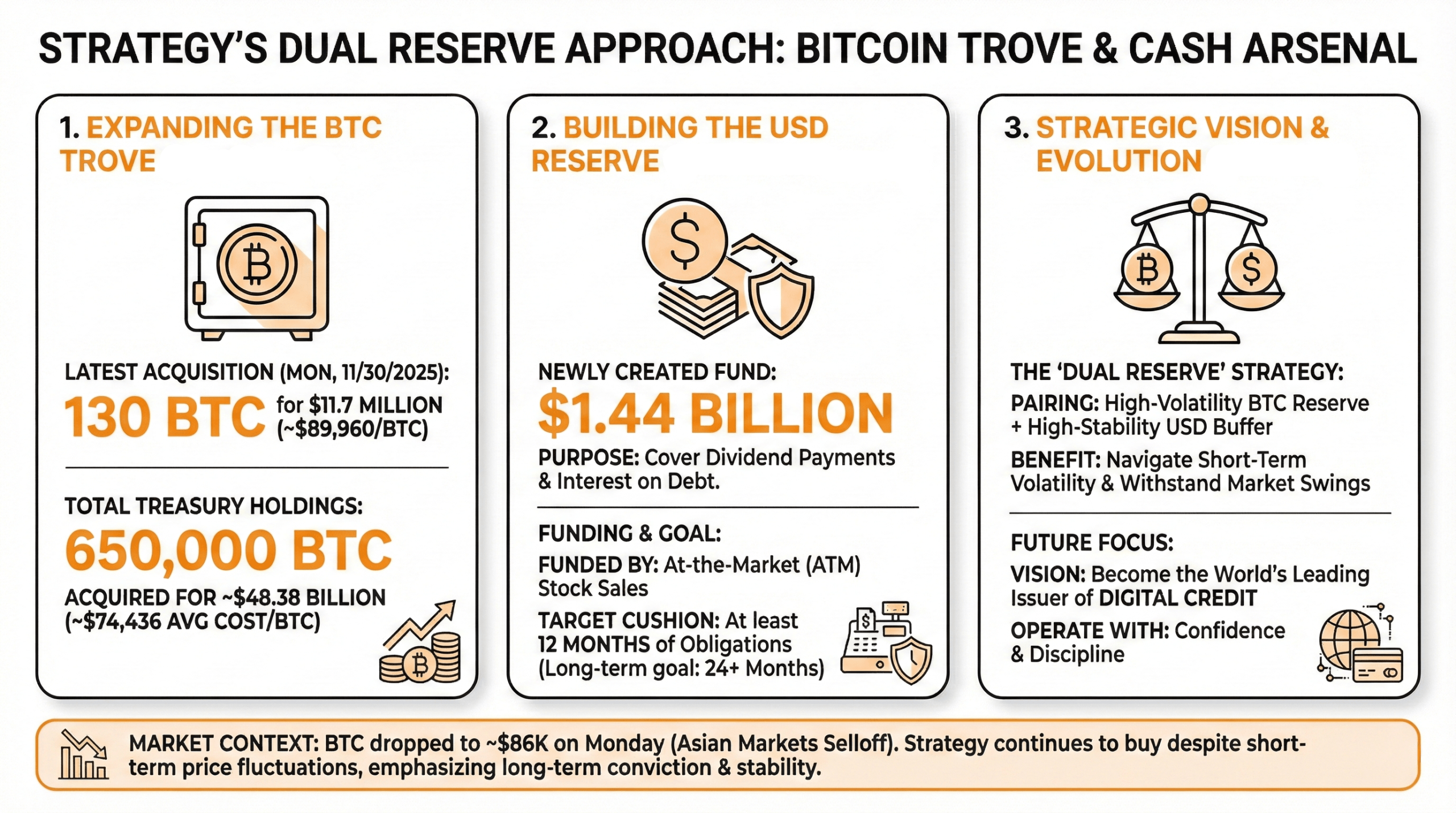

On that fateful Monday, Strategy – the titan of bitcoin treasuries – revealed a most audacious move. It seized 130 more BTC, swelling its grand treasure to a staggering 650,000 BTC. But wait, there’s more! They also unleashed a USD Reserve of $1.44 billion, setting the stage for future dividends that will cushion their bulging wallet. How terribly unpretentious.

Strategy Expands Its BTC Trove and Cash Arsenal

Ah, Michael Saylor, the mastermind behind Strategy, who, in his own inimitable style, took to Twitter to trumpet yet another stack of bitcoin acquisition. “We’ve added 130 BTC for a mere $11.7 million, or about $89,960 per bitcoin,” he said with characteristic humility. But that was only the beginning, for he revealed, “as of 11/30/2025, we hold 650,000 BTC for approximately $48.38 billion, a mere $74,436 per bitcoin.” Ah, the sweet smell of unapologetic bullishness.

And as if that weren’t enough, Strategy announced the creation of a $1.44 billion USD Reserve, a cash fortress to cover dividends and interest obligations. This fund, born of Strategy’s at-the-market stock sales, promises to keep enough liquidity to cover at least 12 months of obligations. The long-term vision? To stretch that cushion to 24 months. You know, just in case they decide to take a nap.

Strategy also pointed out that the size and management of this reserve may change depending on liquidity needs, market conditions, or perhaps just a whim from the higher-ups.

“The establishment of a USD Reserve, complementing our BTC Reserve, marks the next stage of our evolution,” said Saylor, waxing philosophical. “We believe it will better equip us to navigate market volatility while fulfilling our mission of becoming the world’s leading issuer of Digital Credit.” Bold words from the man who’s clearly in no danger of running out of ambition.

By pairing an ample bitcoin reserve with a massive cash buffer, Strategy is not just playing it safe; they’re signaling to the world that they intend to ride the storm with the confidence of a well-dressed bull. Still, one must note that, once again, Strategy paid more than the current market price of $85,972 per bitcoin (at 8:30 a.m. EST on Monday). Well, it’s a small price to pay for such audacity, don’t you think?

FAQ ❓

- What did Strategy buy this week?

Ah, the ever-growing pile of bitcoin. 130 more BTC were added, bringing their total to a truly enormous 650,000 BTC. - Why did Strategy create a USD Reserve?

Well, it’s all about the dividends and interest payments. They need a little cushion for their cushion, after all. - How was the USD Reserve funded?

Through the artful use of stock sales. A clever move, no? - What is Strategy’s broader goal with these reserves?

To provide stability, naturally. And, perhaps, to become the undisputed champion of Digital Credit.

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- All Kamurocho Locker Keys in Yakuza Kiwami 3

2025-12-01 18:13