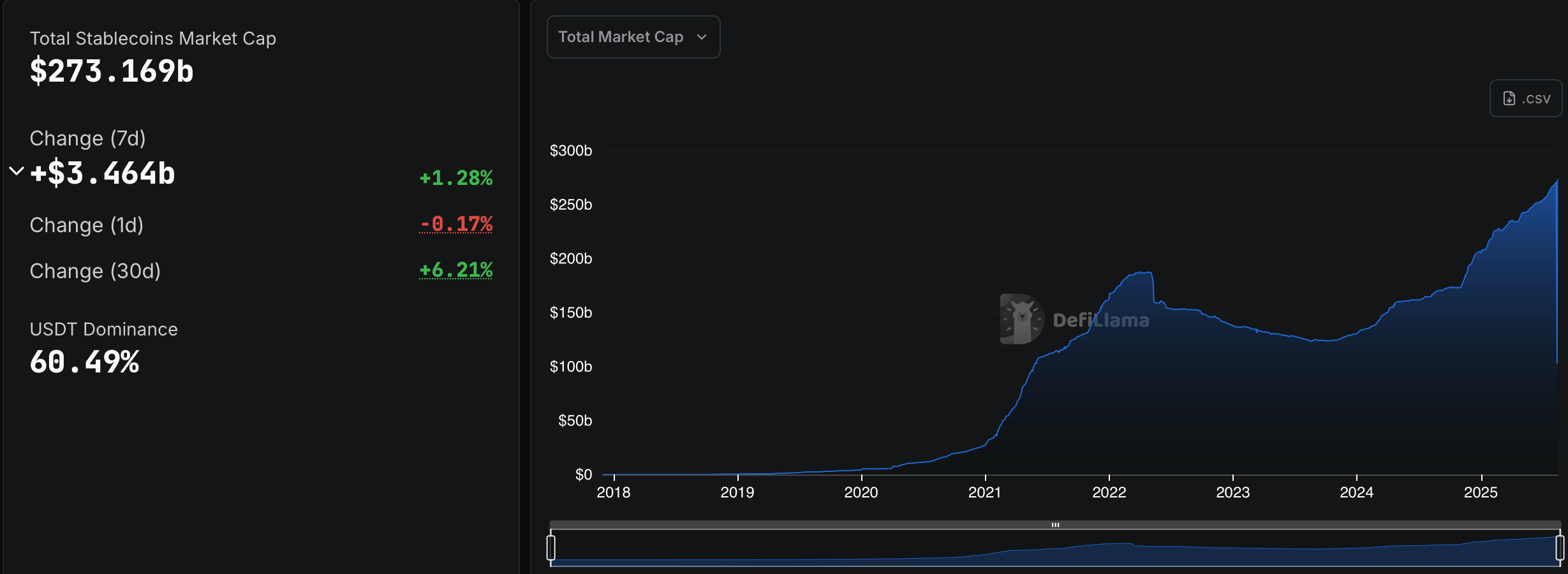

In the course of the past week, the realm of stablecoins has experienced a most delightful expansion of 1.28%, thereby adding a rather impressive sum of $3.464 billion, culminating in a grand total of $273.169 billion. Tether (USDT), that veritable colossus of the market, continues to reign supreme, commanding a staggering 60.49% of the entire sector, with its supply swelling by approximately 730 million coins during this brief period of seven days.

As Tether and USDC Flourish, the Stablecoin Economy Ascends to New Heights

Tether (USDT) maintains its commanding position atop the stablecoin hierarchy, boasting a market cap of $165.25 billion, which has seen a modest increase of 0.44% this week and a commendable 2.93% over the past month. In terms of dollars, this translates to a rather princely boost of $4.7 billion to USDT’s market cap in the span of a mere thirty days. Meanwhile, USDC, in its second-place glory, holds a respectable $66.80 billion, having ascended by 3.56% in the past week and 7.56% in the month.

USDC has graciously added approximately $2.29 billion to its market cap this week, bringing its thirty-day growth to a delightful $4.69 billion. In the third position, Ethena’s USDe sparkles with $10.99 billion, soaring by an astonishing 12.31% over the week and a jaw-dropping 106% for the month. Sky’s DAI, with its $4.51 billion, has climbed 4.38% in a week and 4.39% in a month, while its counterpart, the sky dollar (USDS), lingers just behind at $4.48 billion, having dipped 11.22% weekly but advanced 11.24% over the course of thirty days.

Blackrock’s BUIDL, with a market cap of $2.37 billion, has experienced a rather mild gain of 4.48% for the week, albeit a rather steep decline of 15.61% over the month. This monthly descent can be traced back to last month’s rather unfortunate pullback in the tokenized treasury sector, though the market has rebounded by 6.46% in the past week, as per the estimable rwa.xyz statistics. World Liberty Financial’s USD1 trails closely behind with a market cap of $2.21 billion, edging up a modest 0.51% this week and a mere 0.12% over the past month.

Ethena’s USDtb, with its $1.46 billion, has posted modest gains of 0.34% for the week and 0.76% over the month. Falcon’s USDf has leapt a remarkable 6.50% this week and an eye-catching 86.35% in thirty days, reaching a commendable $1.23 billion. Paypal’s PYUSD follows closely at $1.18 billion, climbing 15.56% weekly and 40.26% for the month. Alas, First Digital’s FDUSD has slipped from the top ten, now languishing in the 11th position with a market cap of $1.02 billion, having eked out a paltry 0.08% gain for the week but tumbled a rather disheartening 14.73% over the past month.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- How to Unlock all Substories in Yakuza Kiwami 3

- All 100 Substory Locations in Yakuza 0 Director’s Cut

2025-08-16 23:08