Oh, Solana (SOL), you cheeky blockchain troublemaker, you rebounded 3% on Sunday, October 8, hitting intraday highs of $190 and snatching back that sweet $100 billion market cap for the first time since early September. Because nothing says “recovery” like a week of rollercoaster volatility sparked by that presidential tariff drama on China-who knew geopolitics could turn crypto into a soap opera? 🙄💥

Solana Price Rebounds Above $190 as DEX Activity Smashes Record $8B (Is This Legit?) 😏

Amid the total market meltdown, Solana’s decentralized world flexed like a gym bro on steroids. On Saturday, some fancy Solana news aggregator data spilled the beans: perpetual DEXs on the Solana network cranked out over $8 billion in trading volume during the crash. Take that, gravity! 💪

And get this-four Solana-based exchanges blew past $1 billion in 24-hour volume, with Orca strutting at $2.49B, Meteora at $1.7B, and Raydium at $1.5B. Who needs Hollywood when you’ve got decentralized drama? 🎭

📊Report: During last night’s massive liquidation event, @Solana DEXs processed over $8B in trading volume with @orca_so leading at $2.49B. Four Solana DEXs crossed $1B in 24-hour volume.

– SolanaFloor (@SolanaFloor) October 11, 2025 🤯

While the rest of crypto was panicking and saying “bye-bye” to liquidity, Solana’s DEX squad held onto that capital like a hoarder with a lifelong supply of toilet paper. Increased chaos led to way more validator fees and token burn action, which is basically making SOL behave better than your cousin at Thanksgiving-faster rebound, fewer awkward silences. 😂👍

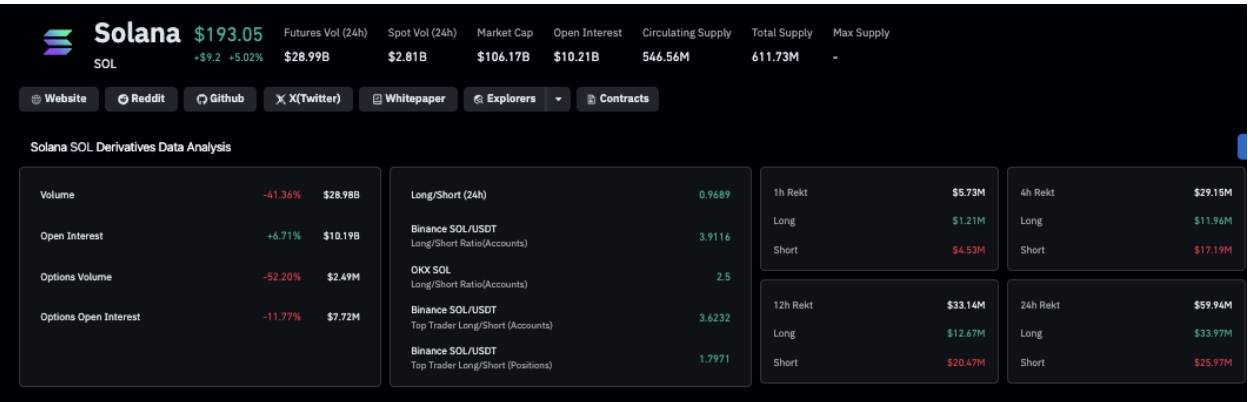

Solana Derivatives Market Analysis | Source: Coinglass 😎

Derivatives trading? Oh honey, it’s practically bursting with optimism for Solana’s comeback tour. Coinglass stats show open interest jumped 6.9% to $10.2 billion on Sunday, even though prices only ticked up 5% to $192. This little mismatch screams “leveraged traders are back, baby!” after those forced liquidations on Friday. Remember, leverage: it’s not just for drama queens anymore. 📈😏

Solana Price Forecast: Can SOL Keep the Party Going All the Way to $200? (Spoiler: Maybe Not Without Cake 🎉)

Solana’s tech charts are playing nice with all that on-chain and derivatives jazz, hinting that the bulls are creeping back in like that one friend who always shows up unannounced. Check it out: SOL price ricocheted off the lower Bollinger Band at $181.6, proving buying ain’t dead yet after the global crypto temper tantrum. 📊✨

Solana (SOL) Technical Price Analysis | TradingView 🧐

SOL has clawed back to the mid-Bollinger level at $213.3, which is now the oh-so-important resistance no man’s land. Break above that, and we’re talking upper band glory at $244.9-aka the August swing high, and yeah, bulls are gunning for it this week like it’s Black Friday. 🍿

Meanwhile, the RSI has inched up from super-oversold territory near 41.1 to neutral 49.7, basically saying “downside drama, chill out.” But let’s not get crazy-a flop at $213 could send us tumbling back to $181 support. It’s crypto, folks: equal parts genius and total unpredictability. 🤷♀️😅

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Who Is the Information Broker in The Sims 4?

2025-10-12 23:25