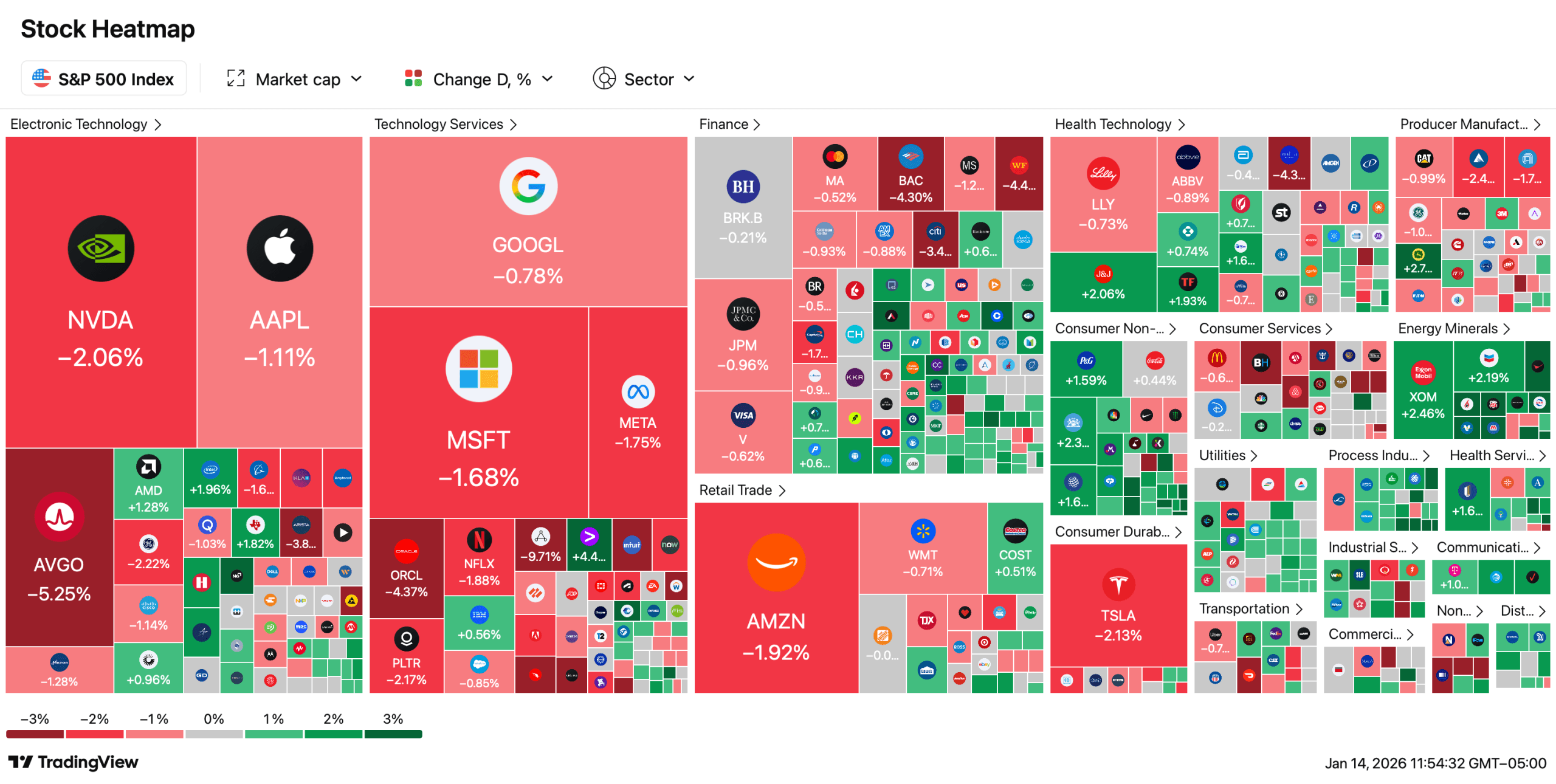

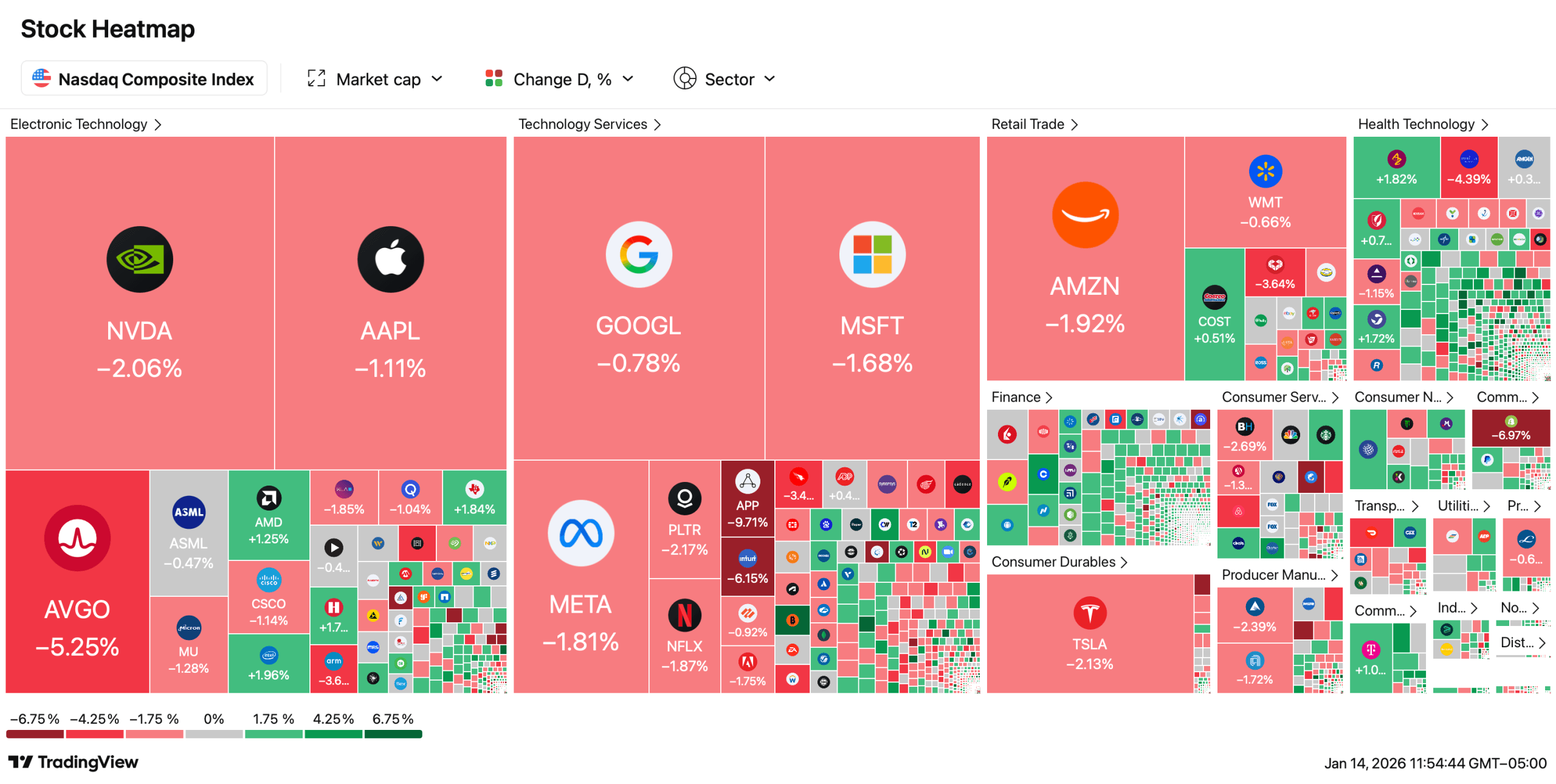

In the grand theater of markets, U.S. stocks performed a morose ballet on Wednesday, their movements stiff and red-splattered, as if choreographed by a director with a grudge. Gold and silver, meanwhile, pirouetted into record books, while crypto’s coin-flipping antics added 3.66% to its portfolio, now a bloated $3.29 trillion. The Nasdaq, ever the dramatic lead, tumbled 344 points at dawn, setting the stage for a day of sighs and shrugs.

Equities, those eternal optimists, failed to sync with the rhythm of crypto and precious metals, which danced to a playlist curated by chaos. The Dow, S&P, and NYSE followed suit, their declines painting the morning in shades of regret-until the NYSE, in a moment of fleeting courage, dabbed a green blush on its cheeks by 11:50 a.m.

As markets mulled the ongoing feud between the Trump administration and the Federal Reserve, Chair Powell’s video message was met with the kind of silence usually reserved for bad poetry. Trump, ever the drama king, declared Powell “a jerk who will be gone soon,” a line that left traders rolling their eyes harder than a Bitcoin miner. Earnings from Bank of America and Wells Fargo followed, their mixed reports failing to ignite any spark of hope.

