- In a world where Tether’s Paolo Ardoino dreams of a “stablecoin multiverse,” firms and governments are apparently lining up like children at a candy store.

- USDT may lead in transaction volume, but USDC’s meteoric rise is like watching a tortoise outrun a hare—unexpected and slightly alarming.

As the market flounders like a fish out of water, Tether’s CEO, Paolo Ardoino, has unveiled a vision so grand it could make even the most optimistic of us chuckle. He calls it the “stablecoin multiverse.” Yes, you heard that right—a multiverse! Perhaps next, he’ll propose a stablecoin galaxy. 🌌

In a recent proclamation, Ardoino waxed poetic about the increasing significance of stablecoins in the global financial tapestry, predicting that both private enterprises and government entities will soon adopt them like a new fashion trend.

Taking to X (formerly known as Twitter, because who doesn’t love a good rebranding?), Ardoino declared,

“A new era begins: the stablecoin multiverse. Hundreds of companies and governments are launching (or will soon) their stablecoins. I’m very proud to see such massive adoption of a technology that Tether created back in 2014. Good luck everyone.”

What led to Ardoino’s prediction?

This grand statement followed Fidelity Investments’ recent announcement, which made headlines as if they had discovered a new planet. Their entry into the stablecoin arena signals that even the big players are getting curious about this rapidly expanding sector.

The firm’s digital assets division, which already handles Bitcoin, Ethereum, and Litecoin like a seasoned waiter at a fancy restaurant, is leading this initiative. 🍽️

In a separate tweet, Ardoino added,

“Today Tether USDt has (conservatively) more than 400 million users across the world. Soon 1 billion. We always focused on the adoption from the ground up, working in the streets, among other people, while traditional finance was watching at us from their ivory towers. That’s the difference. That’s why we’re unstoppable together.”

However, not everyone in the crypto community is rolling out the red carpet for Ardoino. Some, like Criptovaluta.it, pointed out,

“It seems like everyone thinks it’s an easy business. Spoiler: it’s not.”

Is USDC overpowering USDT?

On the market front, Circle’s USDC has been gaining traction faster than a cat chasing a laser pointer, recently hitting a record market cap of $60.2 billion—surpassing its previous 2022 peak of $55 billion. 🐱💨

In the past three months, USDC has outpaced Tether’s USDT in growth, expanding its supply by $16.6 billion compared to USDT’s $4.7 billion. It’s like watching a tortoise and a hare race, but this time the tortoise is winning!

Despite USDT’s dominance due to its deep liquidity and widespread adoption, USDC’s strong regulatory compliance, fully backed reserves, and institutional partnerships are making it a formidable competitor. Talk about a plot twist!

Metrics suggest otherwise

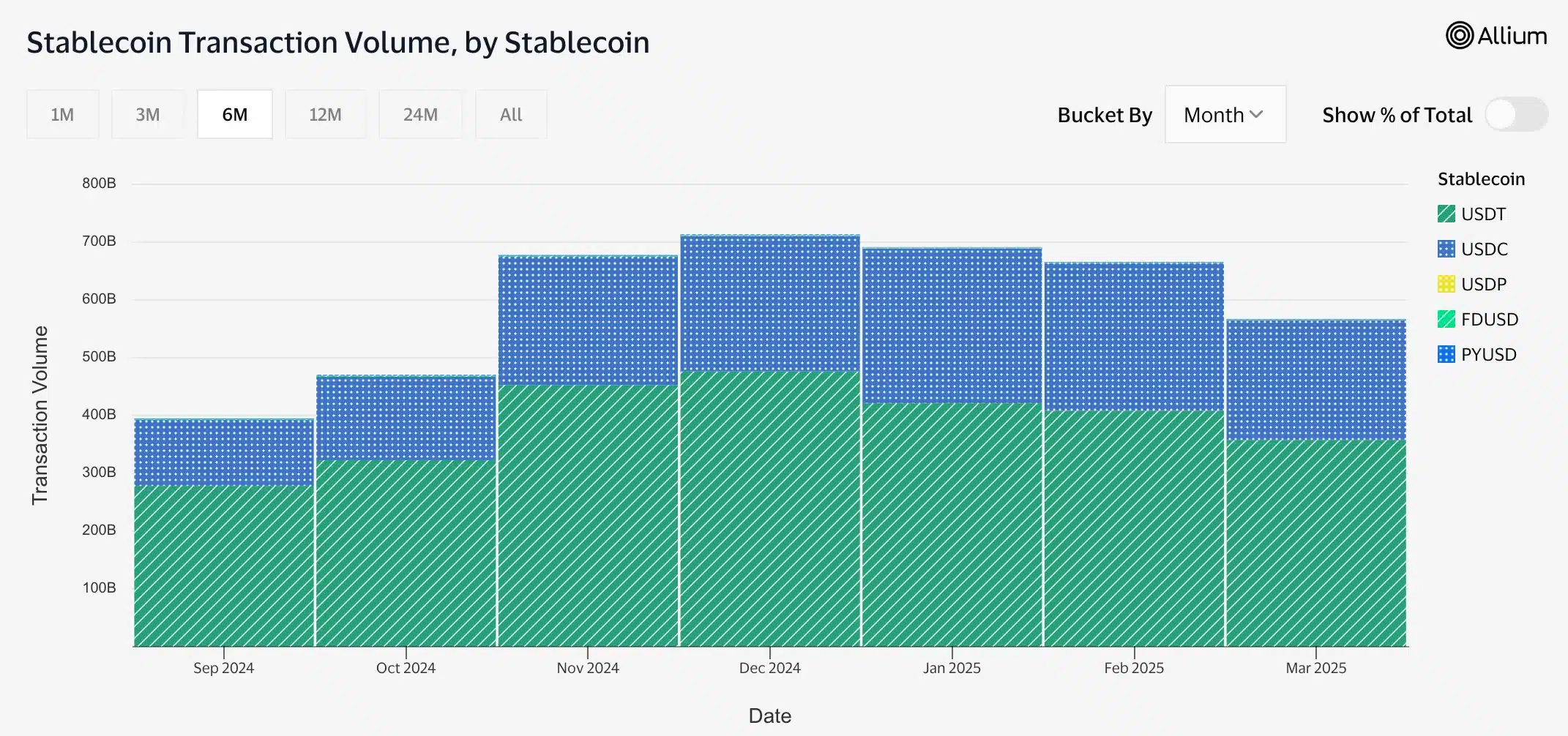

However, according to data from Visa on-chain analytics for March 2025, Tether still reigns supreme in the stablecoin market. USDT, at press time, recorded a staggering $357.35 billion in transaction volume, significantly outpacing USDC’s $207.80 billion. It’s like a heavyweight champion still holding the title!

Other stablecoins like FDUSD and PYUSD have also joined the fray, contributing to the growing sector. Yet, the gap between USDT and its competitors remains as clear as day.

Therefore, regardless of who dominates the stablecoin market, given this kind of overall growth, the stablecoin era might just arrive sooner than expected. Or perhaps it’s just a mirage in the desert of digital finance. 🏜️

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- 8 Best Souls-Like Games With Co-op

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- REPO: How To Fix Client Timeout

- Choose Your Fate in Avowed: Lödwyn’s Ruins or Ryngrim’s Adra?

- The White Rabbit Revealed in Devil May Cry: Who Is He?

- How to Unlock the Mines in Cookie Run: Kingdom

2025-03-28 09:17