, which many believed would boost its price performance.

The value of Solana dropped by nearly 10% unexpectedly. This asset, which appeared poised for growth following the preliminary acceptance of the Ethereum ETF, now seems less robust compared to other market offerings. It remains uncertain whether Solana will bounce back effectively.

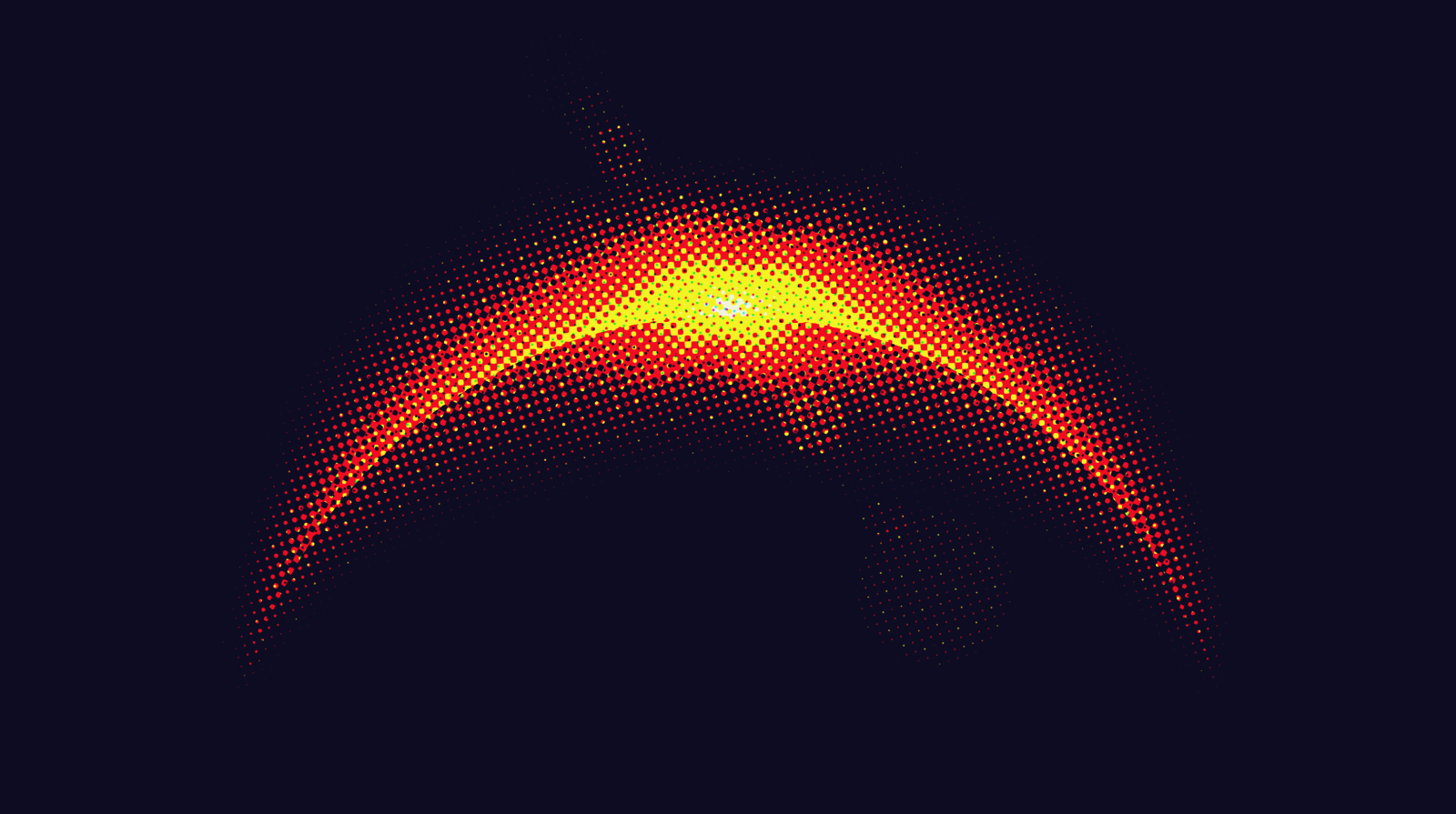

Looking over the chart, Solana underwent a noticeable decrease, sliding from approximately $176 to $164. This substantial drop has caused SOL to approach its crucial support zone at $160, which historically functioned as a robust support base. Should this support level give way, the subsequent significant support would be around $150, aligning with the 200-day moving average (represented by the orange line).

From the perspective of opposition, Solana encounters an initial barrier at $176, a price point it previously found difficult to hold before the recent decline. Beyond this point, the next significant resistance lies roughly around $190, which is currently where the 50-day moving average (represented by the blue line) sits. Overcoming these hurdles would be essential for any meaningful rebound to take place.

Solana’s drop in value could be due to a combination of factors. For one, investor sentiment following Ethereum ETF approval has been uncertain, causing some assets to thrive while others, such as Solana, experience setbacks. Moreover, technical issues may have come into play, with the failure to hold crucial resistance levels potentially triggering automatic sell orders and exacerbating the downward trend.

For traders and investors, the importance of Solana holding the $160 mark cannot be overstated. Should the cryptocurrency manage to sustain this point, it may take a pause before attempting another price surge. Conversely, if Solana falls below the $160 threshold, the attention shifts to the next vital resistance at $150. A breakdown at this level could signal a deeper decline and increased market turbulence for investors.

Ethereum stays composed

The anticipated surge in Ethereum’s price due to its ETF listing was a disappointing outcome. Several reasons might have contributed to this weak price behavior. Regardless, it is essential to consider if there’s potential for future price increases instead of dwelling on the failed rally.

As a researcher investigating Ethereum’s price behavior, I’ve observed that despite the ETF approval, the cryptocurrency has yet to convincingly surpass significant resistance levels. The nature of this approval, which falls short of a full-blown S-1 filing, leaves open the possibility for additional regulatory challenges.

Furthermore, the Divison of Trading and Markets granted approval for this under their delegated power, but this decision can be contested within the subsequent 10-day period. Consequently, this additional element of potential change contributes to the existing market volatility.

As an analyst, I believe there are positives to be gained from the potential approval of an Ethereum ETF, despite initial apprehensions. This acceptance would pave the way for future crypto adoptions, establishing a significant precedent in the industry and potentially leading to larger instances of cryptocurrency integration into traditional financial markets.

Cardano’s weird position

Cardano hasn’t gained significant attention in the market recently and has shown minimal price fluctuations. Nevertheless, it’s worth noting that ADA is nearing a crucial support level. If this level holds, it could potentially act as a foundation for a future price reversal.

Currently, the graph indicates that Cardano is forming a new support line around $0.45. This figure has been put to the test multiple times and has proven resilient during market declines, potentially signaling significant investor interest at this price point. The surge in trading volume accompanying this trend further bolsters the argument that $0.45 is an essential price level for Cardano. If ADA manages to maintain its position above this line, it could provide a solid foundation for future price growth.

In the daily chart, the resistance level for ADA is at $0.50. This price has previously caused rejections in the upward price trend over the past few days. It’s important to keep in mind that if this resistance is broken, there’s a strong possibility that the price could reach $0.55 – a significant level where the 200-day moving average is situated.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- BICO PREDICTION. BICO cryptocurrency

- USD ZAR PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- USD CLP PREDICTION

- WQT PREDICTION. WQT cryptocurrency

2024-05-25 03:39