As a seasoned financial analyst with extensive experience in the crypto market, I’ve observed numerous trends and patterns over the years. One such trend that has consistently proven to be a bullish sign for Bitcoin is the growth of the stablecoin market cap. The recent surge in this metric is no exception.

Recent on-chain data indicates that the market capitalization of stablecoins has resumed its upward trend, a sign that could bode well for Bitcoin‘s price movement.

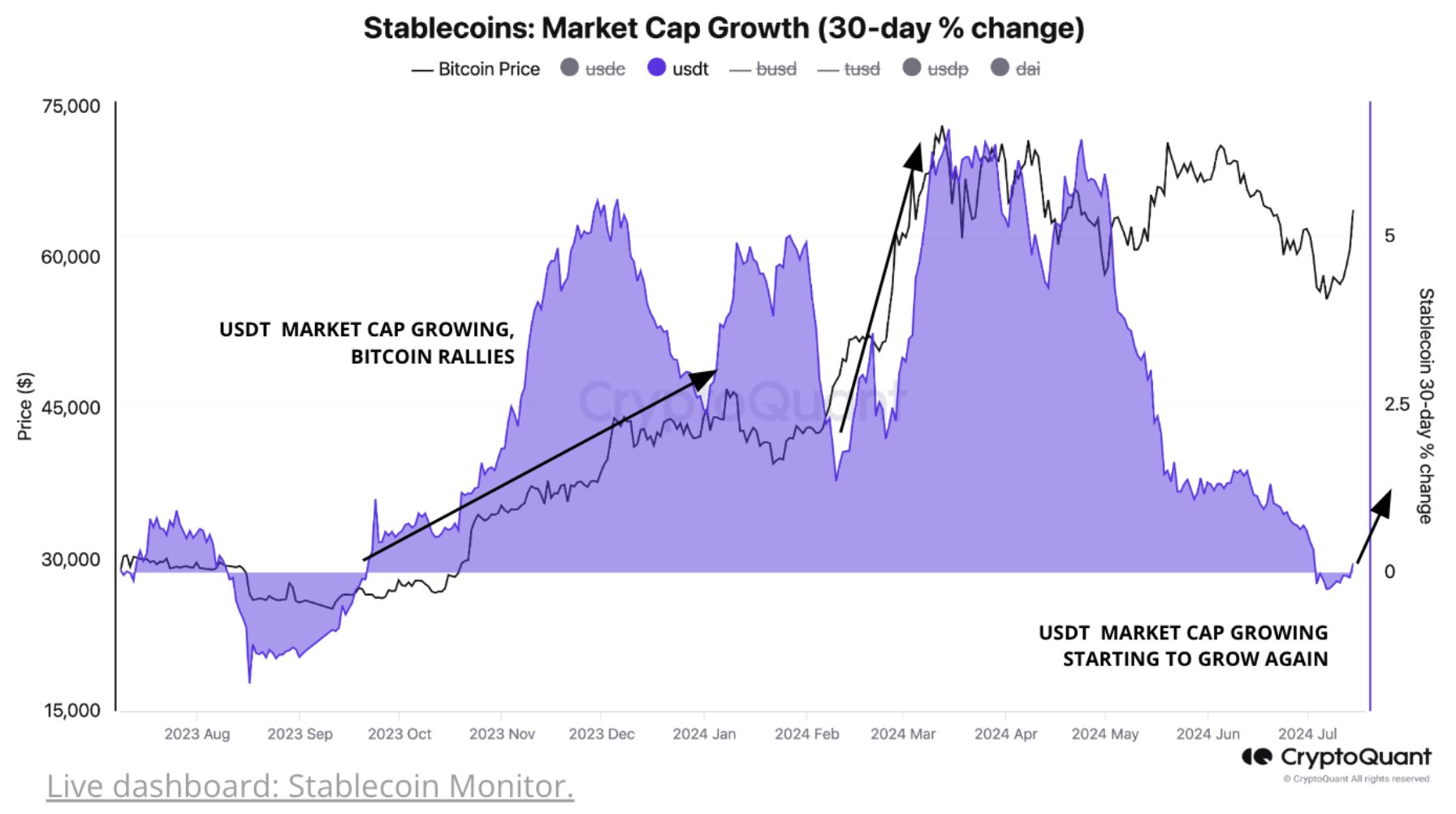

Stablecoin Market Cap Has Finally Flipped On 30-Day Change

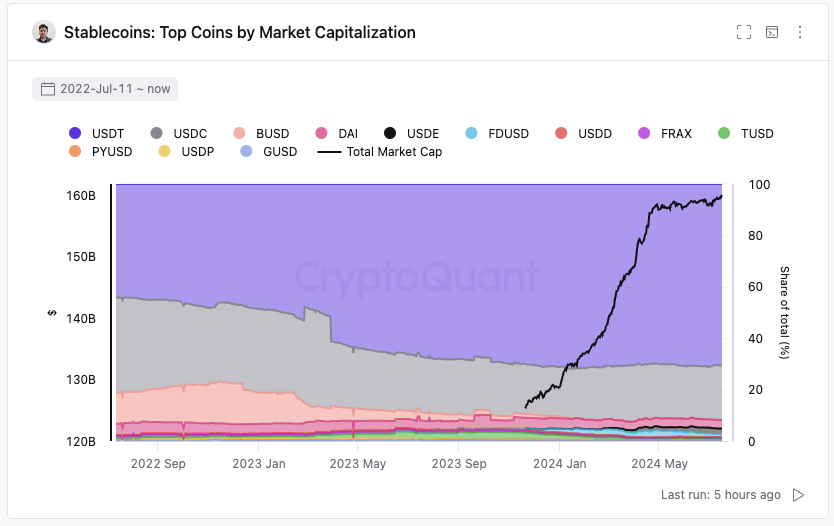

According to a recent post by Ki Young Ju, the founder and CEO of CryptoQuant, the total value of stablecoins has reached a new record high. This increase in value comes after the resumption of the upward trend in the market.

With my extensive background in financial markets and data analysis, I find Young Ju’s chart intriguing. Over the past year, I have observed the fluctuation of the market cap of Tether (USDT), the biggest stablecoin in the sector. This chart provides valuable insights into how the value of this digital asset has changed by 30-day intervals over the past twelve months. As someone who closely monitors market trends and trends in the cryptocurrency world, I find it essential to keep track of such data to better understand the dynamic nature of this rapidly evolving space. Young Ju’s chart is a valuable resource for anyone looking to gain a deeper understanding of the Tether market cap trend.

The graph demonstrates that the 30-day market cap percentage decrease for USDT became negative previously, indicating a reduction in the overall value of this stablecoin.

As a crypto investor, I’ve noticed that the market downturn didn’t persist for an extended period. Recently, the metric has rebounded and moved back into positive territory. However, this uptick isn’t significant, signaling that the potential turnaround is just beginning.

As a researcher studying the cryptocurrency market trends, I’ve observed that an uptick in the market capitalization of stablecoins often signals a bullish trend for Bitcoin. This correlation was evident from my analysis of the past year’s data, as depicted in the chart.

