As a seasoned financial analyst with over a decade of experience in the market, I have witnessed numerous landmark events that have shaped the investment landscape. The recent approval of spot Ethereum ETFs by the SEC was undoubtedly one such event, generating immense excitement within the cryptocurrency community. However, my analysis reveals a different story.

The unexpected approval of Ethereum ETFs (exchange-traded funds) by the US Securities and Exchange Commission (SEC) has generated significant buzz in the cryptocurrency world. However, these crypto investment products have failed to meet the high expectations following a lackluster trading debut over the past week.

Grayscale Responsible For Heavy Spot Ethereum ETF Outflows

As an analyst, I’ve observed that Ethereum spot ETFs have experienced notable redemptions for three consecutive days starting from Friday, 26th of July. These products, which became available on Tuesday, July 23rd, recorded a net outflow amounting to approximately $341 during their inaugural week.

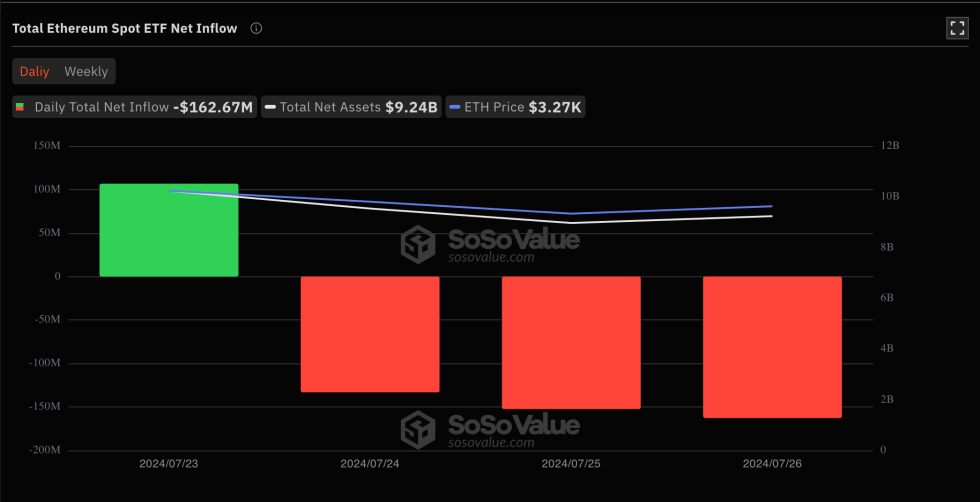

Based on information from SoSoValue, the Ethereum spot ETF began with considerable success, recording approximately $106.8 million in net inflows during its debut day. Market analysts viewed this strong start as noteworthy, particularly when considering the launch of Bitcoin ETFs earlier in the year.

On Wednesday, July 24, Ethereum ETFs experienced a significant withdrawal of funds to the tune of over $133 million. This was further aggravated by continuous outflows totaling $152 million on Thursday, and $162 million on Friday.

Notable is the large role played by Grayscale’s Ethereum Trust ETF (ETHE) in the recent outflow of funds. On Friday alone, this particular product experienced an outflow exceeding $356 million. To date, it has recorded a total net inflow amounting to $1.51 billion.

It’s intriguing to note that Ethereum’s price has faced significant challenges since the introduction of Ethereum-based Exchange Traded Funds (ETFs). Based on CoinGecko’s data, Ethereum, often referred to as the leading altcoin, has experienced a 7% decrease in value over the past week. Currently, its price hovers around $3,248, representing a minimal decline of 1.1% within the previous day.

New Money Inflow Less Impactful On ETH

Based on data from CryptoQuant’s recent analysis, the influence of new investments, like ETFs, on Ethereum’s price growth is relatively smaller compared to Bitcoin’s. This conclusion stems from the “realized capitalization multiplier” metric, which indicates that the existing Ethereum supply has been accumulated at higher prices compared to Bitcoin, reducing the impact of fresh investments.

Each dollar invested in Bitcoin has the capability to expand its market value by a factor of 5, according to current data. In contrast, Ether’s market capitalization grows by a smaller margin, with every additional dollar contributing approximately $1.3 to its total worth.

Back in 2024, each dollar I put into Bitcoin saw its market value grow to an impressive five dollars, whereas Ethereum returned a more modest gain of one dollar and thirty cents for every dollar invested.

New money flows have a weaker effect on $ETH than Bitcoin.

— CryptoQuant.com (@cryptoquant_com) July 26, 2024

The discovery made in 2024 indicates that Ethereum’s amplifying impact on investments has been notably less than Bitcoin’s.

Read More

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- Strongest Magic Types In Fairy Tail

- ENA PREDICTION. ENA cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- AAVE PREDICTION. AAVE cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

2024-07-28 12:20