As a seasoned researcher with years of experience tracking crypto markets, I find the recent surge in inflows into Spot Bitcoin ETFs nothing short of intriguing. The data from Farside Investors and other reliable sources suggests that institutional and retail investors are increasingly bullish on BTC, which could be a significant catalyst for its price movement.

Institutional and individual investors who trade with Spot Bitcoin Exchange-Traded Funds (ETFs) are increasingly investing heavily in Bitcoin, as there’s been a significant increase in fund inflows. This trend suggests that these investors have high expectations and confidence in Bitcoin’s potential growth over the long term.

A Substantial Inflows Into Spot Bitcoin ETFs

Based on information from Farside Investors, a London-based investment firm, as reported by crypto expert Michael Van De Poppe and holding the position of CIO at MN Consultancy, there has been a significant surge in the number of Bitcoin ETFs available for spot trading over the past day.

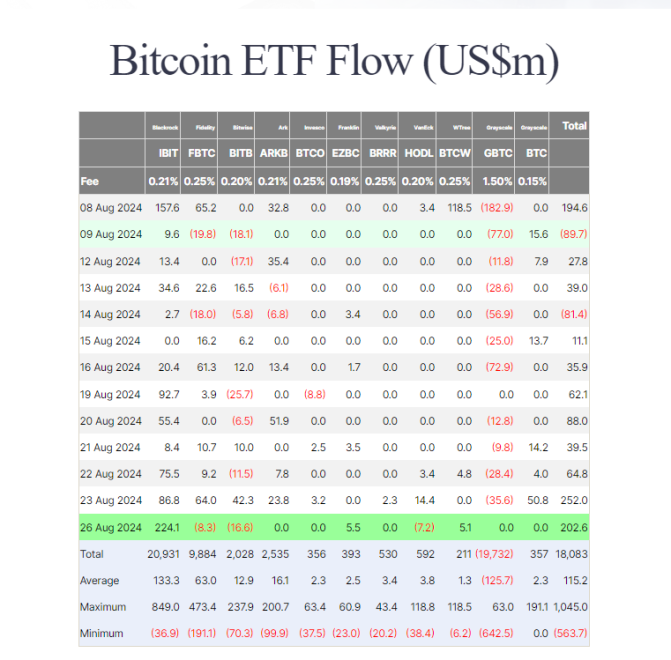

On Monday, Van De Poppe noted that there was an impressive surge in investment into exchange funds, totaling approximately $202 million in net positive inflows. This is a substantial rise compared to the previous Monday’s inflows of around $62.1 million, suggesting a growing interest among investors in these products on a daily basis.

Yesterday’s net inflow was almost half of the total net inflow from all trading days last week, amounting to approximately $500 million.

If Bitcoin ETFs persistently draw substantial investments, as Van De Poppe suggests, this could be a powerful indicator of the cryptocurrency’s strength, potentially causing its value to rise further. Considering the influence these products have on prices and the increased enthusiasm among investors, market expert Van De Poppe anticipates that Bitcoin might reach a new record high before the end of September.

It’s important to mention that the dramatic increase in investments into BlackRock’s iShares Bitcoin Trust (IBIT) is largely responsible for the recent surge in inflows. On a notable day, July 22nd, the IBIT fund received approximately $526 million, which was its highest daily inflow over the past 35 days.

Yesterday saw significant movements in Bitcoin-related investment funds. For instance, the Franklin BTC ETF (EZBC) and WisdomTree BTC Fund (BTCW) experienced inflows of approximately $5.5 million and $5.1 million respectively. On the other hand, Bitwise BTC ETF (BITB), Fidelity Wise Origin Bitcoin Fund (FBTC), and VanEck BTC ETF (HODL) recorded substantial outflows of around $16.6 million, $8.3 million, and $7.2 million respectively.

To conclude, there were no new investments made into the Grayscale Bitcoin Trust ETF (GBTC), the Invesco Galaxy Bitcoin ETF (BTCO), or the Coinshares Valkyrie Bitcoin Fund ETF (BRRR) for the day.

BTC’s Recent Price Performance

This surge in investment into Bitcoin ETFs happens following a drop in Bitcoin’s price, where BTC dipped from around $65,000 down to $62,720. This trend suggests that both institutional and individual investors are taking advantage of the price fall to amplify their holdings in this digital currency.

As an analyst, I’ve observed a surge of investments flowing into Bitcoin (BTC). This trend is sparking speculation that we might witness another price increase for BTC in the near future. In just the past 24 hours, BTC’s trading volume has soared by more than 44%, with its current price standing at approximately $62,818.

Read More

- USD PHP PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- Strongest Magic Types In Fairy Tail

- ADA PREDICTION. ADA cryptocurrency

- ALI PREDICTION. ALI cryptocurrency

- HBAR PREDICTION. HBAR cryptocurrency

- THL PREDICTION. THL cryptocurrency

- SWFTC/USD

2024-08-28 03:11