Silver prices have stayed stubbornly low despite demand shooting up. Goldsilver HQ has dropped a bombshell report accusing some big players of pulling the strings behind the scenes, using a dirty trick called “spoofing.”

Silver’s Suppressed Price: A Market Anomaly?

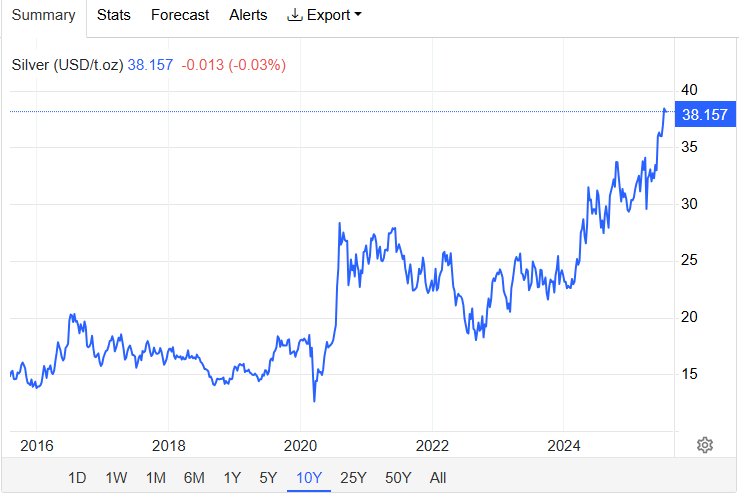

Silver should be shining by now, right? With all the hype around solar energy, electric vehicles, and tech, why’s silver still stuck in the mud? We saw it creep up in 2020 when the pandemic turned the world upside down, but it’s been a bumpy ride ever since.

Back in 2020, silver had a brief moment of glory, rising to over $27 an ounce. But that was just a taste. The real fireworks didn’t come until March 2024, when silver finally blasted to over $38 per ounce. That’s a 50% jump in just 15 months. Talk about making up for lost time!

Still, silver is more than $10 away from its all-time high (ATH) of $49.45, set back in 1980. If you adjust for inflation, that ATH is more like $140. Yep, silver’s still a bargain — but why?

The Allegation: Market Manipulation Through Spoofing

So, what’s going on? According to Goldsilver HQ, it’s not the market at fault. No, no. It’s all a big act, courtesy of some “market manipulators.” They’re using a shady tactic called “spoofing” to trick the system and make silver look like it’s worth less than it really is.

In a post on X, Goldsilver HQ spills the beans: the goal of spoofing is to create a fake “massive supply” that makes everyone panic. This false flood of silver orders scares the living daylights out of buyers, causing prices to crash. Then, when the price plummets, these sneaky traders cancel their fake orders and scoop up real silver at a discount. Scammy, right?

The usual suspects? Big financial institutions like JPMorgan. Goldsilver HQ claims these spoofers are flooding the COMEX (Commodity Exchange Inc.) with massive fake orders, especially during the prime New York morning trading hours. Sure, the price might bounce back later in Asia or Europe, but the damage is done, and silver stays artificially cheap.

How’s it done? Here’s the playbook, straight from Goldsilver HQ:

Trader places 1,000+ contracts to sell at a low price (spoof side), while quietly buying on the opposite side. Algos & HFT [high-frequency trading] bots react to the fake supply, slamming prices. Spoofer cancels, profits from the dip. Recidivists do this 100s of times!

To back this up, Goldsilver HQ drops some serious proof. They’ve shared screenshots of a 2020 report showing that JPMorgan was fined a whopping $920 million by the DOJ for spoofing in precious metals. Ouch. Traders were caught red-handed, admitting to rigging the market for years. Talk about a criminal enterprise!

And get this: JPMorgan traders didn’t just get fined — they also served jail time in 2023 for their little silver scheme. Plus, UBS and Deutsche Bank got slapped with fines in 2018 for doing the same thing. So much for fairness, right?

The Far-Reaching Impact: Beyond Investor Loss

But wait — it’s not just the investors who are getting burned. Oh no. This manipulation affects all of us. If silver is artificially cheap, guess who gets hit? Consumers, that’s who. Expect to pay more for things like solar panels and electronics because the cost of silver is being kept artificially low. Miners? They’re also suffering because the profitability of silver extraction is being squeezed.

Goldsilver HQ sums it up perfectly: “It’s not free market — it’s cartel control since 1965 US policy to suppress silver.” Whoa.

Oh, and don’t think the manipulators are only pulling the strings with spoofing. No, no. They’ve got “advanced tactics” too — like rigging futures to mess with exchange-traded funds like SLV. Or, even worse, flooding the market with orders before big news drops, making sure they can cash in on any volatility.

So, while the CFTC is supposedly on the case, Goldsilver HQ says enforcement is lagging behind. But don’t worry, there’s hope. If silver demand really takes off, the manipulators might finally be exposed for good. We could be looking at a huge squeeze — just like the Hunt brothers in 1980. Only this time, the digital age could lead to some serious fireworks. 🎆

Read More

- EUR USD PREDICTION

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- TRX PREDICTION. TRX cryptocurrency

- How to Unlock & Upgrade Hobbies in Heartopia

- Xbox Game Pass September Wave 1 Revealed

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- How to Increase Corrosion Resistance in StarRupture

- Best Ship Quest Order in Dragon Quest 2 Remake

2025-07-28 13:58