In the vast expanse of the financial world, the price of Solana approaches a critical support area, where the fate of investors’ hopes and fears intertwine. 🧠💸 Will the bulls, those valiant champions of optimism, stand firm, or shall the bears, with their icy grip, seize control? The market, ever fickle, whispers of uncertainty, as if it too is lost in the labyrinth of its own volatility.

Solana Price Sliding Back Into Support Territory

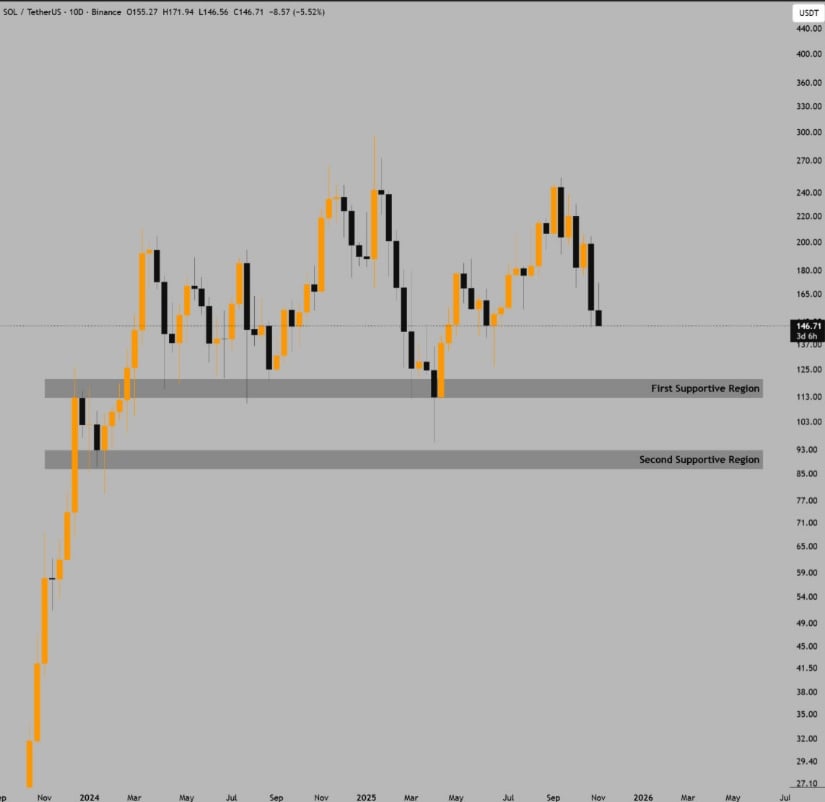

Behold, Solana hovers just above the $145 to $150 demand zone, a region once a sanctuary for buyers, now a battleground of waning resolve. 🛡️ The candles, those silent witnesses, reveal a tale of cooling fervor, as lower highs stack like weary soldiers, their ranks thinning. The latest retest, though, arrives with a sigh, as volume wanes-evidence of buyer fatigue, a lament echoed in the halls of market analysis.

ShangoTrades, that venerable oracle of charts, marks support aligning with broader market structure. Should this level falter, the price may plunge into a deeper void, where $118 to $125 await like a siren’s call. 🌊 Yet, the distance between these realms underscores the urgency: Solana must defend its current test, lest it face the abyss.

From a structural perspective, the market teeters on the edge of chaos or order. As long as Solana lingers here, traders should brace for reactive moves, yet remain wary of illusions of sustainability. 🕳️ The dance of price is a cruel mistress, offering glimpses of hope only to snatch them away.

Macro Structure Shows a Head and Shoulders Risk

Zooming out, the higher-timeframe structure unveils a potential head-and-shoulders pattern, a classic formation that has haunted the markets for centuries. Yet, in the realm of crypto, where liquidity dances like a fickle lover, such patterns are but shadows, their reliability as fleeting as the morning mist. 🌫️

Though traditional head-and-shoulders patterns are widely flagged, their validity in crypto is as uncertain as a pendulum’s swing. Still, this formation matters, for it:

- Explains the continued hesitation near $150, a testament to the market’s indecision.

- Contextualizes why sellers persist in their defense of lower highs, a battle of wills.

- Outlines a clear validation/invalidation threshold, a gauntlet for traders to cross.

