The crypto market in 2025 is a veritable carnival of chaos. Meme coins, once the darlings of the digital age, have plummeted into obscurity. Decentralized finance (DeFi) protocols, once flush with capital, now resemble a leaky bucket, with TVL draining from $120 billion to a paltry $87 billion.

Amid this maelstrom, Sonic emerges as a beacon of hope—or perhaps just another mirage. In April, it hit the $1 billion TVL mark, a feat achieved in a mere 66 days. How, you ask, does Sonic manage to shine while the rest of the market wallows in despair?

Investors Flock to Sonic Like Moths to a Flame

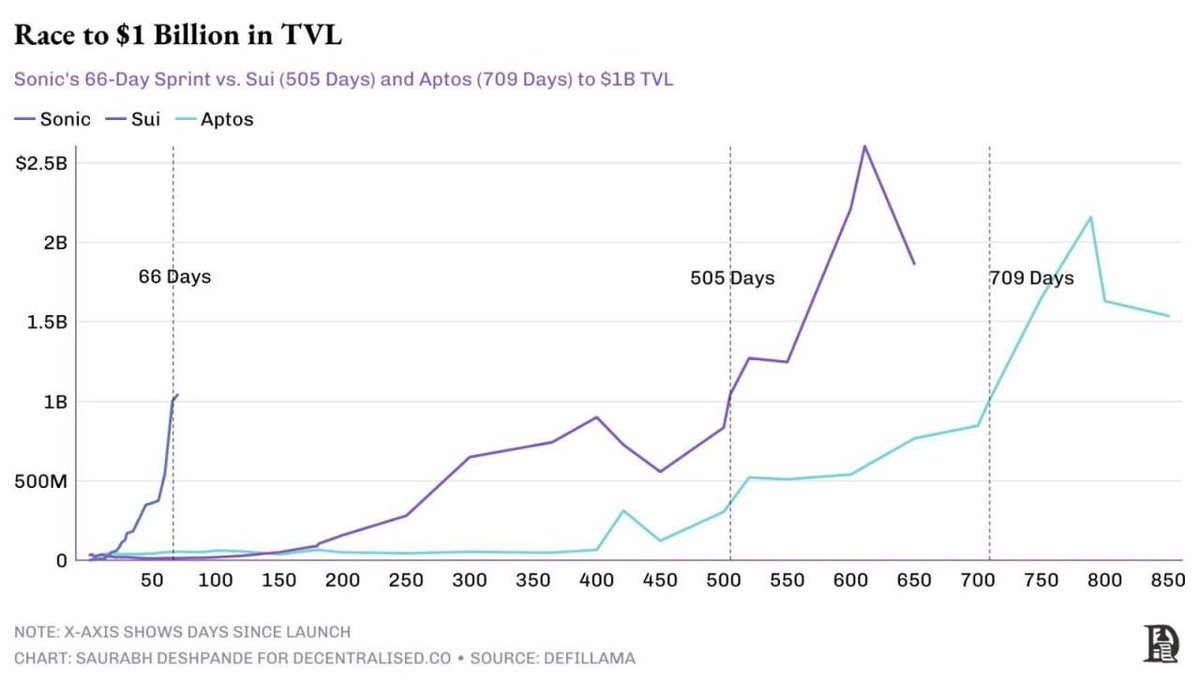

Sonic’s TVL growth rate is nothing short of meteoric, leaving its more illustrious competitors in the dust. According to DefiLlama, Sonic reached $1 billion in TVL in just 66 days. Sui, by comparison, took 505 days, and Aptos a leisurely 709. One might wonder if Sonic is the Usain Bolt of blockchains or just a flash in the pan.

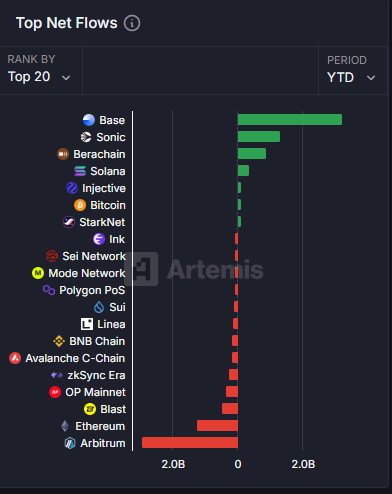

This achievement is a testament to the strong capital inflows into the Sonic ecosystem, even as the broader DeFi market hemorrhages funds. Data from Artemis ranks Sonic as the second-highest netflow protocol this year, trailing only Base, a blockchain backed by Coinbase. One might say Sonic is the Robin to Base’s Batman—though whether it’s a hero or a sidekick remains to be seen.

The growth isn’t just about TVL numbers. Sonic’s ecosystem is attracting a motley crew of projects, including derivatives exchanges like Aark Digital and Shadow Exchange, and protocols such as Snake Finance, Equalizer0x, and Beets. These projects, though still in their infancy, have the potential to draw new users and capital, propelling Sonic’s momentum. But one must ask: Is this a sustainable trajectory or just a fleeting infatuation?

Andre Cronje: The Man Behind the Sonic Curtain

Andre Cronje, the developer behind Sonic, is nothing if not ambitious. In a recent interview, he shared his vision to propel Sonic beyond its competitors.

“Sonic has sub-200 millisecond finality, faster than human responsiveness,” Cronje declared, as if he were describing a new sports car rather than a blockchain.

According to Cronje, Sonic isn’t just about speed. The platform also focuses on improving both user and developer experience. He explained that 90% of transaction fees go to dApp, not to validators, creating incentives for developers to build. One might say Sonic is the Robin Hood of blockchains—robbing the validators to pay the developers.

Unlike other blockchains, such as Ethereum, which are hobbled by long block times, Sonic leverages an enhanced virtual machine that theoretically processes up to 400,000 transactions per second. Cronje acknowledges, however, that current demand has yet to push the network to its full capacity. Still, these technical advantages make Sonic a compelling option for developers seeking more user-friendly dApps.

He also revealed new features on Sonic that have the potential to attract users.

“If your first touch point with a user is to download this wallet and then buy this token on an exchange, you’ve lost 99.9% of your users. They’ll use their Google off-email password, fingerprint, face, whatever it is, to access the dApp and interact with it, and they’ll never need to know about Sonic or token,” Cronje revealed, as if he were unveiling the secrets of the universe.

Risks and Challenges: The Dark Side of the Sonic Moon

Despite its impressive milestones, Sonic is not without its risks. The price of its token, S, has declined significantly from its peak. According to BeInCrypto, it has dropped around 20% in the past month—from $0.60 down to $0.47—mirroring the broader market’s volatility. One might say Sonic’s token is as stable as a house of cards in a hurricane.

Furthermore, Grayscale recently removed Sonic from its April asset consideration list. This decision reflects a shift in the fund’s expectations and raises concerns about Sonic’s ability to maintain its TVL should investor sentiment deteriorate. One might wonder if Sonic is the Icarus of blockchains, flying too close to the sun.

Sonic also faces fierce competition from other high-performance chains like Solana and Base. Although Sonic holds a clear advantage in speed, long-term user adoption will depend on whether its ecosystem can deliver real value, not just high TVL figures. One might say Sonic is in a race against time—and the competition is relentless.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Top 8 UFC 5 Perks Every Fighter Should Use

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Obsessed with Solo Leveling? Meet Super Cube, China’s Jaw-Dropping Answer to Anime

2025-04-11 15:13