The reason behind the connection between stables and Bitcoin lies in understanding their functions within the market. Essentially, stables serve as a refuge for investors seeking to shield their funds from the price fluctuations common among other digital currencies by holding fiat-pegged tokens.

Stablecoin holders who maintain their funds in this manner typically intend to re-enter the volatile markets. Consequently, the market capitalization of stablecoins functions as a proxy for the liquidity ready to be utilized in cryptocurrencies such as Bitcoin. Thus, an increase in this metric signifies a growing pool of resources accessible for buying BTC and related assets.

Recently, Tether’s market capitalization has experienced a significant change, coinciding with Bitcoin’s sudden price rise. This implies that the growth in Tether’s value may not be the result of funds shifting from Bitcoin, but instead, new investments pouring into stablecoins.

Based on my extensive experience in the financial markets and specifically in the cryptocurrency space, I strongly believe that this combination could be particularly bullish. The reason being, it implies not only do these investors have substantial capital ready to invest in Bitcoin, but also that the digital currency itself has recently experienced direct inflows of capital. This is a powerful indication of confidence and optimism towards Bitcoin’s future growth potential.

After the recent growth, Tether holds approximately 70% of the current market value for stablecoins, as shown in the following chart.

The graph clearly shows that the stablecoin market cap has reached a new high due to the recent influx of investments.

Bitcoin Price

At the time of writing, Bitcoin is trading at around $63,700, up more than 10% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- USD PHP PREDICTION

- WIF PREDICTION. WIF cryptocurrency

- USD VES PREDICTION

- HYDRA PREDICTION. HYDRA cryptocurrency

- USD COP PREDICTION

2024-07-19 12:11