As an experienced analyst, I’ve closely monitored the cryptocurrency market and its various on-chain indicators for years. The recent drop in exchange inflows of Ethereum-based stablecoins is a trend that caught my attention.

Recent data from the blockchain reveals a significant decrease in inflows of stablecoins into cryptocurrency exchanges. This trend might indicate bearish sentiment towards Bitcoin‘s price.

Ethereum-Based Stablecoins Have Seen Low Exchange Deposits Recently

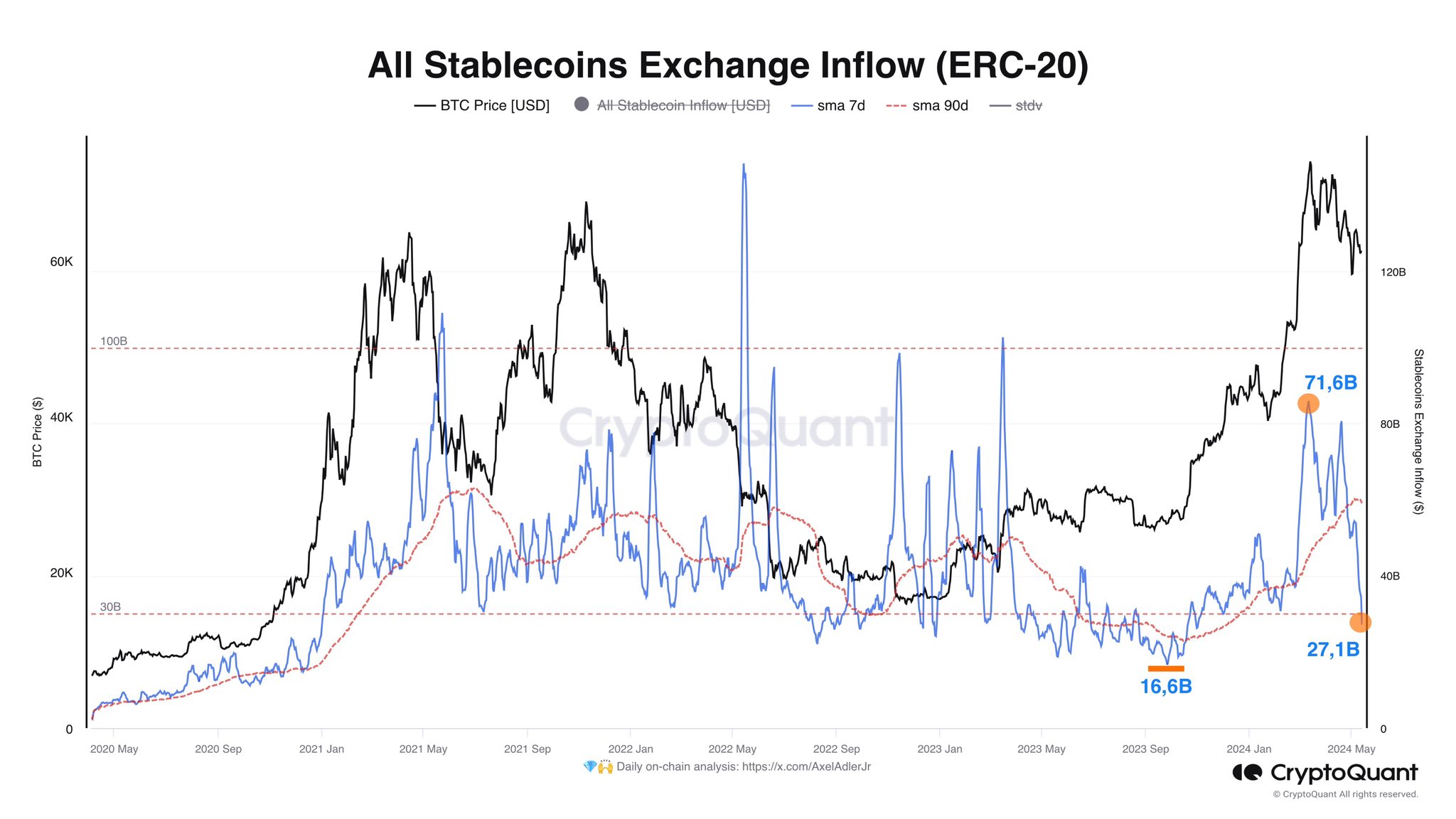

According to a recent post by Axel Adler Jr. on platform X, the current inflow of Ethereum-stablecoins into exchanges is lower than the average inflow over the past 90 days.

Here, “exchange inflow” signifies a metric derived from the blockchain that monitors the overall volume of a specific cryptocurrency moving into wallets linked to centralized trading platforms.

When the value of this metric is elevated, there’s a surge in investors depositing substantial amounts of the asset into these platforms. Typically, owners transfer their coins to exchanges for trading activities, indicating a strong appetite for converting the cryptocurrency.

The impact of inflows on the broader market varies depending on the specific asset. For instance, when it comes to volatile assets such as Bitcoin, an increase in inflows could signify selling pressure and potentially lead to a decrease in price.

BTC serves as a significant entryway for investment into the digital assets market. Consequently, selling Bitcoin could lead to a domino effect on the value of other cryptocurrencies.

The value of stablecoins remains constant at the $1 mark, so selling them doesn’t impact their price directly. However, when large amounts of these coins are exchanged, it signifies that their holders intend to convert them into other assets, which can influence market dynamics.

As a crypto investor, if I observe a significant number of investors converting their digital assets back into fiat currency, I would interpret this trend as a bearish sign for the market. This is because it suggests that a notable amount of capital is flowing out of the cryptocurrency sector, potentially weakening its overall value and momentum.

If deposits are used to buy Bitcoin and other unstable digital coins, the prices of these assets will likely experience an uptrend.

As a financial analyst, I would rephrase it as follows: Whenever significant inflows occur into large stablecoin exchanges, it becomes more probable that investors are holding their funds in these secure, fiat-pegged tokens. They do this with the intention of waiting for favorable market conditions before investing in the unstable cryptocurrency market.

Here is a chart illustrating the overall trend in inflows to the Ethereum exchanges for the stablecoin category:

The graph shows that the seven-day average of stablecoins flowing into exchanges has significantly dropped and now sits below the ninety-day average.

As a crypto investor, I’ve noticed a shift in behavior among stablecoin users lately. Instead of actively buying Bitcoin and other cryptocurrencies like during the last bull run leading to new all-time highs, there seems to be less demand now. This is reflected in the drop in trading volume below the quarterly average, which serves as a warning sign for me.

BTC Price

As a researcher studying the cryptocurrency market, I’ve observed Bitcoin making another attempt to regain momentum over the past day. Its value has recently surpassed the $63,000 threshold.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- USD CLP PREDICTION

- USD ZAR PREDICTION

- USD COP PREDICTION

- USD PHP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- SBR PREDICTION. SBR cryptocurrency

2024-05-14 06:11