Gold and silver, those old-world rebels, continued their ascent, while Bitcoin sprinted past $97,000 like a caffeinated squirrel. Even real estate, that stodgy old friend, managed a 5% jump in sales. The markets, it seemed, had split into two camps: one groaning under the weight of policy squabbles and corporate meh, the other sprinting toward assets that either promised safety or simply looked more fun.

Wednesday’s lesson? Stocks may be the main act, but the side shows-crypto, gold, and housing-were stealing the spotlight. Investors, ever the fickle crowd, shifted their bets, leaving the NYSE to blush green for a moment before retreating into its usual pallor. A day of tentative shuffles and whispered questions, where even the Fed’s independence felt as secure as a sandcastle at high tide.

FAQ ❓

- Why were U.S. stocks down today? Markets, in their infinite wisdom, pulled back as investors balanced the delicate scales of political tension and mixed bank earnings. A true masterpiece of indecision.

- Why is the crypto sector rising while stocks fall? Digital assets, ever the party crashers, surged as traders traded equities for crypto’s wild ride. A 3.66% gain-because why not?

- What is driving record highs in gold and silver? Precious metals, those vintage rockstars, soared on demand from investors seeking alternatives to equities’ “meh” vibes. Who needs stocks when you can have glittering bars?

- What does the latest housing data show? Existing-home sales leaped 5%, proving that even real estate can join the parade of winners. A 5% increase: because 5% is the new 10%.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2026-01-14 21:08