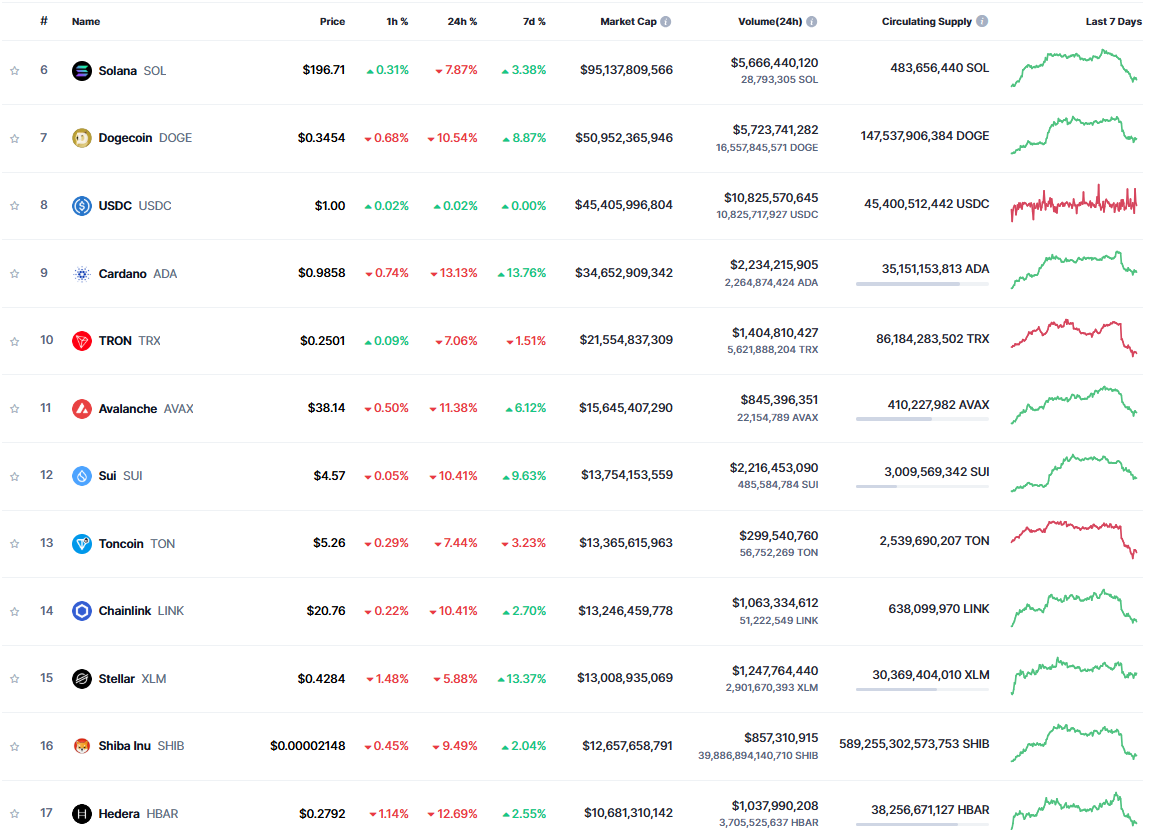

Lately, Stellar (XLM) has moved ahead of Shiba Inu (SHIB) in the crypto market standings. At this moment, Stellar stands at 15th position among leading cryptocurrencies based on market capitalization, boasting a market worth of approximately $13.15 billion. Conversely, Shiba Inu finds itself ranked 16th, with a current market estimation of around $12.69 billion.

The fall of Shiba Inu to the 16th position occurs during a continuous market downturn, causing Shibu Inu’s prices to decrease as much as 11%.

During the recent market downturn, meme coins have taken a significant hit, leading to the sell-off of approximately $711 million worth of cryptocurrency assets. In the last day alone, the total market capitalization of these playful digital tokens has decreased by about 10.31%, now standing at roughly $102.33 billion. Many meme coins have experienced double-digit declines, with some losing as much as 10%.

As a researcher, I find myself reporting that over the past 24 hours, Shiba Inu has experienced a significant drop of 10%, reaching a price point of $0.00002148. Stellar (XLM), too, felt the market’s pinch, though its losses were relatively smaller, with a decline of 4.83% to land at $0.432. In contrast to Shiba Inu’s modest weekly gains of 2.21%, XLM has managed to surpass it by registering a more substantial increase of 18% within the same timeframe.

At the beginning of the year, the value of XLM went up, boosting its total market value and pushing it ahead of Shiba Inu in terms of ranking.

What’s next for crypto market?

On Tuesday, cryptocurrencies dropped due to worries about rising inflation, and this downward trend persisted on Wednesday. The total market value of all cryptos decreased by approximately 6.11% in the previous 24 hours, leaving it at around $3.33 trillion globally.

The potential uncertainty about the pace of Federal Reserve interest rate reductions could mean rough patches on the road for cryptocurrency valuations moving forward. In December, the Fed hinted that they might reduce rates at a slower pace in 2025 compared to what investors were expecting previously. Over time, interest rate decreases have generally led to an increase in crypto prices, while increases have tended to decrease them.

On Wednesday, we will receive the minutes from the Federal Reserve’s December meeting where they reduced their main interest rate by a fourth of a percent. Additionally, today marks the release of ADP’s private employment report, which is expected to indicate an addition of around 130,000 jobs in December. Finally, the Bureau of Labor Statistics will publish its monthly employment report on Friday.

Read More

- REPO: All Guns & How To Get Them

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- LUNC PREDICTION. LUNC cryptocurrency

- REPO: How To Play Online With Friends

- BTC PREDICTION. BTC cryptocurrency

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- All Balatro Cheats (Developer Debug Menu)

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

2025-01-08 18:24