As a researcher with a background in financial markets and experience in analyzing investment trends, I find the recent surge in demand for Spot Bitcoin ETFs intriguing. The data from JPMorgan and Farside Investors showing their best weekly inflows since March is a clear indication of institutional investors’ confidence in the cryptocurrency market, particularly Bitcoin.

As a crypto investor, I’ve noticed an uptick in institutional buying during Bitcoin‘s latest dip. This trend is clear from the surge in demand for Spot Bitcoin Exchange-Traded Funds (ETFs). Last week, these ETFs experienced their strongest inflow in quite some time.

Spot Bitcoin ETFs Record Best Inflows In Over A Month

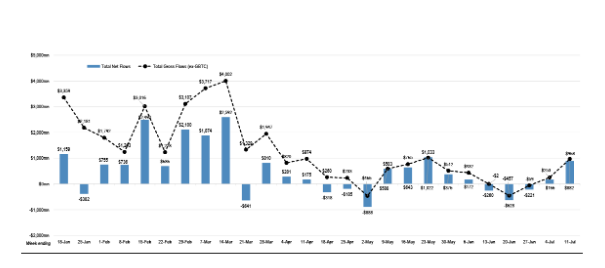

Based on JPMorgan’s figures, there was a significant increase in investments to Spot Bitcoin ETFs during the week ending July 11, with approximately $882 million being added. This is the largest weekly inflow for these funds since May 23, which saw a net investment of $1,022 million.

It’s intriguing to note that the Spot Bitcoin ETFs experienced their strongest weekly inflow since March, amounting to $310.1 million as of June 12, according to Farside Investors’ data. This equates to approximately $1.05 million in total inflows for the week.

On Friday, these Spot Bitcoin ETFs experienced their strongest one-day inflow since June 5, amounting to a total of $310.1 million. The lion’s share of this sum was contributed by BlackRock’s IBIT and Fidelity’s FBTC, which saw investments of $120 million and $115.1 million respectively.

On July 12, the Bitcoin exchange-traded funds (ETFs) from Bitwise (BITB), Grayscale (GBTC), Ark Invest (ARKB), and VanEck (HODL) each saw inflows of approximately $28.4 million, $23 million, $13 million, and $6.6 million respectively. In contrast, no other Spot Bitcoin ETFs recorded any inflow that day.

Based on information from Soso Value, these funds have accumulated a grand total of $15.81 million in new investments since their approval in January. This figure encompasses the substantial $18.64 billion in outflows experienced by Grayscale’s GBTC during this same period. BlackRock’s IBIT, on the other hand, has successfully attracted $18.26 billion in fresh investments during this timeframe, which has effectively offset the significant losses sustained by Grayscale’s product.

Other issuers of Spot Bitcoin ETFs have contributed as well, with these particular funds experiencing collective net inflows. Fidelity’s FBTC follows in second place, having recorded a total outflow of $9.72 billion since its launch. ARKB and BITB come in third and fourth respectively, reporting total net inflows of $2.5 billion and $2.13 billion each.

Worst Is Almost Over For The Crypto Market

Over the past few weeks, the cryptocurrency market has experienced a downturn due to the German government’s massive sale of Bitcoin, initiated last month. Fortunately, it seems that the worst of this selling frenzy may have come to an end, as recent data from Arkham Intelligence indicates that the German government has already sold all of its Bitcoin holdings.

Using the Spot Bitcoin and Ethereum ETFs, Bitcoin appears poised for a comeback and to retake the $60,000 threshold of support. The anticipated launch of Spot Ethereum ETFs is imminent, with Bloomberg analyst James Seyffart forecasting they might debut in trading as early as next week. This development will likely add more fuel to Bitcoin’s rally and bolster the entire crypto market.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD ZAR PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- PRIME PREDICTION. PRIME cryptocurrency

- Best Turn-Based Dungeon-Crawlers

- REF PREDICTION. REF cryptocurrency

2024-07-13 19:41