Oh, Solana, you fickle beast. While the rest of the crypto market is having an existential crisis, you’re over here flexing like you just discovered a hidden stash of blockchain Kool-Aid. 🥤✨ Momentum? Sure, if you call a rollercoaster “momentum.” But hey, SOL’s got its game face on, and apparently, the technicals are throwing it a parade. 🎉

Solana ETFs: The Only Thing More Reliable Than My Therapist’s “Uh-huhs” 💼💰

So, Solana’s ETFs are like that one friend who always shows up with wine-consistent, appreciated, and slightly suspicious. 🍷 20 days of net inflows? Impressive. Or is it just the crypto equivalent of a participation trophy? 🏆 Either way, institutions are throwing money at it like it’s a going-out-of-business sale at a blockchain boutique. Meanwhile, altcoins are sitting in the corner, muttering, “Why wasn’t I invited?” 😢

Analysts are calling it “thesis-driven accumulation.” I call it “hoping for a miracle.” 🤞 But hey, who am I to judge? If SOL’s got the moxie to keep this up, more power to it. Just don’t ask me to hold its crypto while it does a backflip. 🤸♂️

Crypto Tony’s Crystal Ball: $150 or Bust? 🔮💥

Enter Crypto Tony, the Nostradamus of charts, who’s convinced SOL’s headed for the $145-$150 zone. 🤑 Because nothing says “bullish” like a resistance level that’s been teased more times than a soap opera plot twist. 🧼 Currently, SOL’s bouncing around like a ping-pong ball at a frat party, but Tony’s betting the bulls will sober up and make a move. 🐂🍻

If it breaks $150, we’re apparently in for a joyride to $160. 🚗💨 But let’s be real-crypto and predictability go together like oil and water. Or oil and blockchain. Same difference. 🛢️

Liquidations: The Crypto Version of Whack-a-Mole 🎮💥

CW8900’s heatmap is basically a treasure map for short sellers, with $145 marked as the X. ☠️ If SOL hits that, it’s liquidation city, population: everyone who bet against it. 🏙️ With liquidity stacking up like pancakes at brunch, a sweep to $145 seems as likely as a hangover after said brunch. 🥞🤕

But let’s not get ahead of ourselves. Crypto’s favorite game is “expect the unexpected,” and SOL’s just another player in this high-stakes carnival. 🎪

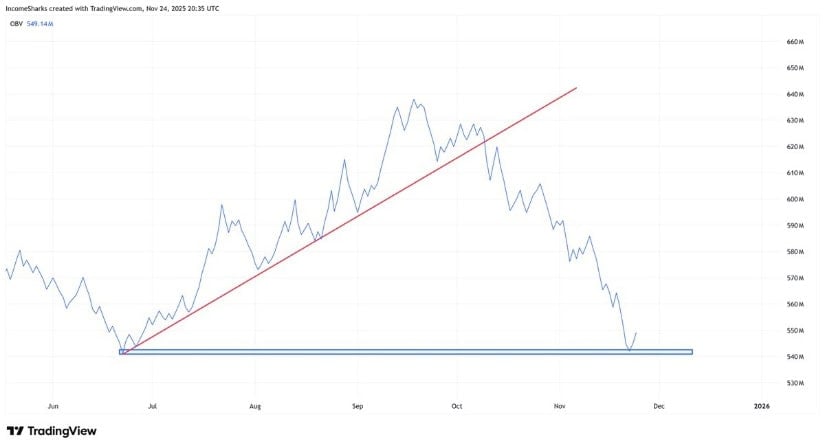

OBV: The Crypto Analyst’s Security Blanket 🛡️😴

Income Sharks is here to remind us that OBV is sitting on a support level so clean, it could pass for a Marie Kondo special. 🧹 If volume shifts back to the buyers, it’s like adding rocket fuel to SOL’s already questionable life choices. 🚀 But let’s be honest, OBV is about as reliable as a weather forecast in the crypto world-take it with a grain of salt and a shot of whiskey. 🥃

Still, a bounce is a bounce, and in this market, we take what we can get. Even if it’s just a temporary reprieve from the chaos. 🪂

SOL vs. BTC: The Crypto Underdog Story 🐕🆚🐋

Gordon’s SOL/BTC chart is basically a Rocky training montage, with SOL as the scrappy underdog. 🥊 The neckline at 0.0030 BTC is the final boss, and SOL’s gearing up for the fight of its life. If it breaks through, it’s not just a win-it’s a statement. 💪 But let’s not forget, Bitcoin’s the heavyweight champ, and SOL’s still in the lightweight division. 🏋️♂️

Relative strength? Sure. But in crypto, strength is as fleeting as a meme’s 15 minutes of fame. 🕰️

Final Thoughts: Will SOL Survive or Self-Destruct? 🤔💥

So, here we are. Solana’s got the fundamentals, the technicals, and the institutional love. But does it have the staying power? 🧐 ETF inflows are nice, but they’re not a magic wand. And let’s not forget, crypto’s favorite hobby is rug-pulling expectations. 🪨

If SOL can keep its head above water and buyers stay loyal, $145-$150 isn’t just a dream-it’s a possibility. But in this circus of a market, nothing’s guaranteed. Except maybe the drama. 🎭 Until next time, keep your wallets close and your stop-losses closer. 🤑

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-11-26 00:11