A sustained break below $120 to $125 would solidify the downside scenario, exposing Solana to deeper extensions. Until then, the pattern should be treated as a cautionary tale, not a prophecy. 📜

No Bullish Confirmation Until Solana Price Reclaims $177

Short-term structure remains heavy, a burden borne by the price of Solana. Lower highs continue to stack, and attempts to build momentum stall before the $170 to $177 zone, a key resistance cluster that once triggered a breakdown. 🛑

Crypto Tony’s chart marks this zone as the gatekeeper for trend recovery. Relief bounces towards $162 to $168 are possible, yet without a reclaim of $177 supported by rising volume, bullish narratives remain mere fantasies. 🧠 The Elliott Wave count, a labyrinth of overlapping waves, reinforces the lack of a validated reversal structure. Until buyers reclaim a decisive higher-low formation, rallies are more likely to be absorbed than extended. 🧩

For participants, this is the clearest conditional marker: no trend reversal can be taken seriously while SOL trades below $170-$177. 🚫

Solana Price Prediction: Key Trendline Break Raises Concerns

Howard’s Solana chart adds another key datapoint: the loss of a multi-month diagonal support. When these trendlines break, they typically shift the market from accumulation into redistribution or full corrective mode. ⚖️

Since losing the trendline, Solana’s recovery attempts have remained shallow, and Fib projections indicate potential support at:

- $125 (first reaction level) 🌟

- $81 (Fib 100% extension) 📉

- $40-$50 (extreme 161.8% extension) 🧨

These levels are scenario-based, not predictions, but they highlight how quickly downside territory widens if the current structure continues weakening. The volume profile beneath the current price is notably thin, meaning any breakdown could accelerate faster than traders expect. 🚀

Final Thoughts: Can ETFs Turn It Back for Solana?

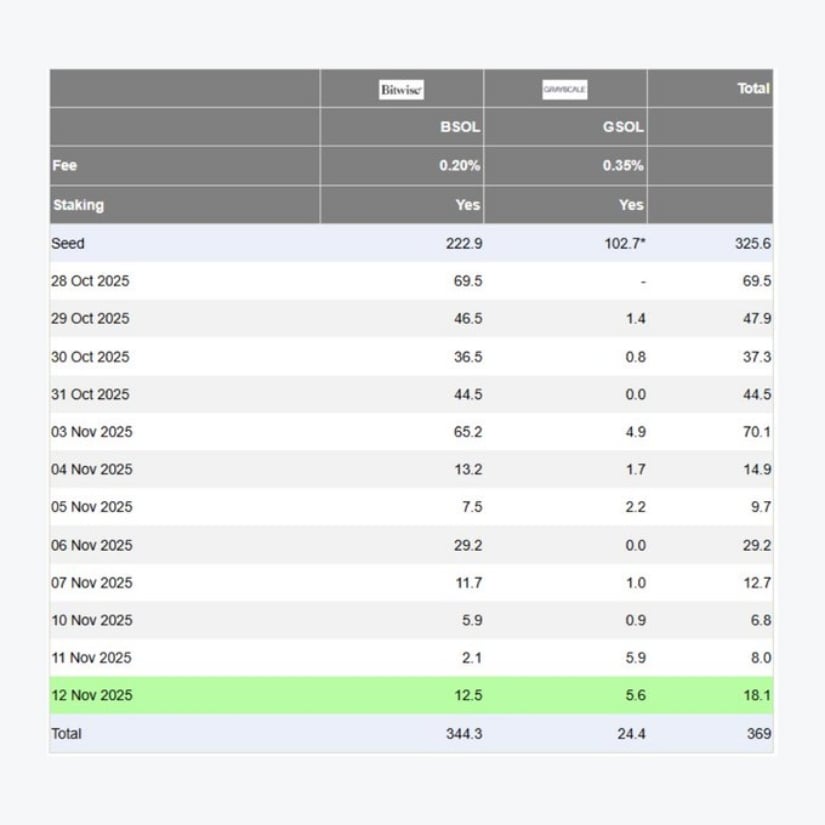

Despite technical fragility, institutional appetite remains surprisingly steady. ETF products like BSOL and GSOL continue to see net inflows, an important long-term signal that external demand is not deteriorating. 🏦 Yet, the divergence between Solana ETF demand and actual price action suggests that technicals are still in control of the near-term trend. Until Solana reclaims $170 to $177, buyers do not have structural confirmation, regardless of longer-term fundamentals. 🧩

If ETF inflows persist and current support zones hold, sentiment could shift quickly. Crypto markets are known for sharp reversals once bearish positioning reaches extremes. But until major resistances are regained, traders must approach the Solana chart with caution, clear risk management, and an understanding that both bullish and bearish scenarios remain technically valid. 🧭

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-11-13 23:54